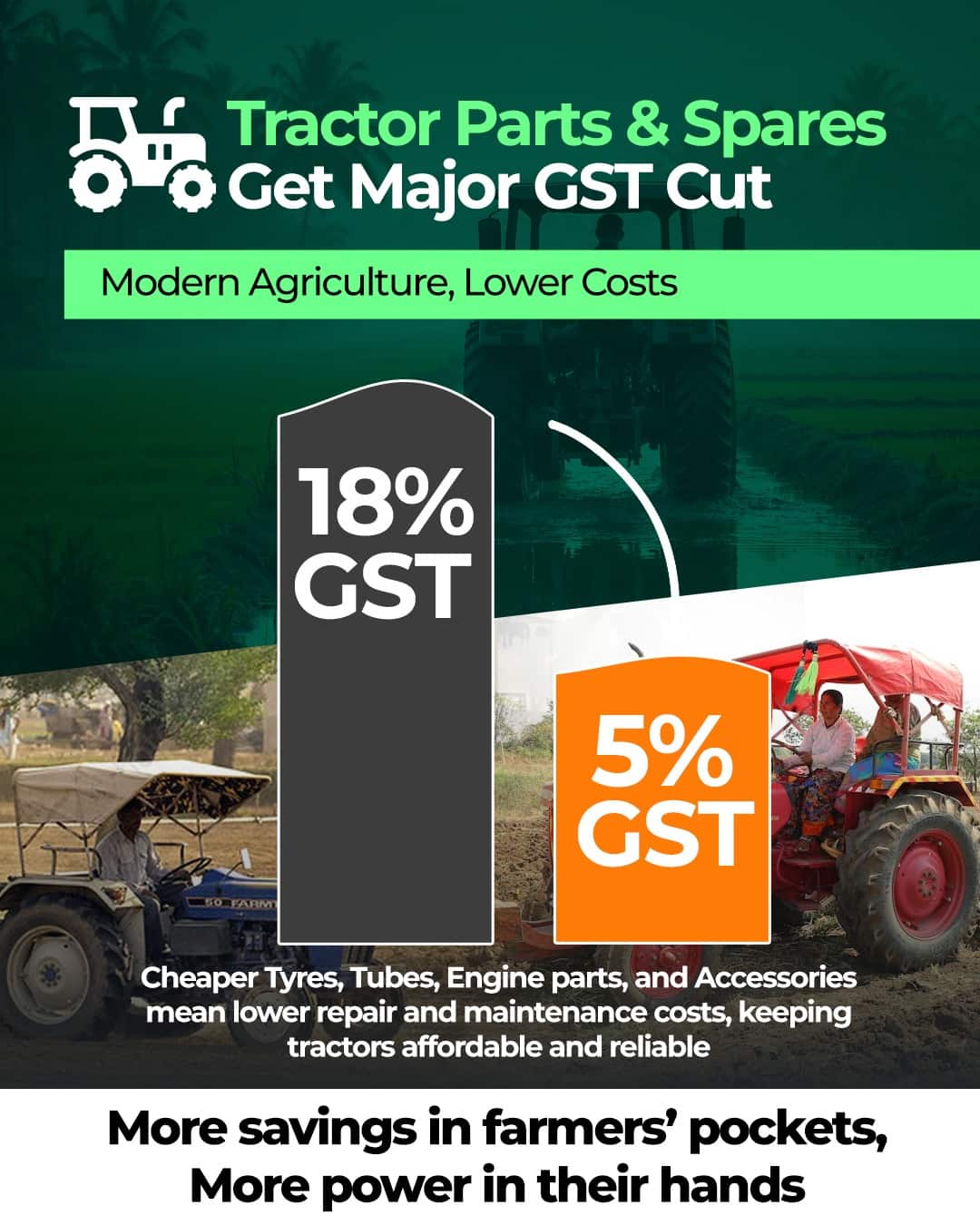

In a big boost for farmers, the GST Council on September 3 reduced the goods and services tax rates on a number of farm goods to 5 percent from 12 percent, including tractors, agricultural, horticultural or forestry machinery for soil preparation or cultivation, lawn or sports-ground rollers, nozzles for drip irrigation equipment or nozzles for sprinklers.

However, the reduced rate will not be applicable to road tractors for semi-trailers with an engine capacity of more than 1800 cc.

More items that saw a reduction on the GST rates to 5 percent are the following:

-- Fixed Speed Diesel Engines of power not exceeding 15HP

-- Other hand pumps

-- Sprinklers; drip irrigation system including laterals; mechanical sprayers

-- Harvesting or threshing machinery, including straw or fodder balers; grass or hay mowers; parts thereof

-- Other agricultural, horticultural, forestry, poultry-keeping or bee-keeping machinery, including germination plant fitted with mechanical or thermal equipment; poultry incubators and brooders; parts thereof

-- Composting Machines

-- Self-loading or self-unloading trailers for agricultural purposes

-- Hand propelled vehicles such as hand carts, rickshaws and the like; animal drawn vehicles

The changes in GST rates for all goods except pan masala, gutkha, cigarettes, chewing tobacco products like zarda, unmanufactured tobacco and bidi, will be implemented from September 22, 2025.

The Council's decision follows an announcement by Prime Minister Narendra Modi from the ramparts of Red Fort on August 15 and aims to rationalise the current four-tiered tax rate structure into a citizen-friendly ‘Simple Tax’ with a standard rate of 18 percent and a merit rate of 5 percent.

A special de-merit rate of 40 percent will be levied for a select few goods and services

Finance Minister Nirmala Sitharaman while addressing a briefing after the 56th Council meeting said that in most cases, GST rates have come down drastically for farmers and agriculture and health-related products.

"PM (Narendra) Modi desired to give the benefit of GST cuts to people at the earliest. These reforms are not only on rationalising rates, but they are structural too. We have corrected the inverted duty structure," she said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.