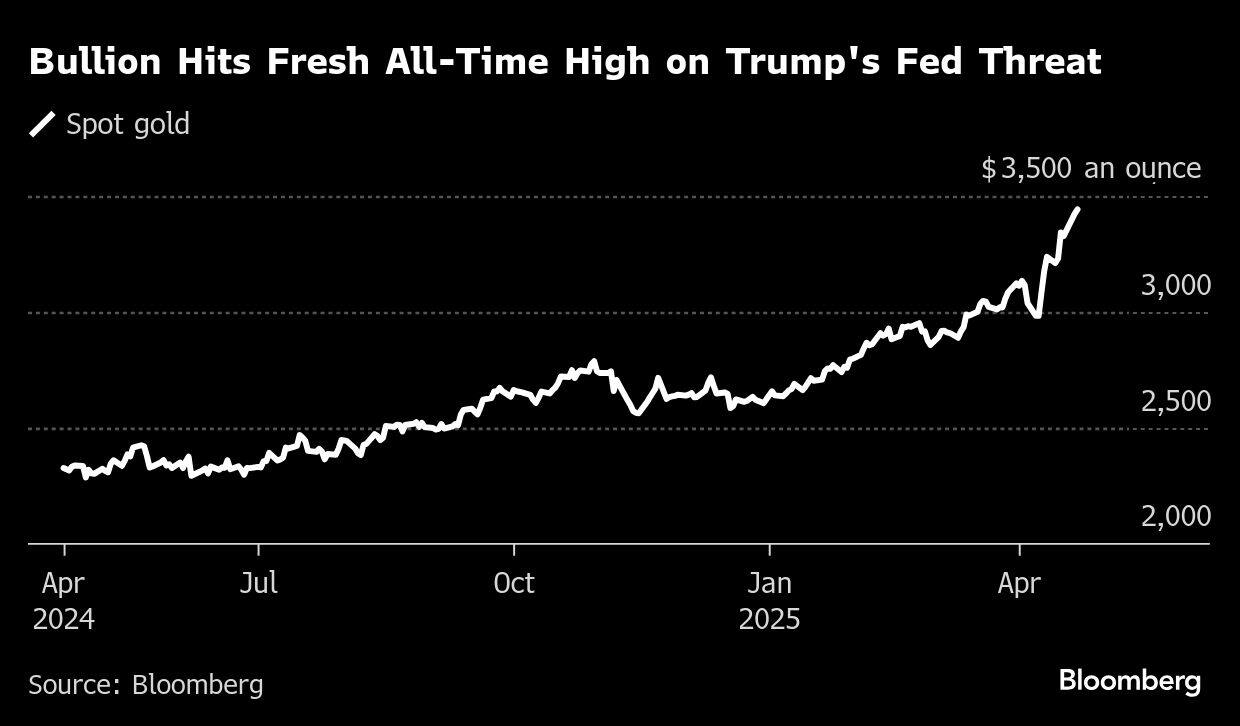

Gold rose to a record as concern that President Donald Trump could fire Federal Reserve Chair Jerome Powell triggered a flight from US stocks, bonds and the dollar.

Bullion topped $3,444 an ounce, following a 2.9% surge on Monday. Trump called on the Fed to cut rates immediately, a move seen as a threat to the central bank’s independence that drove the dollar to the lowest since late 2023.

Gold has surged more than 30% this year as trade tensions have roiled markets and eroded trust in dollar assets, boosting some traditional havens. Flows into bullion-backed exchange-traded funds and central-bank buying have supported the upswing, with bullion gaining every month this year.

“Gold’s rapid ascent this year tells me that markets have less confidence in the US than ever before,” said Lee Liang Le, an analyst at Kallanish Index Services. “The ‘Trump Trade’ narrative has evolved into a ‘sell America’ narrative,” she said.

Banks have become progressively more positive about gold as this year’s rally has gone from strength to strength. Among them, Goldman Sachs Group Inc. forecast the metal could hit $4,000 an ounce midway through next year.

Gold for immediate delivery was up 0.4% to $3,435.84 an ounce at 9:17 a.m. in Singapore. The Bloomberg Dollar Index was flat after a 0.7% decline on Monday. Silver steadied just below $33 an ounce, while palladium and platinum edged higher.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!