While the growth story around defence continues to be strong, analysts maintain that there is unlikely to be any significant change in allocation in the upcoming budget. However, they believe that any increase in allocation will be a positive surprise on this front and that markets will cheer.

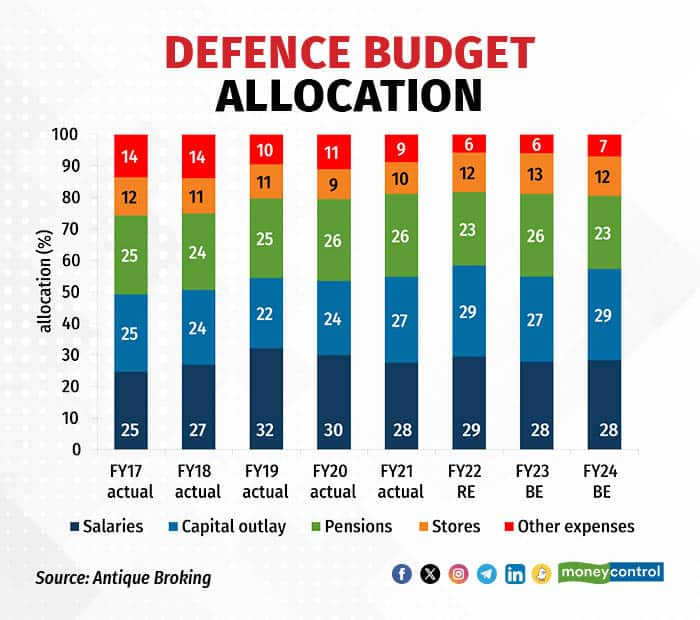

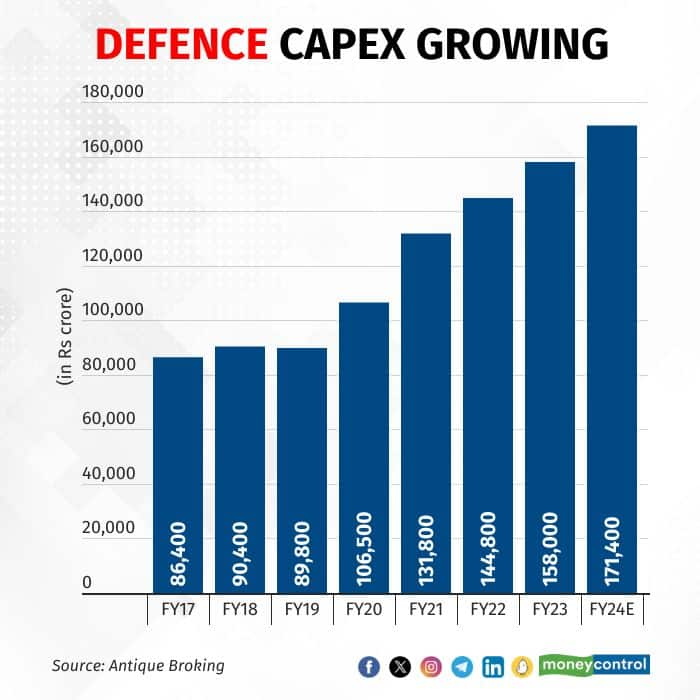

In the FY23–24 budget, the defence segment received an allocation of Rs 5.94 lakh crore, a 13 percent increase over the previous year’s Rs 5.25 lakh crore. Of this, the capital outlay for “modernisation and infrastructure development” was increased to Rs 1.62 lakh crore, 6 percent higher than the FY2023 budget’s Rs 1.52 lakh crore and a 57 percent increase from FY2020.

While most analysts believe that the interim budget “is a non-event” with major changes to come in only after the elections, the overall expectations for the defence sector remain positive. “The government’s target is to become self-reliant and also make India an export hub in the long term. I believe investments would continue on the defence side as well, with increases in capex spending to be seen more in FY2025,” says Sneha Poddar, AVP Retail Research, Broking, and Distribution, MOFSL.

Also read: Budget Snapshot: Defence capex sees renewed thrust

In the FY2023 budget, the government had specifically allocated around 68 percent of the capital procurement budget to be earmarked for the domestic industry to promote self-reliance and reduce import dependency; 25 percent of the defence R&D budget was earmarked for private players and startups.

According to Amit Anwani, Lead Analyst (Capital Goods, Industrials, and Defence) at Prabhudas Lilladher, the industry anticipates some incremental allocations, if not large, in the upcoming budget for sectors such as defence, power, and railways. But more significant announcements may be expected only when the full budget is presented after the election. Anwani believes that defence capex may see some slight moderation from previous years. In FY2023, the defence capex increase was around 7 percent to around Rs 1.62 lakh crore, up from Rs 1.52 lakh crore in the previous year.

“Maybe next year, if things are good, it could be pushed up to 10 percent; it could come through in the August full budget as well,” he adds.

Sector optimistic, backed by strong order books

According to Dipen Vakil, Analyst, Aerospace & Defence, InCred Equities, while spending on foreign procurement has been increasing, the proportion has been decreasing compared to domestic procurement, which is good news for local players. By the end of the year, domestic procurement could increase to over 70 percent (from 62 percent), benefiting both defence manufacturing and allied industries. In a recent interview, the defence secretary also spoke about how, going forward, nearly 45 percent of procurement will be from the private sector. This, Vakil believes, could be another positive for the segment.

In a recent report, analysts at Antique Broking said that they continue to be bullish on the segment and expect that overall for FY2024, defence PSUs will benefit immensely as the Ministry of Defence has placed multiple big-ticket orders, which has helped DPSUs like BEL, HAL, and BDL to bolster their already strong order book and meaningfully increase revenue visibility for years to come. “We continue to believe in the robust ordering prospects that are expected to play out in the medium term as India looks to modernise its armed forces and also scale up exports with an emphasis on Make in India,” they said.

Analysing the players

Anwani says that the increased order announcements over the last 12 months have made revenue visibility very strong for defence companies for the next 3–4 years. “What we saw over the past three years is just the beginning, as the government is now focused on improving the overall defence manufacturing ecosystem in the country,” he adds. Analysts believe that any announcements of increased defence spending could aid the growth of these companies.

HAL

HAL, one of the largest players in the space, has an order book of around Rs 80,000 crore, which analysts expect to increase to around Rs 2.4 lakh crore by FY2026. According to a report by Sharekhan by BNP Paribas, the company is also pursuing export orders worth close to Rs 70,000 crore, which will provide it with sustainable long-term growth.

Going forward, domestic self-reliance goals, proven execution capabilities, and a healthy cash balance are positives for the company. HAL has also entered into a JV for maintenance, repair, and operations, for which it is working to develop new facilities. This, analysts believe, could help the company diversify its revenue stream further, providing long-term growth opportunities.

In Q2 FY24, HAL reported a lower-than-expected earnings performance; however, analysts continue to be bullish on its growth trajectory, as it is one of the key beneficiaries of structural reforms in the defence sector. In Q2FY24, HAL reported a 1.26 percent YoY increase in net profit at Rs 1,236.67 crore. Revenue for the period also grew 9.5 percent YoY to Rs 5,635.7 crore. Earnings Before Interest Tax Depreciation and Amortisation were down 5.8 percent YoY at Rs 1527.7 crore for the quarter ended September 2023.

“Once the execution of large orders like LCA (Mk1A) picks up pace, the company could post double-digit revenue growth in FY2025E, and it should stabilise at 14-15% sales growth from FY2026. Additionally, the company is debt-free and has strong cash and cash equivalents and healthy return ratios,” the report adds.

Also read: HAL on course to re-rate like BHEL, says UBS; sets target at Rs 3,600

BDL

Bharat Dynamics (BDL) spent around Rs 120 crore towards capex for the modernisation of plant and machinery and other infrastructure in FY2023. In H1FY24, the order inflow for BDL stood at Rs 166 crore. Major government order wins during this period included upgraded Akash missiles of about Rs 250 crore from the Indian army and unmanned aerial vehicle-launched precision-guided missiles worth Rs 110 crore.

According to analysts at Elara Capital, total order inflows worth Rs 5,000-6000 crore can be expected in FY2024, including export orders. For FY2024 to FY2027, analysts say that BDL is aiming for an order pipeline of Rs 20,000 crore, “including export opportunities, comprising MRSAM orders for the Navy and the Air Force, quick-range surface-to-air missiles (QRSAM), Helina and Nag ATGM, smart anti-air field weapons (SAAW), advanced light torpedoes, and ULPGM.”

In Q3 FY24, BDL reported a revenue of Rs 602 crore, around 30 percent higher than the Rs 462 crore revenue of the previous fiscal. EBITDA for the reporting period was up by 32 percent at Rs 119 crore, against Rs 90 crore in the previous fiscal. Net profit for the period also grew 61 percent YoY to Rs 135 crore in Q3 FY2024.

BEL

Bharat Electronics has also seen an increased capex of around Rs 540 crore for the modernisation of plant and machinery, test instruments, R&D investments, infrastructure, etc. in FY2023. The company is also focused on investing in R&D in diversified areas such as arms and ammunition. As of September 2023, the order book for BEL stood at Rs 68,700 crore, up around 5 percent on a QoQ basis.

According to Elara Capital, BEL’s Q2 inflows give confidence in the company’s guidance for FY2024. H1FY24 inflows rose to Rs 15,400 crore (which is around 77 percent of targeted inflows in FY24). For FY2023 to FY2026E, Elara analysts estimate an earnings CAGR of 26 percent with an ROE of 24 percent over the same period. In Q2 FY2024, analysts at JM Financial noted that revenue remained flat at Rs 3,990 crore, and that “unfavourable conditions like strikes and delays in delivery impacted revenue booking to the extent of Rs 400 crore”. However, they expect revenue growth of 17 percent CAGR over FY23–26E, led by a strong backlog and a positive outlook for order inflows given the Government’s thrust on defence modernisation and efforts at scaling up exports and non-defence segments.

Data Patterns

One of the larger private players in the defence segment, Data Patterns, incurred a capex of around Rs 74.5 crore in FY2023, contributing mainly towards expanding existing buildings and infrastructure and further investments in technological infrastructure. Data Patterns saw significant growth in its order book in Q2 FY24 (the company is yet to announce Q3 earnings), with new domestic orders worth Rs140 crore and export orders worth Rs 39 crore, bringing its total order book to Rs 1,000 crore.

According to analysts at Elara, the company expects the strong new order momentum to continue with orders worth Rs 78.8 crore. These are orders where negotiations are complete but the orders are yet to be received. “Data Patterns’ order book is well-diversified, with 59 percent development orders, 37 percent production orders, and 4 percent service orders. The higher share of development contracts in the order book is a positive sign for the company, as it could lead to strong production revenue in the future,” the report says.

On valuations, analysts believe some of the stocks in the segment may be overvalued and may be in line for some rerating. Over the last year, a large majority of defence stocks have given multibagger returns, such as Premier Explosives, which has given returns of around 287 percent, and HAL, which has given returns of 144 percent.

According to Moneycontrol estimates, current defence stock valuations (P/B) are in the range of 3.71x and 18.51x. While some corrections and rerating are expected in the segment, most believe that as long as growth continues and the order books keep growing, stocks may not see any serious corrections after the budget is presented.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!