Anubhav Sahu

Moneycontrol research

Britannia has received decent investor attention in the last one-year on account of a ramp-up in distribution network, capacity expansion and focus on value-added products. Positive traction from these focus areas in the company’s Q4 FY18 result, once again, confirms its execution capabilities.

Though the stock has had a great run up in the last one-year, the valuation factors in near-term earnings growth. Going forward, investors need to watch out for intensified competition in some of the sub-segments of the food and beverage sector like cheese and premium biscuits.

Posts double-digit volume growth in Q4 FY18

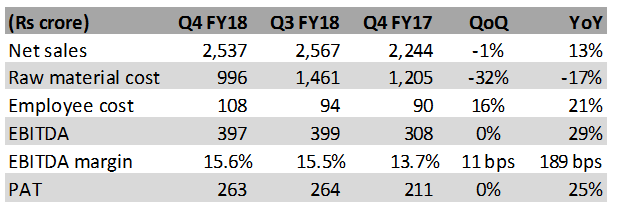

The company’s Q4 FY18 consolidated sales grew 13 percent year-on-year, aided by double-digit volume growth in the domestic business that also drove topline. Ramp up of the distribution network with focus on direct reach, improved demand in rural market and higher growth in northern states aided the domestic business.

EBITDA margin improved 189 bps YoY on account of a decline in raw material cost and other expenses but the same was partially offset by employee costs. Margins at the subsidiary level improved due to higher share of value-added products and lower milk procurement costs.

Consolidated financial snapshot

Invests Rs 1,000 crore in the food park

The company expansion plans are on track. Its greenfield plants in Mundra special economic zone and Guwahati (Rs 400 crore capital outlay) have been commercialised. This resulted in a six percent addition to the company’s capacity (60,000 MT). The management plans to expand capacity over the next three-years at a cost of about Rs 1,000 crore. To boost capacity at its mega food park in Ranjangaon, Pune, Rs 300 crore would be invested in the current year.

Improved retail reach and innovation

Distribution expansion has been solid, particularly, its direct reach. The latter increased by more than 2.5 times in the past four years. Its current direct reach is about 1.84 million outlets (versus 1.55 million in FY17) or 37 percent of total outlets.

The management focus is on new product innovation, with launches like croissants and macro snacking (cake and rusk). In case of croissants, a joint venture with the Greek-based baker, Chipita is under progress for the Pune food park.

Benign food inflation and premiumisation to support margins

The company’s quarterly result was positive, with improved volumes and margin. The latter was complimented by increased direct reach and expected traction in capacity expansion plans.

Among the near-term factors to monitor is inflation in input costs. Recently, prices of milk, sugar and flour have reduced while that of refined palm oil have increased mainly on account of higher import taxes (from 7.5 percent to 48 percent). A moderate level of inflation (three percent YoY) in the company’s commodity basket continues.

Increased emphasis on cost efficiency, along with the continuing premiumisation, is expected to support margins despite heightened competition. The management has been able to save Rs 225 crore in FY18 and targets savings of about Rs 240 crore in FY19.

Outlook

While Britannia’s attempt to expand its portfolio and focus on high margins products is commendable, increasing competition in the premium biscuits and cheese categories needs to be watched carefully. In the last one-year, the stock has run up 53 percent and now trade at 52 times FY19e earnings, which is well ahead of the sector’s average, and prices in near-term growth prospects.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!