India will need at least $7.8 trillion worth of gross capital formation in the form of greenfield assets in the next five years if the government’s target of the country becoming a $5 trillion economy is to become a reality, a new report by Deloitte has shown.

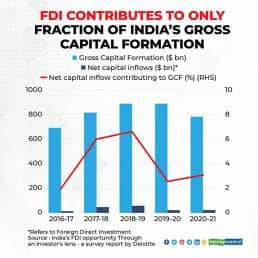

For this to happen, foreign direct investment (FDI) worth at least $400 billion needs to reach new investments, ‘India’s FDI Opportunity – a global survey report’ says. Of the $80 billion worth of FDI in FY21, only 3 percent led to gross capital formation, it adds.

Capital formation is used to describe the net capital accumulation over a fixed period. The term refers to addition of capital goods, such as equipment, tools, transportation assets, and electricity, that can then be used to produce economic goods, leading to an economic cycle of growth.

Riding on domestic investments

“While foreign investment inflows into India have been consistently rising over the past five years, they have not contributed proportionately to the country’s capital formation and GDP,” the report says. Over the last five years, net capital inflows contributed about 4 percent to the total gross capital formation (GCF), suggesting that domestic investments, funded by domestic savings, accounted for the remaining 96 percent.

FDI contributes to only fraction of India's Gross Capital Formation

FDI contributes to only fraction of India's Gross Capital Formation

The government has remained bullish on meeting the $5 trillion mark by FY26, banking on an ambitious increase in infrastructure investments along with the recently announced national monetisation pipeline. However, even under Deloitte’s most optimistic scenario, the deadline has been pushed back till FY27 due to the impact of Covid-19.

But the report says a scenario with high growth and moderate inflation remains “highly likely”, whereby the target would get postponed till FY29. In this case, real GDP growth moderates after the first year but remains stable. “The annual average growth rate is assumed to be at 6 percent with the annual average inflation rate hovering around the mid-point of the RBI’s target range (close to 4 percent). Healthy growth results in modest currency depreciation,” it forecasts.

Capital formation priority

India can target an additional $1 trillion of merchandise exports in the next five years by attracting higher FDI into seven capital investment-led focus sectors, the report says. They are the electronics, textiles, pharmaceuticals, chemicals, food processing, capital goods and automotive sectors.

For this to happen, Deloitte has suggested a host of reforms such as extending the lower corporate tax rate to existing electronics manufacturing companies that achieve thresholds set for manufacturing activity, as well as examining existing multilateral and bilateral

trade agreements that give other nations an advantage in pharma and textiles.

Improving existing schemes has also been widely suggested. For automobiles, the report has suggested that the Production Linked Incentive Scheme also specifically cover the cross-section of Tier 1 and Tier 2 domestic suppliers with added incentives for the Electric Vehicle portfolio. For the food processing sector, it has mooted extending concessionary provisions currently available under the Mega Food Park scheme to single occupant facilities by large anchor investors, supported by initiatives to attract large food processing initiatives.

Investor interest strong

An accompanying survey of 1,200 top business leaders from multinational companies spread across the United States, United Kingdom, Japan and Singapore shows that up to 44 percent are currently planning to invest in India.

The highest positive response came from the US, where almost half of all leaders said they were planning additional or first-time investments, followed by the UK (45 percent), Japan (41 percent) and Singapore (38 percent). The US also tops in the period taken for investments, whereby 21 percent of respondents said they planned to invest in the next two years, whereas 17 percent and 12 percent said the same in the UK and Japan, respectively.

The report notes that despite recent reforms to improve the ease of doing business in India, awareness among investors remains low. Business leaders in Japan (16 percent) and Singapore (9 percent) were least aware of initiatives such as the digitisation of customs clearance and production linked incentives for manufacturers. Accordingly, India was perceived as a more challenging environment to do business compared to China and Vietnam.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!