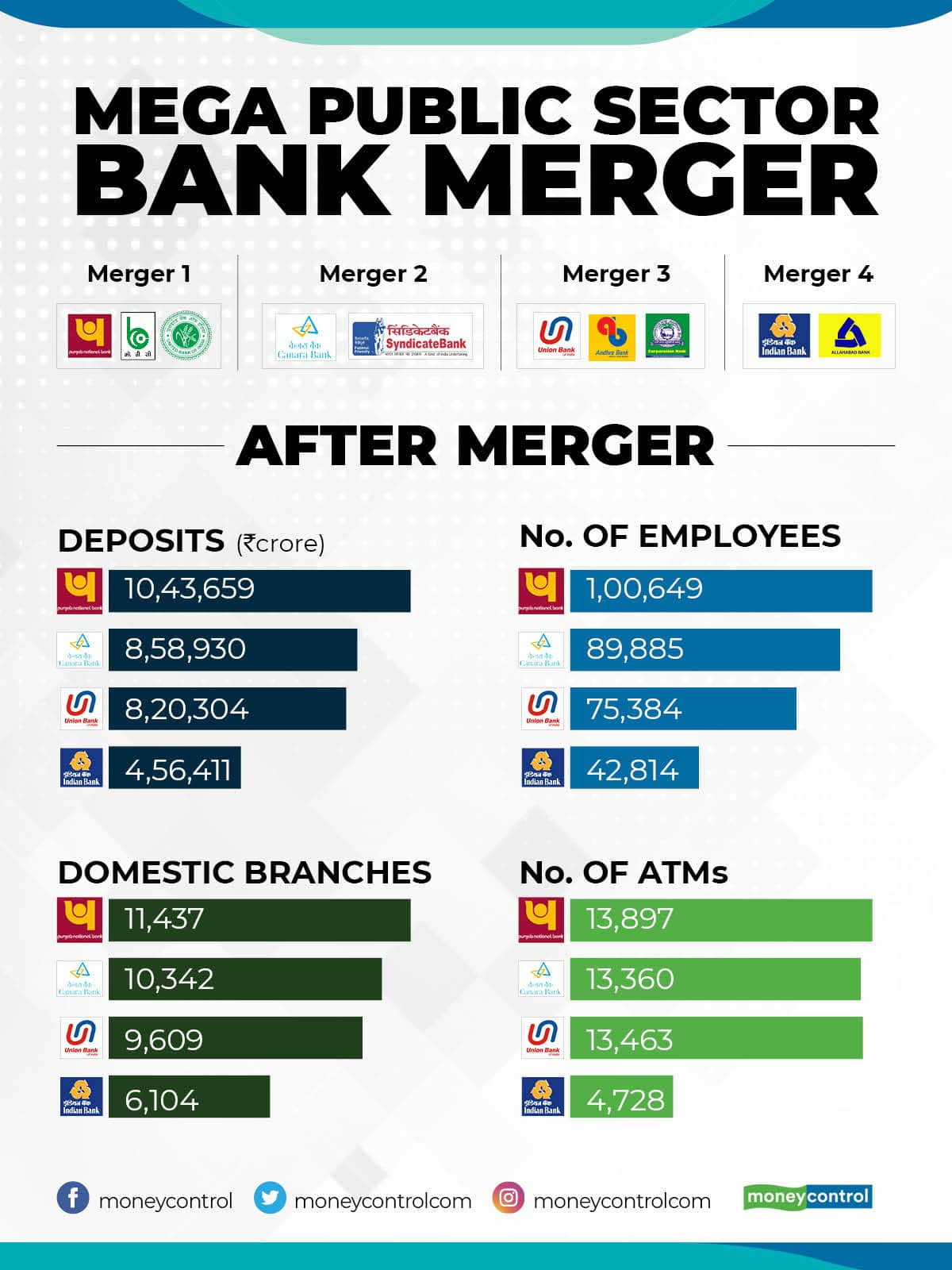

Finance Minister Nirmala Sitharaman today announced that Allahabad Bank will be merged with Indian Bank to form India's seventh-largest public sector bank, as part of a mega consolidation drive that will see 10 banks being merged into 4 entities.

Indian Bank and Allahabad Bank will have a total business of Rs 8.08 lakh crore which is around 1.9 times of Indian Bank before consolidation. The banks will aim at strong nationwide presence in South, North and East. Combined lending capacity of the banks is also expected to improve the business.

Consolidated Indian & Allahabad Banks to be 7th largest #PSB with ₹ 8.08 lakh cr. business. Strong scale benefits to both with business doubling. High CASA & lending capacity combined in consolidated bank. @PMOIndia@FinMinIndia@PIB_India#PSBsFor5TrillionEconomypic.twitter.com/fRercARJIU— Rajeev kumar (@rajeevkumr) August 30, 2019

The FM said that the consolidation of the state-run banks will give banks benefits of scale and synergy, as well as strong national presence and increased risk appetite.

Allahabad Bank has strong presence in east India while Indian Bank is a southern India focused bank.

Both the banks have same core banking solution (CBS) platform, BaNCS.

| Indian Bank | Allahabad Bank | Amalgamated bank | |

| Total Business (in crore Rs.) | 4,29,972 | 3,77,887 | 8,07,859 |

| Gross advances (in crore Rs.) | 1,87,896 | 1,63,552 | 3,51,448 |

| Deposits (in crore Rs.) | 2,42,076 | 2,14,335 | 4,56,411 |

| CASA ratio | 34.71 % | 49.49 % | 41.65 % |

| Domestic branches | 2,875 | 3,229 | 6,104 |

| PCR | 49.13 % | 74.15 % | 66.21 % |

| CET-I ratio | 10.96 % | 9.65 % | 10.36 % |

| CRAR ratio | 13.21 % | 12.51 % | 12.89 % |

| Net NPA ratio | 3.75 % | 5.22 % | 4.39 % |

| Employees | 19,604 | 23,210 | 42,814 |

The FM made merger announcements with three more entities:

- Oriental Bank of Commerce and United Bank of India would be amalgamated into Punjab National Bank.

- Syndicate Bank will be amalgamated into Canara Bank

- While Andhra Bank and Corporation Bank will be combined with Indian Bank.

In place of fragmented lending capacity with 27 PSBs in 2017, now 12 #PSBs post consolidation. बड़े बैंक अब अपना लक्ष्य रखेंगे global मार्केट पर, मँझले बैंक बनेंगे राष्ट्रीय स्तर के और कुछ बैंक स्थानीय नेतृत्व करेंगे। @PMOIndia @FinMinIndia @PIB_India #PSBsFor5TrillionEconomy pic.twitter.com/Z4dcyZOG5f

— Rajeev kumar (@rajeevkumr) August 30, 2019

In 2017, where there were 27 PSBs, there are now only 12 PSBs.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.