India’s top-tier private banks are continuously under pressure of higher attrition, which is at 34-46 percent. The country’s largest private sector bank, HDFC Bank, saw a 34.15 percent attrition in FY23 while Kotak registered 46 percent, up from 29 percent in FY21.

Experts cite talent poaching among the banking bellwethers, increased competition from other sectors, especially fintech, and a reluctance to hire in bulk for the ever-increasing employee turnover.

For instance, in Axis Bank’s case, 60-70 percent of the talent moved within the banking ecosystem, another 20 percent towards other industries, and just 5 percent for personal reasons.

“Some organisations are taking to campus plus strategies to build their pool of bankers, rather than hiring from each other,” Rajkamal Vempati, President & Head of Human Resources at Axis Bank told Moneycontrol. She added that hiring remains at an all-time high.

Axis Bank’s attrition increased to 34.8 percent in FY23 from 31.6 percent in FY22.

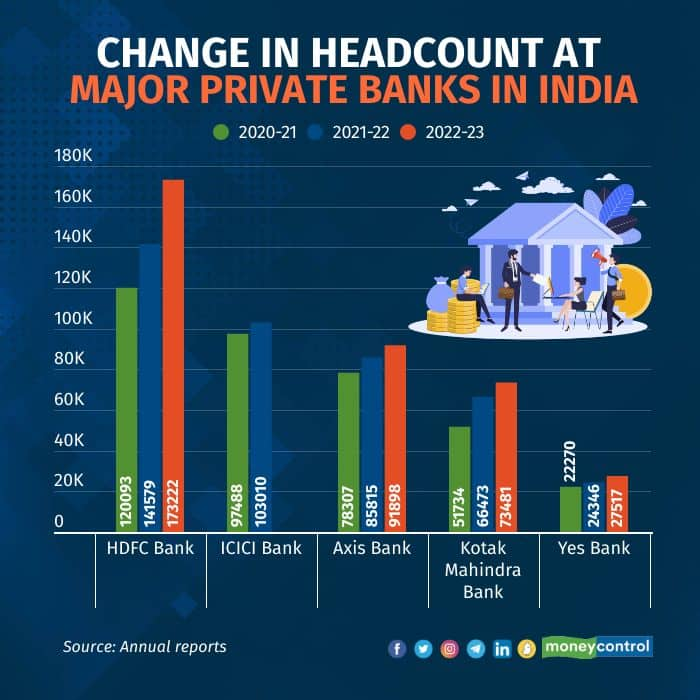

Banking bellwethers like HDFC Bank, Axis, Kotak, ICICI, among others, who account for over 30 percent of the sector’s workforce, tackled 26 percent attrition and raised their collective headcount by 16 percent, data from staffing firm Xpheno showed. However, the Indian banking sector’s headcount as a whole rose just under 2 percent, with 20 percent attrition.

A case in point is HDFC Bank, whose headcount increased 22.35 percent in FY23 but with 53,760 employees also leaving the bank.

Over the last few years, HDFC Bank has experienced a marked shift in the mindsets, stickiness and commitment levels of younger talent. “Their willingness to invest in building a career versus taking on the next higher paying job seems to be on the decline,” said Vinay Razdan, CHRO of HDFC Bank.

ALSO READ | Ghost jobs haunt candidates amid a spooky job market“Significant headcount movement among bellwethers not resulting in significant sectoral growth typically denotes lateral movement. This lateral movement is what we call a zero sum game within the sector and between bellwethers. It doesn’t necessarily result in job creation,” said Kamal Karanth, Co-founder of Xpheno.

However, Xpheno noticed that the Indian banking sector had lost 37,000 professionals to other sectors while it absorbed 65,000 back over the last 12 months. This rules out attrition being driven by a talent exodus.

Queries sent to Kotak Mahindra Bank had not elicited a response till the time of publishing this article.

Hiring numbersAs far as hiring trends are concerned, job vacancies in the banking sector were up by almost 40-45 percent year on year (Y-o-Y) as compared to the first quarter of 2022. Hiring activity is up by around 10-12 percent Y-o-Y, according to staffing firm Randstad.

While this is a positive trend, Yeshab Giri, Chief Commercial Officer, Staffing & Randstad Technologies, pointed out it could also explain the reason for the higher attrition, given that there opportunities aplenty for the talent pool to pick and choose employers they feel aligned with in terms of work-life balance, flexibility, compensation and benefits, along with career growth opportunities.

When will attrition cool?Experts suggest it is highly unlikely banks will see a major drop in attrition soon. According to Karanth, the current pattern of major banks engaging in both attrition refills and expansions will feed attrition for a “few more quarters”, and it will take at least two quarters for the numbers to cool down.

Nevertheless, HDFC Bank said efforts are underway on several fronts to rein in attrition, such as improving the onboarding experience for new recruits and introducing policies to support women employees returning from maternity.

ALSO READ | Semiconductor industry has 8,000 active jobs, mainly in entry-level positionsAxis Bank has chalked out strategies to see how it can reduce the attrition rate. The bank’s top leadership does quarterly webcasts, and town hall meetings with employees, besides travelling nationwide regularly to meet with staffers.

“Our ability to attract people from diverse industries remains high. If you look at our advocacy on sites like Glassdoor, it is the highest among large Indian private banks,” Vempati said.

Millennials and Gen Z employees — a major part of the employee churn at HDFC Bank and Kotak Mahindra Bank — often seek more growth opportunities, learning and skilling opportunities at their workplace.

“They are more likely to stay with an organisation where learning is celebrated, an environment that embraces change, encourages adaptability and where the employees see clear career paths,” said Nishchae Suri, MD, India, at Cornerstone OnDemand, a talent management software firm.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.