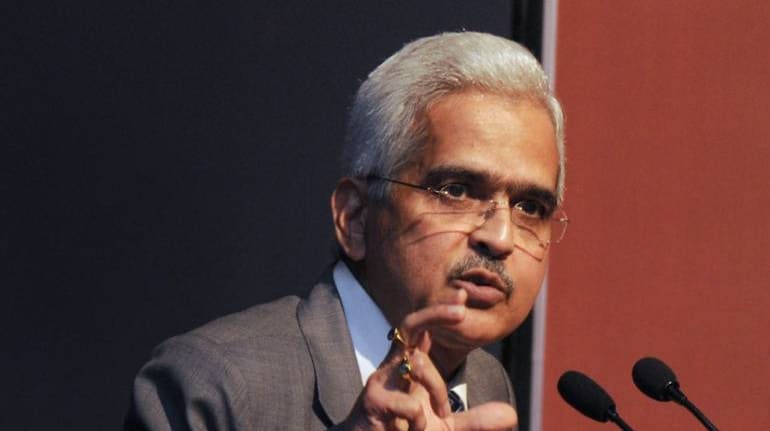

The Reserve Bank of India Governor Shakuntala Das announced a projection for Consumer Price Index (CPI) inflation at 5.1 percent for FY 2021-22.

"A normal south-west monsoon along with comfortable buffer

stocks should help to keep cereal price pressures in check," Das said adding that that normal monsoon and business resilience can provide a tailwind to economic recovery.

Das pegged the quarter wise inflation projections for FY22 at 5.2 percent in Q1, 5.4 percent in Q2, 4.7 percent in Q3 and 5.3 percent in Q4, with risks broadly balanced.

"On the other hand, the rising trajectory of international crude prices within a broad-based surge in international commodity prices and logistics costs is worsening cost conditions. These developments could keep core price pressures elevated, although weak demand conditions may temper the pass-through to consumer inflation," he added.

Das also stated that the Monetary Policy Committee (MPC) was of the view that at this juncture, policy support from all sides is required to regain the momentum of growth that was evident in H2:2020-21 and to nurture the recovery after it has taken root. Hence, it decided to keep the policy rate at its current level of 4 percent and to continue to maintain an accommodative stance as long as necessary.

In April, the CPI inflation came at 4.29 per cent compared with 5.52 percent in March backed by a fall in food prices. This is the fifth consecutive month that CPI inflation is within the MPC's target range.

On March 31, the Centre gave the MPC an unchanged inflation target for 2021-22 to 2025-26.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.