Buyback taxation has always remained a contentious issue and several tax experts are of the view that shifting tax incidence from the listed company to the hands of shareholders would be fair and impartial. This would also bring buyback tax at par with dividend tax, they said.

Tune in to Moneycontrol for live budget coverage.

Currently, under Section 115QA of the Income Tax Act, the company is liable to pay tax at a flat rate of 23.3 percent on distributed income. Distributed income is essentially the difference between the amount the company pays to purchase the shares and the amount it received when the shares were first issued.

Budget and Markets: Will the FM spook the F&O party by hiking securities transaction tax?

Meanwhile, shareholders whose shares are accepted in a buyback are not liable to pay any tax, a move aimed at avoiding double taxation.

On the other hand, when it comes to dividends, shareholders pay the tax and the company does not. Earlier, companies used to pay Dividend Distribution Tax (DDT) but the Finance Act 2020 abolished it.

So, what is the contention?

Vijay Gilda, Partner, Tax and Regulatory Services, BDO India, explained that in the case of dividends, all shareholders are remunerated while in a buyback, there is no surety that all the shareholders who tender shares will receive proceeds. "In that sense, on account of buyback tax being paid by the company, there is a value erosion for those shareholders who don't participate or don't get their shares accepted in a buyback," said Gilda.

To this, Amit Gupta of Saraf and Partners added, "The company pays the buyback tax from its reserves, which is a common kitty for all shareholders. Essentially, shareholders who do not participate in a buyback, end up bearing the tax burden for the shareholders who exit through the buyback route."

In 2019, market regulator Securities and Exchange Board of India (Sebi) had also noted in a consultation paper that tax treatment is not equitable in case of buybacks, more so, in the case of open market buybacks.

Under the open market route, there is a possibility of the entire sell order of any shareholder of the listed entity, getting matched with the purchase order placed by the company. "This is irrespective of the fact if the said selling shareholder intended to offer his/her shares to the company pursuing its buyback on the exchange," said Sebi.

On the other hand, if a shareholder is willing to sell shares but his/her order does not match with the company's buy order, then it becomes a normal market transaction and the seller will end up paying capital gains tax. This is one of the reasons why Sebi wants to phase out open market buybacks.

RBI deals body blow to Paytm with crippling restrictions on its payments bank

Promoters' misuse?

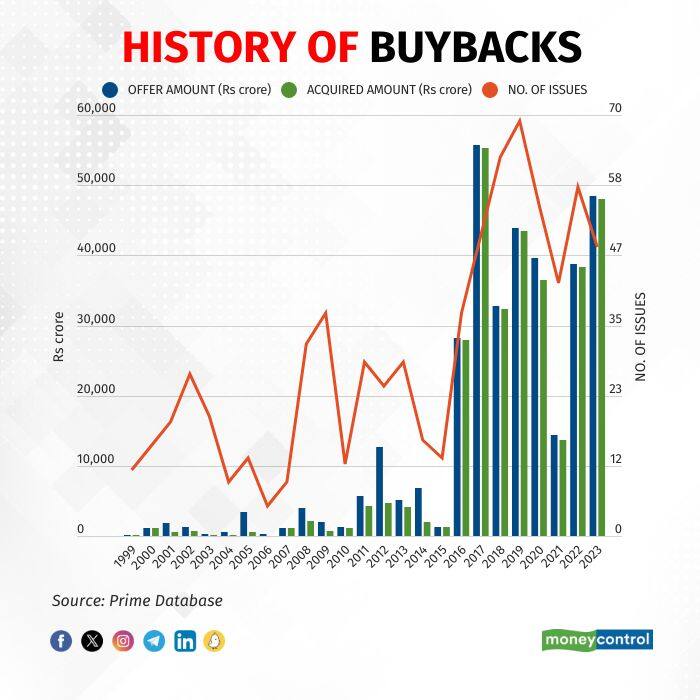

To be sure, when buyback tax was extended to listed companies in July 2019 (earlier it was only for unlisted companies), there was a dip in the number and quantum of buybacks. However, this trend quickly reversed.

Gupta explained that for the promoters there is an inclination for buybacks over normal dividend distribution by virtue of considerable tax arbitrage, approximately 12 percent, as per the extant tax regime.

As per SEBI guidelines, only 15 percent of the buyback has to be reserved for retail investors. So, promoters and high-networth individuals have a better chance of getting their shares accepted and thus, get the tax benefit.

Pranav Sayta of EY breaks down the math behind tax arbitrage:

Suppose, a company has Rs 123 cash available to be distributed to shareholders. Option A, the company goes for a dividend. Assuming the highest tax slab of 35.88 percent, cash that finally reaches shareholders is Rs 80.

Option B, buyback. Company distributes Rs 100 via buyback. Shareholders get the entire Rs 100 and company pays Rs 23.3 as buyback tax. So, effective tax is 18.9 percent (Rs 23.3 of Rs 123, which is company's total outgo)

Budget 2024 | Do's and Dont's for traders to protect from big losses on Budget day

What if tax goes to the shareholders' hands?

Prior to the introduction of buyback tax on the company, shareholders were paying capital gains tax if their shares were accepted in a buyback. Even if that practice is brought back, the shareholders would not be disadvantaged in a big manner, said Gupta.

"Long terms capital gain are taxed at special rates, viz. 10 percent and not as per the higher tax slab based rates for dividend income," he said.

Further, Gilda added that it brings parity between incidence of tax on dividend and buybacks, and any burden of tax on gains does not fall on all the shareholders.

It remains to be seen how the Finance Minister tinkers with these taxes, and one can only hope that there are no negative surprises.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!