Canadian pension fund CDPQ and I Squared Capital backed Cube Highways are amongst the suitors that have evinced interest in acquiring the maiden roads portfolio of the Indian government backed National Investment and Infrastructure Fund (NIIF), said sources aware of the development.

The portfolio of five road projects is likely to fetch an enterprise valuation of around Rs 10,000 crore (approximately $1.2 billion), the sources said.

“CDPQ, through its infrastructure investment trust (InvIT), Indian Highway Concessions Trust, and Cube through its InvIT, Cube Highways Trust, have submitted non-binding offers for the NIIF roads portfolio. Around 3-4 suitors have submitted offers and due diligence on the assets will start now,” said one of the sources cited above.

Emails sent to NIIF, CDPQ and Cube did not elicit a response.

Biggest road dealAt $1.2 billion, the NIIF’s sale of its road portfolio will be the biggest road deal in the country so far.

Last month, Highway Infrastructure Trust, an infrastructure investment trust (InvIT) backed by private equity firm KKR, said that it has agreed to acquire a dozen road projects from PNC Infratech Ltd and PNC Infra Holdings Ltd for a total enterprise value of Rs 9,005.70 crore (approx. $1.1 billion).

In June 2023, IndInfravit, the infrastructure investment trust set up by Larsen & Toubro, acquired four road projects owned by Canadian investor Brookfield for Rs 8,270 crore.

NIIF road portfolioThese operating road assets are housed under Athaang Infrastructure, a company sponsored by NIIF’s Master Fund.

Athaang holds five assets with a total road length of over 230 kilometres spread across north and south India.

These include two major assets in the state of Jammu and Kashmir acquired separately by the fund in 2022 - the 16.3-kilometre Quazigund - Banihal Expressway acquired from Navayuga Engineering in July 2022 for $380 million (3,163 crore) and the 64.5-kilometre Jammu Udhampur Highway acquired by Athaang in August 2022 from the Shapoorji Pallonji Group for $290 million (Rs 2,414 crore).

These projects are amongst the largest annuity projects awarded by the National Highways Authority of India (NHAI).

NIIF also operates the 73-kilometre Kashi Tollway in Uttar Pradesh that connects Prayagraj and Varanasi, which it won under the Toll-Operate-Transfer (TOT) monetisation programme of the NHAI for a value of Rs 3,144 crore in January 2023.

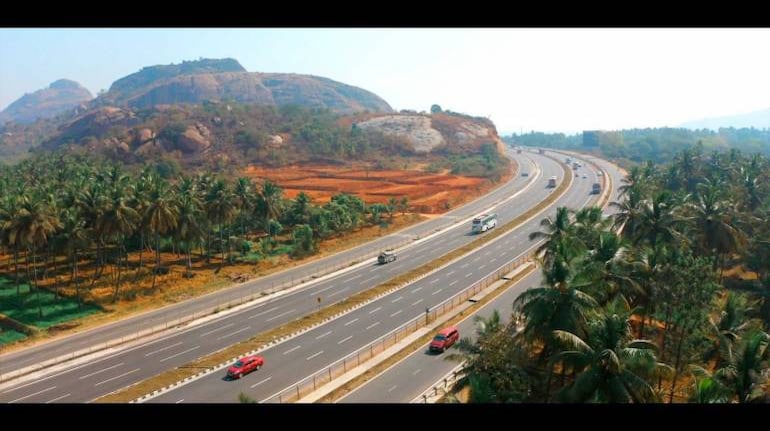

Other assets include the 60-kilometre Dichpally Tollway in Telangana and the 22-kilometre Devanahalli Tollway in Karnataka, which were acquired from the Essel Group in 2020. The former connects Hyderabad to Nagpur while the latter connects Bengaluru city to its airport.

The NIIF Master Fund has a corpus of $2.34 billion and is backed by marquee investors such as Abu Dhabi Investment Authority, Temasek, Ontario Teachers’ Pension Plan, Australian Super, Canada Pension Plan Investment Board, Public Sector Pension Investment Board, Development Finance Corporation, ICICI Bank Limited, HDFC Group, Axis Bank Ltd and Kotak Life Insurance Company Ltd.

The fund primarily focuses on core infrastructure sectors and has made investments across roads, ports and logistics, renewables and the smart metering space.

NIIF had earlier planned to monetise these roads through an infrastructure investment trust (InvIT), but later decided to sell the assets outright.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.