Mumbai, Sep 13, 2024 — Verticalized SaaS payments platform Easebuzz has released its financial numbers for FY24. The annual Gross Transaction Value (GTV) processed by the platform during the year crossed a record INR 1,00,000 Crore, a 48% growth rate compared to FY23. With a rapidly expanding merchant base touching 1,50,000 mark, the platform experienced a year-on-year revenue growth rate of 23%, taking the revenues to INR 290 Crore. The daily volume run rate of the platform touched close to 1 Mn transactions.

Despite headwinds in the fintech industry and changing regulatory landscape, Easebuzz is able to maintain its growth trajectory with strong focus on verticalization, personalization and compliance culture. With a robust tech and product suite, the platform has retained its dominance as one of the largest SaaS based payment solutions providers in the Education segment, with over 10,000 institutes relying on its full-stack technology and payment infrastructure. Easebuzz offers solutions to some of the marquee clients across sectors like Parul University, State GRAS, Noida Power Corporation, BSES Rajdhani Power, GoKwik, IRCTC, DLF, Brigade, BigBasket, MTDC, etc.

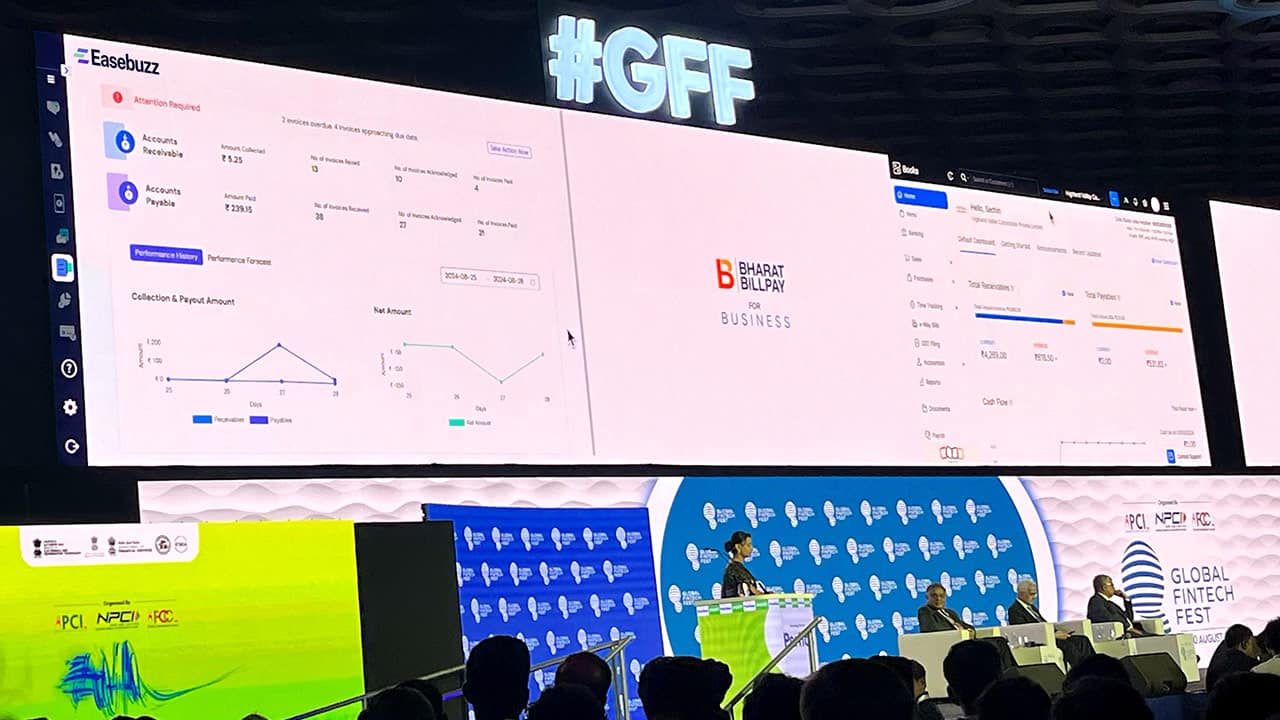

Easebuzz is now foraying into B2B Payments and has recently launched its invoice management and payments platform in exclusive collaboration with NPCI Bharat BillPay Ltd. (NBBL), at Global Fintech Festival 2024, in the presence of honorable RBI Governor Shri. Shaktikanta Das and Shri. Nandan Nilekani, Chairman of Infosys, in Mumbai. This platform enables interoperability to the ecosystem, simplifying business payments. During the launch event at the Global Fintech Festival, the interoperability of Easebuzz platform was demonstrated by NCPI: through successful payment processing of a cross-platform B2B invoice payment using Easebuzz’s platform and payment gateway. Live demonstration of B2B invoice payment transaction on Easebuzz Platform at GFF2024, in the presence of honourable RBI Governor Shri Shaktikanta Das

Live demonstration of B2B invoice payment transaction on Easebuzz Platform at GFF2024, in the presence of honourable RBI Governor Shri Shaktikanta DasRohit Prasad, Founder & CEO, Easebuzz, said, "Our partnership with NPCI Bharat BillPay in launching B2B Payments Platform is a significant step towards democratizing and transforming B2B transactions in India. Easebuzz Platform will help businesses with simplified invoice presentation and settlement process and brings efficiencies across the supply chain. We aim to continue these industry leading innovations that deliver value to businesses. B2B Payments will augment our existing revenue streams and will help us to reach the $50 Bn GTV milestone and $100 Mn revenue in FY25.” He also stated that the company aims to achieve this growth while maintaining their strong record of profitability. “Our technology-centric approach, focus on personalized solutions and compliance driven culture has fostered trust among leading enterprises and government organizations. With increased market share and profitability at the core, we also aim to go public in the next 2 to 3 years”.

Easebuzz will onboard merchants (manufacturers and distributors), who can leverage this B2B platform to raise invoices for goods and services and receive payments digitally from buyers (retailers and shopkeepers) through any of the online payment modes. Businesses that are already onboarded on Easebuzz platform includes Lenskart, 1Vendor Platform, Pice, Symbiosis University, SRV Media and many more. Buyers can pay multiple invoices in a single transaction using a wide array of payment modes, including UPI, net banking, cards, wallets, and NEFT, all facilitated by robust payment infrastructure of Easebuzz. The platform also facilitates invoice lifecycle management, flexible payment options, and integrated financing solutions. Additionally, the platform's Rewards, Accounting, and Compliance suites help businesses across various sectors streamline their payment processes and enhance cash flow management.Moneycontrol Journalists were not involved in the creation of the article.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!