The Indian stock market may well be going through a correction amidst overall bearish sentiments but historical data shows that markets more often than not do well in the period following the Union Budget.

The government is set to announce the Union Budget on February 1 and while investors are hoping for market-friendly announcements, data analysed by Moneycontrol shows that equity markets often perform well in the 1-month and 3-month period following the Budget.

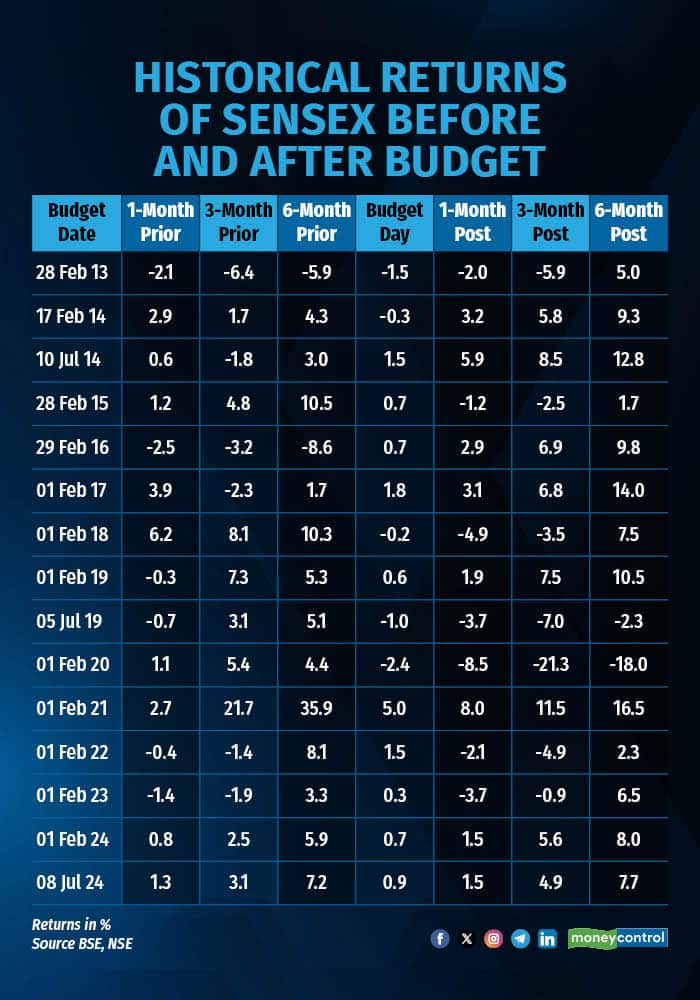

Of the past 13 instances since 2014, the benchmark Sensex and Nifty posted gains seven times, averaging 3.5% returns. On the other hand, markets showed gains in eight cases and losses in five during the month preceding the Budget. In the three-month period post the Budget, both indices recorded gains in seven of 13 instances.

In 2024, the interim budget in February and the full budget in July -- following the election results -- triggered a market rally fuelled by the government’s commitment to fiscal deficit targets and aggressive capex plans.

However, 2025 has presented significant challenges for Indian equity markets. Global economic headwinds and domestic obstacles have exerted considerable downward pressure. Year-to-date, the Sensex and Nifty have declined by over 2%, while broader indices like the BSE MidCap and BSE SmallCap have fallen over 7% in a short span of time.

Domestically, economic growth has slowed, eroding India’s status as the fastest-growing major economy. Persistent selling by Foreign Institutional Investors (FIIs), who have offloaded shares worth over $2 billion in the current month till date, has compounded the issue. The Indian rupee has depreciated to record lows, further dampening market sentiment.

Corporate earnings have also disappointed, with over half of Nifty 50 companies missing or barely meeting analyst expectations in the September quarter, a trend expected to continue through the December quarter. Adding to these challenges, the Reserve Bank of India's (RBI) delay in rate cuts has heightened concerns about a potential economic slowdown. Government capital expenditure, a key driver of growth since the pandemic, has significantly tapered off in FY25.

Despite these issues, brokerages predict the government will maintain fiscal deficit targets, with a recent Goldman Sachs report estimating a fiscal deficit of 4.4%–4.6% of GDP for FY26. Further, public capex growth is projected to align with nominal GDP growth, slowing to 13% year-on-year in FY26 from over 30% between FY21 and FY24. Spending on rural welfare and subsidies is expected to stabilise at pre-pandemic levels of approximately 3% of GDP.

Divam Sharma, co-founder of Green Portfolio, believes that a budget allocation exceeding Rs 2.95 trillion would signal an aggressive stance. Given rising debt-to-GDP ratios, escalating interest costs, and sluggish GDP growth, the government is likely to prioritise Build-Operate-Transfer (BOT) and Hybrid Annuity Model (HAM) projects, which require lower capital outlays compared to traditional Engineering, Procurement, and Construction (EPC) models.

Shripal Shah, MD & CEO of Kotak Securities, is of the view that budget should look at boosting market sentiment amid macroeconomic challenges. He suggests reducing capital gains tax or STT to enhance domestic retail participation, attract foreign investors, curb FII outflows, stabilise the rupee, and improve the investment climate -- benefiting both retail investors and the broking industry.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!