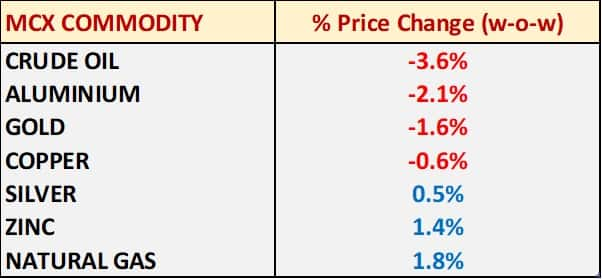

The commodities market displayed a mixed performance last week (ended November 29), with notable price movements across energy, metals, and precious metals on the Multi Commodity Exchange (MCX).

Crude oil experienced a sharp decline, falling by 3.6 percent, driven by concerns over a potential global economic slowdown, which could dampen demand. Additionally, easing geopolitical tensions reduced the risk premium factored into oil prices. In the coming week, crude oil prices are likely to remain under pressure, with a trading range between Rs 5,600 and Rs 6,100 per barrel.

Aluminium dropped 2.1 percent due to subdued industrial demand, particularly from China, the world's largest consumer of industrial metals. The ongoing slowdown in manufacturing continues to exert downward pressure. Aluminium prices are expected to stay rangebound in the near term.

Gold prices declined by 1.6 percent, influenced by a stronger US dollar, making the metal more expensive for international buyers. However, a sharp slide in US bond yields, driven by expectations of a December rate cut by the Federal Reserve, helped gold rebound from its weekly lows. We maintain a bullish outlook on gold, with prices potentially rising towards Rs 77,000 per 10 gram on MCX.

Copper recorded a modest decline of 0.6 percent, as infrastructure spending in various economies provided some support. However, persistent concerns over demand from China, coupled with increased supply from Chile, added to the cautious sentiment. Chile’s output exceeded expectations, easing global supply pressures and capping copper's price gains. Copper prices are likely to remain rangebound in the short term.

Natural gas prices climbed 1.8 percent, fueled by unexpectedly colder weather in key regions, which boosted heating demand. Strong export demand and lower storage levels also supported prices. Natural gas prices could rise further, with a target of Rs 295.

Zinc prices rose by 1.4 percent, bolstered by tightening supply conditions. Western sanctions on Russia have disrupted production at the Ozernoye mine, while additional disruptions in other global mines have exacerbated supply constraints. This tight supply scenario is keeping prices elevated. Zinc prices are expected to remain firm in the near term and could surpass Rs 300 per kg on MCX.

Silver edged up 0.5 percent, balancing its dual role as an industrial and precious metal. While gold faced headwinds, industrial applications provided silver with some support. We expect silver prices to rise further, targeting Rs 93,000 per kg on MCX.

Looking ahead, the coming week is pivotal, with several major economic data releases likely to influence commodity markets. In the US, the November employment report, due on December 6, will offer insights into labour market conditions, while the ADP Employment Report and ISM Manufacturing and Services Indices earlier in the week will provide snapshots of economic activity. In China, the focus will be on Manufacturing and Services PMIs (December 1 and 3), critical for gauging demand for base metals. Eurozone retail sales figures, scheduled for December 5, will shed light on consumer spending trends and their impact on energy and industrial commodities. Additionally, developments in geopolitical tensions, central bank policies, OPEC+ announcements, and US inventory data will be crucial in shaping market sentiment.

This blend of data and geopolitical events will keep market participants on edge, with significant implications for commodity demand and pricing trends.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!