Sensational news discussing India’s rising debt is not new. COVID-19 induced recession has forced government agencies globally to spend at an unprecedented level contributing to the outstanding debt. This makes it imperative to analyse these new debt levels and their impact on our lives. To this end, Debt-to-GDP ratio (debt level divided by GDP of the country) is a useful measure.

Consider Albania which had a public debt of 10.21 billion dollars versus India which had a debt of over 1800 billion dollars in 2018. At first glance, India’s debt looks enormous compared to Albania’s but a quick glance at the GDP or national income of the countries tells us that the public debt accumulated in both countries is approximately 70% of their respective national incomes. That is, it is inappropriate to compare the debts of two countries when their national incomes differ significantly, in this case, India’s GDP is 880 times that of Albanias’.

Debt-to-GDP ratio greater than 77% can negatively affect growth of a nation in the long run, according to the World Bank. Along with other measures, global investors use this ratio to make their decision about the destination country for their funds. Similarly, a rule of thumb was introduced by the Indian government in the form of Fiscal Responsibility and Budget Management (FRBM) Act in 2003. This act states that the government should maintain a debt-to-GDP ratio at 60% except in extreme situations.

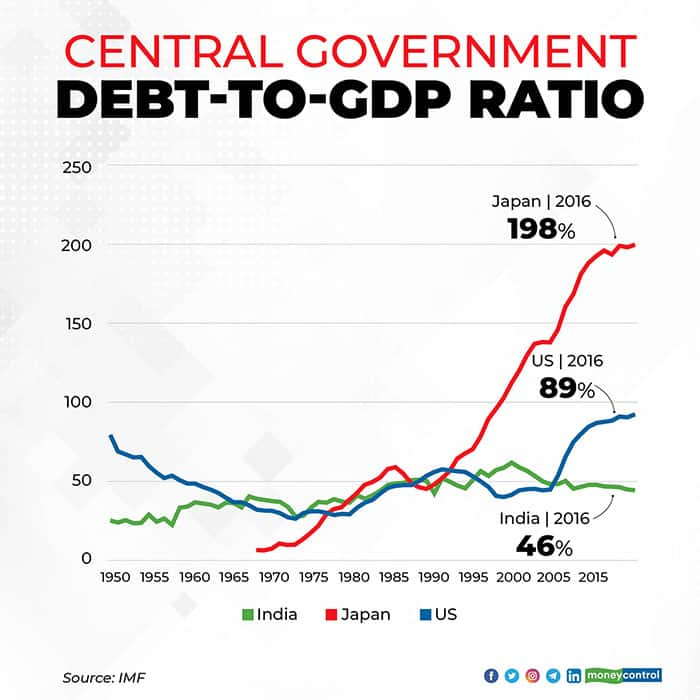

Debt, per se, is not bad. Unlike individuals, a government does not need to save funds for its old age and hence, worry about holding debt. When a nation borrows with prudence and uses the funds to build efficient infrastructure, it improves its capacity to grow at a faster rate. Thus, without relevant context, these debt numbers can sometimes feel overwhelming for the wrong reasons. Some of the advanced nations today, like Japan, the US, etc. witnessed rising and large debt-to-GDP ratios on their path to the present day high living standards (See Figure 1).

While the World Bank’s threshold of 77% has a nice ring to it, it is not the only thing that we watch out for. For instance, the composition of the debt is one of the key considerations in deciphering whether the current levels of debt are dangerous. Too much of external debt can cause considerable damage, especially in countries with limited foreign reserves who could find it hard to repay in the future.

During the “Taper Tantrum” episode in 2013, the Federal Reserve’s Monetary Policy discussions were interpreted by investors to indicate an expected increase in interest rates in the US. This resulted in large capital outflows from developing countries across the world to the US even before the interest rates actually went up. This reversal of capital flow from emerging markets economies (EME) caused their currencies to lose value with respect to the USD i.e. depreciate, as foreign investors pulled out their investments from these markets and invested in the US instead. India, one of the major destinations in the EMEs, with a significant proportion of external debt did not escape unscathed either. Instead the capital outflow reduced the demand for the rupee and India underwent a sharp depreciation of over 19 percent.

Moreover, the composition of the external debt has an important role to play not only in understanding the after effects of such volatile shocks but also in analysing the sustainability of a country’s debt. Countries that had large quantities of debt denominated in foreign currencies were especially in trouble since the unfavourable change in exchange rates increased the value of the debt, i.e. repaying 1 USD now became more expensive for these countries in terms of their local currency.

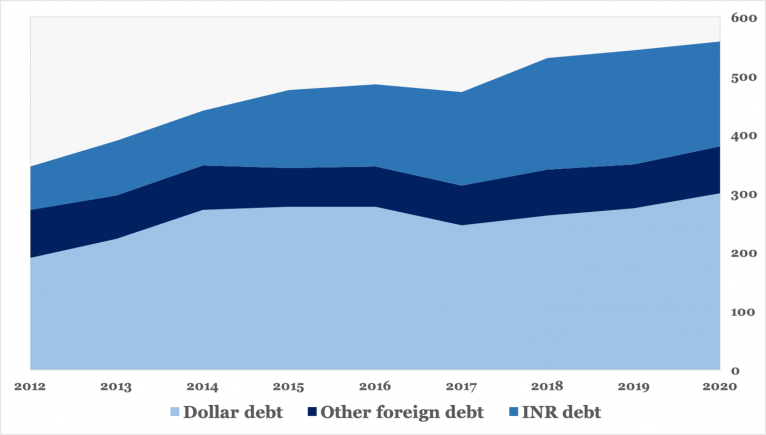

Although India’s overall external debt has increased from 345.8 in 2012 to 558.5 billion USD today (see Figure 2), India has also improved its position as the INR denominated external debt has increased from 21.4% in 2012 to 31.9% in 2020. As Figure 1 shows, even though external debt has gone up in absolute terms, the Debt-to-GDP ratio remained constant at least until 2019. There are many other factors that affect debt sustainability and we will discuss some of them later in this article.

Figure 2: The composition of India’s external debt measured in billions of US Dollars (including Sovereign debt and Non-Government debt) by the currency in which the debt is denominated. Source: RBI

Figure 2: The composition of India’s external debt measured in billions of US Dollars (including Sovereign debt and Non-Government debt) by the currency in which the debt is denominated. Source: RBI

Until very recently, India had been cautious of issuing foreign currency denominated debt. In 2019, the Indian economy was struggling to pick up steam and the government faced shrinking tax revenue along with limited domestic savings available for borrowing. As a result, the government proposed to issue debt in the international bond market to raise the necessary funds. However, this plan faced opposition, primarily out of concern over the volatility that foreign denominated debt issued overseas brings to the financial and economic stability of a country. As the following quote from Raghuram Rajan, the ex Governor of the RBI, explains, the issue is with hot money flows, which refers to the quick and possibly large-scale movement of capital (a fancy word for funds) across countries, depending on which destination provides better returns.

“...faddish investors buying when India is hot, and dumping us when it is not.....The concern is that once the door is opened, the government will be tempted to issue more, much more, with attendant risks –- after all, all addictions start small."

-Raghuram Rajan, 2019

These hot flows can be simply explained if we consider an investor who has to choose a country that would provide the highest returns. If the interest rate in country A increases with respect to country B, the investor will invest completely in country A and if they had any prior investments in country B, they will withdraw all their funds from country B and invest in country A.

Interest rate differentials across different countries generally contain information regarding the economic, political and social infrastructure of the countries. But hot money flows can sometimes occur in advance due to anticipation of future changes in interest rate differentials. In the above taper tantrum example, speculations regarding future interest rate increases were sufficient to cause investors to pull their money out of emerging markets and create hot flows.

A cautionary tale illustrating this scenario played out in the beloved TV series Game of Thrones wherein an audience of over 20 million witnessed the cold blooded strategies of the Iron Bank of Braavos who changed their investments depending on the likelihood of repayment. Not even the Protector of the Realm of Westeros in the fantasy world of Game of Thrones (GoT) could survive the strong hand of the foreign Iron Bank of Braavos when speculators were at play.

Credits: Gameofquotes.blogspot.com

Credits: Gameofquotes.blogspot.comSo how can a country ensure that its debt doesn’t become unsustainable?

Photo credits: Freepik

Photo credits: Freepik

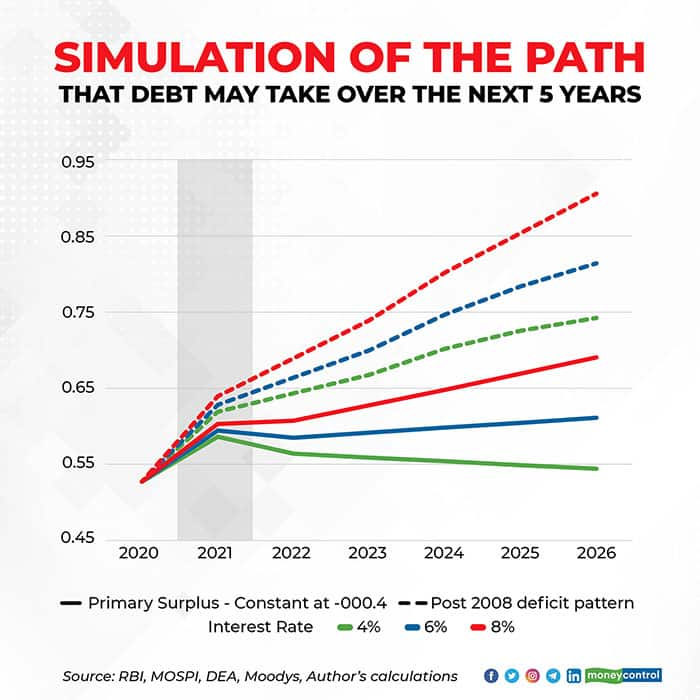

Debt sustainability is a topical issue. Most economists agree that the sustainability of debt is largely dependent on the country’s growth rate, interest rate (to be paid on debt) and the primary surplus (difference between tax revenues and government expenditures excluding interest payments). The dynamics of these variables result in different conditions that can have long-lasting effects on the debt-to-GDP ratio. As long as a country grows at a rate faster than the interest rate it has to pay or succeeds in maintaining a primary surplus or both, then the country’s debt-to-GDP ratio can be reduced. In Figure 3, we have simulated some scenarios of what the debt dynamics may look like using the forecast growth rate as per Moody’s and making other assumptions, detailed below, about interest rates and primary surplus.

This figure simulates the central government debt dynamics in India over the coming years, given the aforementioned assumptions about it’s growth rate and starting from fiscal year (FY) 2019-2020. The grey column identifies the coronavirus shock that occurred at the beginning of the FY 2020-2021. The solid lines illustrate scenario 1 where the primary surplus to GDP level stays constant at the (most recent union budget) estimate of -0.004 (negative level indicates deficit) while in scenario 2, illustrated by the dotted lines, the primary surplus follows a path similar to the one it experienced post the 2008 financial crisis, in which the government had to run a significantly large primary deficit over the next few years. The green, blue and red lines correspond to an interest rate of 4%, 6% and 8%.

The debt dynamics seem to be mainly driven by the magnitude of primary surplus. So, we use Moody’s estimates of growth rate for the next three fiscal years, vary the primary surplus/deficit and see the impact on debt accumulation. In the best case scenario, if the market interest rate, which the government in principle has no control over, remains at a low of 4% and the government is able to run a minimal deficit at 0.004 then in the next 5-6 years we should be much closer to the debt-to-GDP ratio that existed in the pre-COVID era (Figure 3, solid green line). In the worst case scenario, as the market interest rate shoots up to 8%, the debt-to-GDP ratio explodes under the assumption that the primary surplus follows a pattern similar to its path post the 2008 financial crisis. In fact, the central government debt-to-GDP reaches 90% in FY 2025-26 (Figure 3, red dotted line) versus 69% under the more conservative deficit assumption (Figure 3, red solid line).

Thus, this simple analysis shows that even in an unfavourable economic environment, the government can ameliorate the debt situation by keeping the deficit levels in check and returning to the positive surplus levels as soon as possible. In a more comprehensive analysis, we have to emphasise on the fact that it is the joint behaviour of monetary and fiscal policies that determines inflation and stabilises debt in the much more complex real economy. So the next time you see a sensational news story on India’s rising debt, perhaps you should also investigate its composition, the government's fiscal behaviour and other key aspects that affect debt dynamics.

Special thanks to Abhishek Malik for making us think of GoT in an entirely new light.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!