Aside from a revision of income-tax slab rates, one of the big asks by the individual taxpayer is a hike in the Section 80C tax deduction benefits. Section 80C tax deduction benefits entail that your taxable income goes down, provided you invest in a basket of investments or spend in certain specific categories, up to a maximum amount of Rs 1.5 lakh. There is expectation on the street that this limit will be increased.

It was last reviewed in 2014 by the NDA government. Since then deductions under Section 80C have remained the same.

What is Section 80C?

Section 80C serves two purposes; investments and spends in certain categories. Among the instruments that are eligible to earn you Section 80C tax deduction benefits are Public Provident Fund (PPF), Employee’s Provident Fund (EPF), Equity-Linked Savings Scheme (ELSS; more popularly known as tax-saving mutual funds), National Pension Scheme and so on. You can invest a higher amount in any of these instruments, but the Section 80C tax deduction benefits would be available only to an investment of up to Rs 1.5 lakh.

Tax deduction is also available if you spend in certain specified areas. For instance, if you pay your children’s school or college fees, or insurance premium, either traditional plans like endowment or Unit-Linked Insurance Plans.

Also read | Budget 2024-25: Standard deduction for salaried individuals may increase to Rs 1 lakh

But, that’s old tax regime

The biggest impediment to hiking Section 80C tax deduction benefits is that it is available only to those who opt for the old tax regime. Since the Finance Minister Nirmala Sitharaman introduced the new income-tax regime (that comes with fewer tax deductions, but gives relief by imposing lower income tax rates) in her budget speech of 2020, the government has been keen to incentivise the new tax regime. In her interim budget speech of 2023, Sitharaman further incentivised the new income-tax regime by increasing the tax rebate, hiking basic exemption limit, introducing standard deduction and reducing the highest surcharge applicable at the time. But the recent election results of the Central Government where the Narendra Modi led Bhartiya Janta Party didn’t get a clear majority, points to a possibility that the government might just announce some tax sops to placate the middle-class and also some of its coalition partners, which it needs now more than before. Aside from income-tax rate cuts, the hike in tax deductions like Section 80C has been in demand.

Also read: Old vs new income tax regime: which is better?

“We have been inclined to believe that the government needs revenues to address some of its rural issues. Also, a simple regime makes life easier for the common man and woman who stand to benefit from lower income-tax rates that the new regime offers. In my opinion the dual regime would continue for some more time than usual, but in my opinion, the government might resist any enhancement in Section 80C,” says Sonu Iyer, Partner, People Advisory Services (Tax), EY India.

Also read | Budget 2024 expectations: Financial planners wish for more tax benefits in NPS

New compulsions

Some tax experts say that the new scenario post-election has changed the equation at the centre and that the government would need to be more accommodating. But that’s not the only reason, adds Suresh Surana, a Mumbai-based chartered accountant.

Follow Moneycontrol's latest updates on Budget 2024, what to expect, what to look forward to, here

“Considering the need to factor the inflation over the last 10 years, it is high time that budget 2024 provides for enhancing the limit of 80C deduction from Rs 1.50 lakhs to Rs. 2.50 lakhs,” says Surana. He also says that it is time that the budget considers the fall in savings rate. “The gross savings rate in India which stood at 31.2 percent in March 2022 has declined to 30.2 percent in March 2023,” he adds. Surana is of the view that the Section 80C tax deduction benefits should be made available in the new tax regime “as it would offer taxpayers flexibility in claiming deductions aligned with their chosen tax structure and could potentially lead to higher disposable incomes for the taxpayers, stimulating both savings and investment.”

Not everyone is convinced. Chetan Chandak, a chartered accountant, says that aside from offering lower tax rates to the taxpayer, the new income tax regime also removes the compliance burden; the need to give supporting documents to prove your Section 80 investments and spends. “Even the income-tax department is relieved as more and more people shift to the new income – tax regime. But if the Section 80C tax deduction limits are increased to, say, Rs 3 lakh or Rs 4 lakh, then many taxpayers would be tempted to maximise this. The side-effect would also be false claims; people who do not invest but still claim deduction, falsely,” says Chandak. This, he adds, increases the burden on the income-tax department to verify and scrutinise more returns that usual.

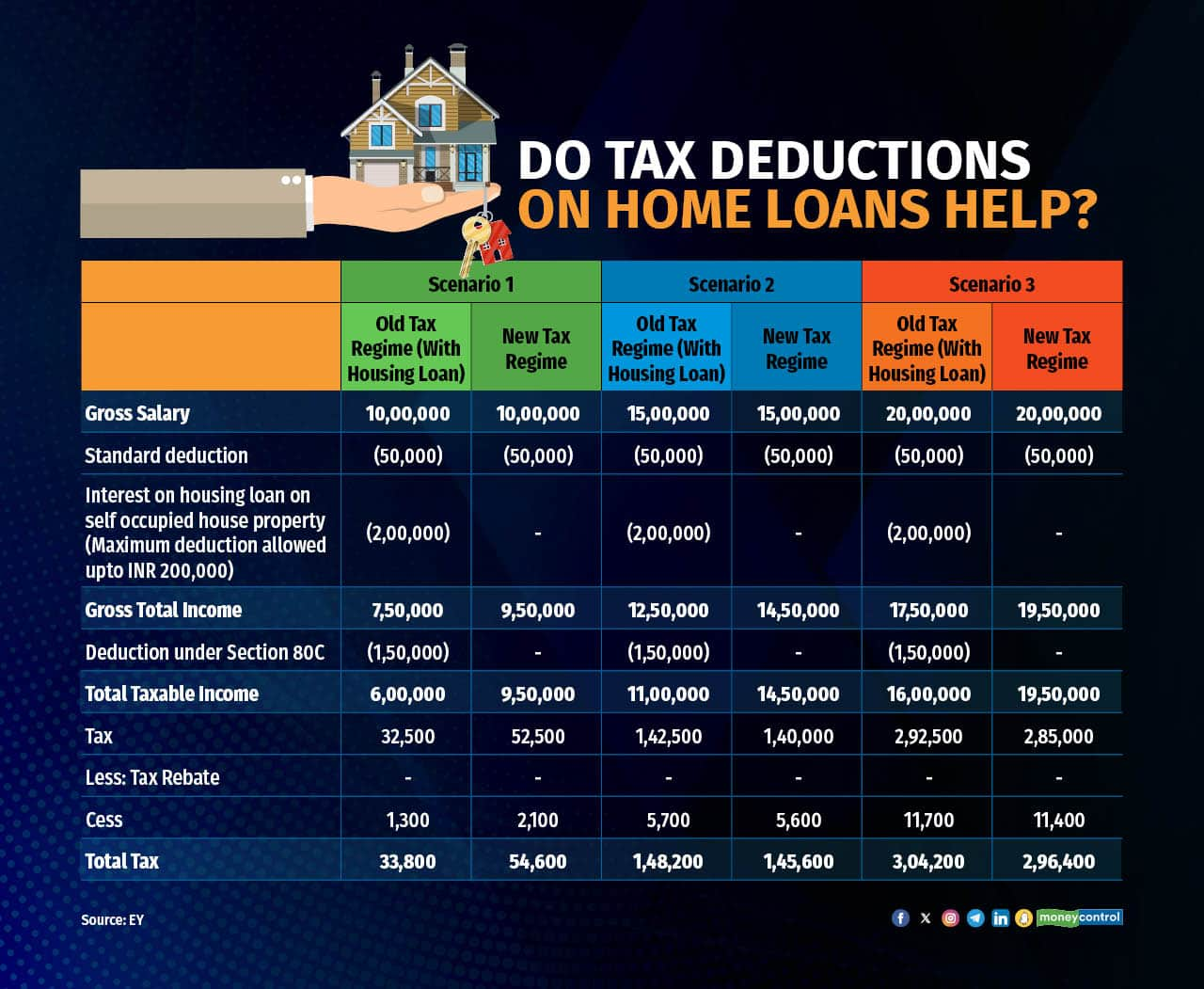

Increase in home prices and equated monthly instalments over the years, on the other hand, might just make a case for a hike in Section 80C tax deduction benefits. Or even Section 24 that gives deduction benefits for the payment towards the interest component of the home loan, up to a maximum of Rs 2 lakh. Another reason for providing an impetus to Section 80C might also be increased investments made by the small investor in the stock markets in the last 2-3 years. A large portion of eligible investments under Section 80C are fixed-income instruments like tax-saving bank fixed deposits and small-saving instruments.

Home loan tax benefits are one of the biggest reasons behind some taxpayers still sticking with old income-tax regime

Home loan tax benefits are one of the biggest reasons behind some taxpayers still sticking with old income-tax regime

Mayank Mohanka, Noida-based charted accountant strongly believes that since the government has been moving in the direction of the new income-tax regime, it should stick to this path. “The government has been slowly implementing recommendations of the direct tax committee in the current income-tax laws on a piecemeal basis. This has been a well-thought-out decision. The new regime is an important change,” says Mohanka. He doesn’t believe that Section 80C tax deductions would be raised because, aside from lower tax rates, the new regime puts more in the hands of many taxpayers, which itself gives them the freedom to invest anywhere they want.

All eyes are now on July 23, when the Finance Minister presents Budget 2024.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!