Note to readers: They hold the economy together but what holds them together? The Aligned Mind delves into the mental health and spiritual wellbeing of India's finest business minds. How they confront their challenges. What disciplines and practices keep them intellectually and emotionally agile. How they attain the mind-body-spirit integrity that keeps their organisations finely balanced on that cutting edge.

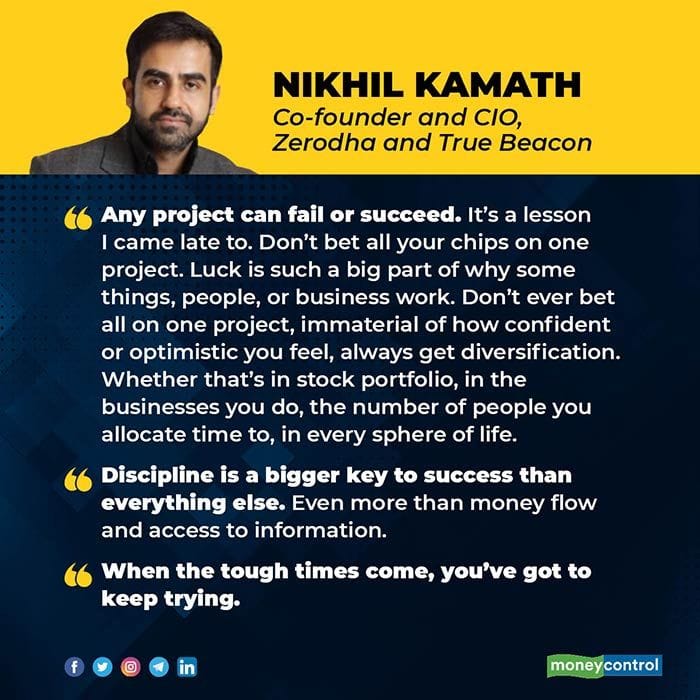

Discipline and structure are more important than even access to information and money flow according to co-founder and CIO of Zerodha and True Beacon, 34-year-old billionaire Nikhil Kamath. Yet, structure is exactly what he renounced when he exited formal education to play competitive chess at the age of 15. He detests volatility in his personal sphere, loves it in the market place. He’s an outcome of capitalism, but advocates for taxing the excesses of wealth. His older brother Nithin has called him a better trader than himself, and as loud as his trades speak, he’s the soft-spoken, self-effacing one.

His father worked with Canara Bank and his mother was a music teacher. How does a middle class south Indian schoolboy in a family where education is at a premium manage to defy expectation? The perception of it being a game for smart people helped, though he’s unassuming enough to suggest it’s a misconception. Between the game and trading, he got all the higher education he needed. The stock market turns into one of those life-sized chess boards he walks onto every morning.

Sociable and disciplined

“Chess teaches you structure, you have to work within a set of rules and be creative within that. It teaches you how disciplined you need to be, in business or anything else. And trading is a very humbling experience. The minute you know or think you know what is going to happen tomorrow it hits you on the head and corrects you” he says.

He’s sociable, makes friends easily, with no hang-ups about who’s befriending him for his net worth, which, no biggie, grew to Rs 7,100 crore, compounded 150 percent this last year. That’s because Nikhil doesn’t come pre-packaged with the straight jacket of barriers such systems bring, class and hierarchies rendered meaningless. It translates into how he hires, looking past degrees and schools, at the value people bring.

“It doesn’t mould you into thinking a certain way. When you’re not going to college formally, you read the books you want to read, you pursue the hobbies you want, and there’s no peer pressure to learn a particular subject. That allows you to think outside the box, be a bit more creative and just opens your mind a little.” He doesn’t champion dropping out of college in principle though. He is aware he’s one out of ten who got lucky, for the other nine, it could be a struggle. He also did miss out on the regular stuff. “When people talk about how they made their best friends in college, I never had that. I do miss it and I sometimes wonder if I did the right thing.”

What in him really escaped the system unscathed is his curiosity. “Most often we have this fixation about wanting to appear smart, especially later on in life, and in that pursuit, we lose some level of curiosity. I think curiosity is directly proportional to how smart one can be. To not have the hinderance of thinking that you might be saying something that could make you look stupid but questioning it anyway, is a cardinal part in how many adults turn out.”

What in him really escaped the system unscathed is his curiosity. “Most often we have this fixation about wanting to appear smart, especially later on in life, and in that pursuit, we lose some level of curiosity. I think curiosity is directly proportional to how smart one can be. To not have the hinderance of thinking that you might be saying something that could make you look stupid but questioning it anyway, is a cardinal part in how many adults turn out.”

Quitting school also drives up your insecurities. You begin to wonder what your classmates are reading and fear that you’ll be left behind. So you read all kinds of crap, from economic theory to philosophy, borrowing from cousins, friends and nudging your parents to buy you Nietzche. His current interest is psychology.

“Deep down I think I am a very insecure person. Every phase of life has been driven by one insecurity or another” he says, with insight few come to within their lifetimes. Currently, his seeking centres around purpose. “I often wonder what the point of things is. It could be a financial, business, or personal goal, I keep asking myself how this is done, what? We set many goals for ourselves when we are younger and once we meet them, there’s no going anywhere from there.”

It’s representative of a generation that achieves by the time they’re thirty what their parents spent a lifetime working towards. It brings with it a constant need to reset goals. Purpose is important to him. He bought a bike a couple of years ago, and used it maybe three times. He didn’t see the point of driving around for two hours, getting some coffee and driving back. Same with meditation. Nikhil has an overwhelming need to know where he’s going. He’s starting to suspect he may have to be okay with not necessarily going somewhere all the time.

“Right now people motivate me more than anything, those I work with, friends, I try to take them along in whatever I’m doing, that gets me interested in whatever I am doing. I don’t have kids, dependents, so the larger sense is ‘what next?’ and I don’t have the answer to and I’m trying to figure it out for myself.”

He’s considered himself a stoic. It reflects in how even his tone of voice is, his lack of a temper, his humour. But stoicism is more than not losing your shit, it’s also a philosophy that has its followers considering worst-case scenarios and offering them no hope to navigate through it.

“Between a philosophy of nihilism, and one that deceives my mind into seeing meaning, the latter’s probably a happier path to take. Maybe if I can deceive myself into seeing meaning I would be happier as a person” he says.

Waiting for organic turns in life

He’s as hit by the doom and gloom of the pandemic as much as any of us, and looks for a reason to stay occupied. Not having it all figured out comes as a bit of a relief to be honest. For someone who is not a planner of the long term, as he waits for organic turns in life, his routine has pretty much stayed the same for the past 15 years. He’s at office by 8 am, is on the markets all day, works out and off to bed, during the week. On the weekends, he hangs out with friends.

“I’m a believer in everything being cyclical. I haven’t had a professional low in a few years now so I’m definitely due one soon. Outside of that I have a pretty repetitive life. I think I am at the cusp of change and new things now,” he says.

His go-tos in difficult times includes a few close friends, his brother Nithin, with whom he plays a game of basketball or table tennis or pool every day, and his books. “I have one decent habit which is when things go terribly wrong I journal it so I have a reminder of it. The notion of ‘this too shall pass’ is a good thought when things are going badly and one is able to look back at how much worse things were in the past and know that they passed anyway.” Four categories of difficult times have left an impression on him include: losing a lot of money trading, a business idea not working out, a girlfriend breaking up with him, and his parents being unwell.

“I hate volatility in my personal life, I love volatility in the markets,” he says. Nikhil’s personal natural counterbalance is to go to a time when the person inflicting volatility did not exist and remind yourself that there is no need to fixate on the person causing it.

“In the markets volatility is what makes it interesting. If you were to have markets that were extremely stable or they were trending in either direction it makes life boring for everybody. You could go into work and be able to fairly predict what might happen on that day. You try to figure out how to counterbalance it by buying insurance hedging portfolios, bunch of things you can do.”

We handle volatility in markets very differently from that in the personal sphere, he notes. The ideal way would be to talk, consult, have a conversation and deal with the issue or person. Like most of us, Nikhil tends to push it under the rug instead. “If a certain sphere is causing volatility I’ll put it in a box in my head and not think about it hoping it magically disappears. It doesn’t it comes back and its much worse. I know that and I still do it.” He enjoys surfing the waves when it comes to the markets though. That’s a thrill. So why does one way of dealing with volatility not translate into the other? It has to do with how well you know where the other is coming from.

“Markets amidst all the volatility, there is some level semblance of rationality there. In personal life there will be some really illogical people who you will never be able to comprehend why they are behaving one way or the other. I like the markets’ volatility because I know rationality will come back at some point.”

Trust in the market's bouncebackability

Nikhil knows the markets so well he can sense its moods, see its patterns unfold, and trust its bouncebackability. Volatility within the known always feels safer and more trustworthy. Just like chess. The queen may be under threat but as long as the game is in play and you know who’s guarding the castle, you know you’ll be okay.

This is a knowledge that extends to the nature of money flow and the real need people have for wealth during the difficult times.

“These rich lists all exaggerate they talk about valuations and nobody really has that much money right. Different business and different people have different levels of liquidity. Money makes a huge difference. It goes a long way in making someone happy. So whenever people say money is not required to be happy, I’m not of that school of thought. I’ve lived in both phases, where I didn’t have a lot of money and when I did, and I know how important it is.”

This is where the stoicism kicks in, the seeing the worst and soldiering through. When the tough times come, you’ve got to keep trying, he says. Governments will also begin to offer help. “The world is moving in a direction where five out of ten of us will be rendered jobless. You can blame it on technology, on automation, on the economic slowdown, there are many reasons. I think governments across the world will try and sell some form of socialism because they won’t have a choice going forward. You’ll have to have universal basic income in some manner.” The world has experimented with many socio-economic systems and we’ve generally prospered best under capitalism he notes. “If you were to gauge how happy people were at different points, the fact that somebody who was nothing can suddenly be wealthy, whatever metric you may choose it doesn’t have to be money, I think that’s a great system to follow. Maybe in its current version it doesn’t work. Maybe a form of capitalism wherein by virtue of having huge inheritance taxes and a bunch other ways to penalise the excessively rich, we’ll have a more level footing for everybody to compete in.”

His brother Nithin has a pet theory on how Goddess Lakshmi sits on a lotus, and you can never grab a lotus, you have to let it come to you. You have to do your work, focus on the good, build a better company, offer a better service, look after people, and the money will come. For Nikhil that translates into structure and discipline.

“It’s very counterintuitive but anybody who walks into the market trying to make 40 - 50 percent or double their money ends up taking a lot of undue risks like trading products which are levered, or derivatives and stuff like that. But when you have structure, a system in place, typically you end up making 15-20 percent a year and the power of compounding 20 percent in three to four years is thrice the amount you started out with. And that compounding kicks in 10-15 years down the line if you’ve been consistently making money. I think discipline is probably a bigger key to success than everything else.”

So much of the discipline he puts into his work now is self-engendered. “When you discard something early on, you understand the importance of it, much like anything in life. It probably teaches you why it’s important” he says.

Nikhil Kamath’s mind+body+spirit mantras

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!