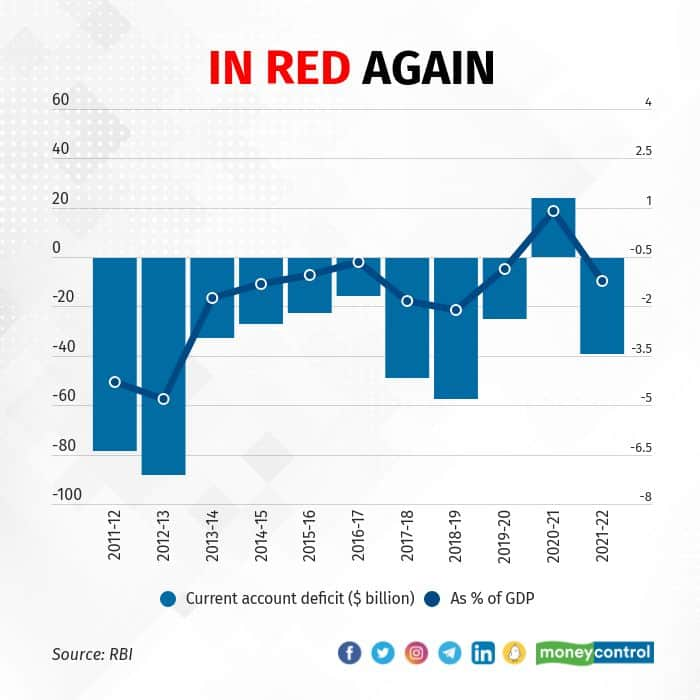

India’s current account deficit (CAD) for FY22 widened to $38.7 billion or 1.2 percent of gross domestic product (GDP) from $23.7 billion (0.9 percent of GDP) in FY21.

The wider deficit is on expected lines as a surge in global oil prices inflated the petroleum and oil bill for the economy during the year. As a result, the trade deficit widened sharply by $185.5 billion.

Since oil prices are likely to remain elevated, economists expect the CAD to widen further in the coming year. What’s more is that the odds of a recession in the US have risen which could dampen the prospects for exports as the country remains the biggest export destination for Indian goods and services.

Then there is the challenge of financing the CAD. Portfolio outflows were persistent but foreign direct investments (FDI) saved the day in FY22. The fall in dollar borrowings by companies also contributed to inflows. But in FY23, funding costs could increase the outflow via commercial borrowings. Together with portfolio outflows, the financing of the CAD could become a challenge. India’s balance of payments is onto a tough path.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.