BUSINESS

Crompton Greaves Consumer Q4: Lower input prices, cost optimisation support margins

Focus on the premium product portfolio and the revival in the lighting business will be key growth drivers

BUSINESS

Berger Paints Q4: Gaining market share despite emerging competition

Outperforming industry growth amid challenging market conditions

BUSINESS

Sticky performance — Pidilite delivers stability in tough Q4

Underlying volume growth continues to remain strong

BUSINESS

Radico Khaitan Q4: IMFL adds punch to sales volume

Stable raw material prices help in the expansion of gross margins

BUSINESS

Asian Paints Q4: Growth slows as competitive intensity tightens grip

Though Asian Paints is a quality business, the competitive intensity in the sector has started show-ing its colours

BUSINESS

Kajaria Ceramics: Muted quarter impacted by strategic realignment

Recovery in domestic market demand expected in the later half of FY26

BUSINESS

RR Kabel Q4: Propelled by strong demand in both domestic and overseas markets

Substantial margin expansion in the quarter on the back of operational efficiencies

BUSINESS

UltraTech – Operational performance shows the company’s competitive advantage

The government's commitment to infrastructure and continued momentum in real estate augur well for the cement maker

BUSINESS

Dalmia Bharat Q4: Solid operational performance

A mixed set of earnings report in Q4 FY25 as cement faces lacklustre demand

BUSINESS

Waaree Energies: A business with growth potential that faces competitive intensity

Stellar financial performance as key growth engines continue to deliver strong operating metrics

BUSINESS

Havells India wraps up FY25 with strong earnings in Q4

Revenue growth remains strong; however, margins were impacted due to a change in the product mix

BUSINESS

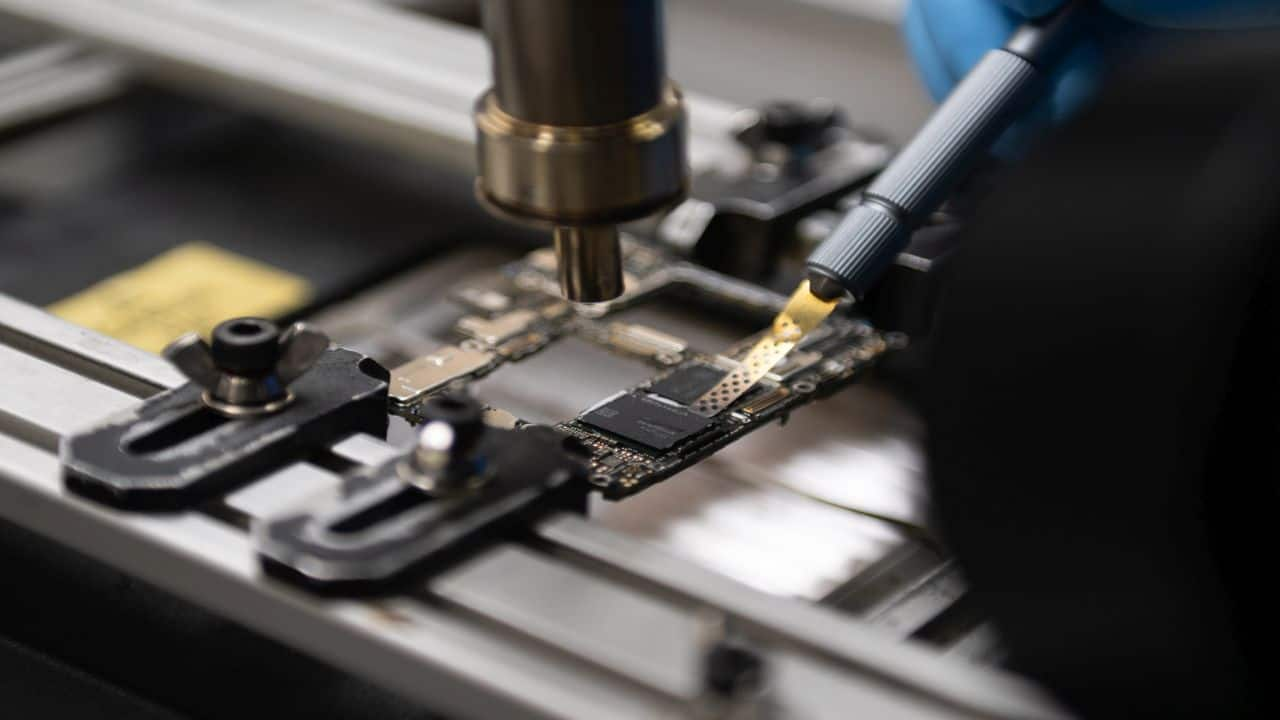

Cyient DLM: Near-term revival appears unlikely

Q4 revenue growth driven by the acquisition of Altek Electronics

BUSINESS

GM Breweries Q4: Solid operational performance

Demand outlook stable but the sugarcane market is facing headwinds

BUSINESS

Big Moves in Logistics: What Delhivery’s latest bet signals

India’s logistics sector just saw its second major distress deal in under three years. Behind it lies a tale of missed targets, lost clients, and shrinking valuations

BUSINESS

Are Indian aquaculture companies safe from US tariff net?

The new tariff will add to costs, but relative tariffs will matter more. Where India stands in the tariff ladder

BUSINESS

Delhivery: Does the current stock price factor in growth concerns?

Although the business environment remains challenging, Delhivery is looking to maintain its market share on the back of its market position and cost leadership in the logistics sector.

BUSINESS

Carysil – Q3 disappoints, but FY26 holds promise

It enjoys a strategic cost advantage compared to peers and stands to benefit from the growing preference for premium products in the home improvement market

BUSINESS

Nazara Technologies: Strong growth from transformative acquisitions

The new sources of revenues can potentially double the company’s top line over the next 18-24 months

BUSINESS

UltraTech’s wires and cables foray: A high-voltage hazard for incumbents?

The W&C industry size is estimated at Rs 80,000 crore, having delivered a CAGR of 12-13% between FY19 and FY24 The shift from the unorganised to the organised market provides an attractive opportunity for a new player

BUSINESS

Avanti Feeds: Many reasons to be optimistic

With raw material prices remaining stable, the company remains well-poised for a healthy growth in the medium term, driven by the scale-up of shrimp processing and pet food segments.

BUSINESS

Transport Corporation of India: Solid quarter; healthy long-term outlook

The company enjoys a strong domestic footprint and can continue to capture incremental market share because of its extensive distribution network.

BUSINESS

SG Mart: Growth outlook intact despite recent hiccups

The management expects a healthy growth in volumes despite volatility in metal prices. Three new centres are expected to become operational by Feb-end, and SG Mart is scouting for more land parcels for five more

BUSINESS

Crompton Greaves Consumer Q3: Cost optimisation drives profitability

Focus on the premium product portfolio and revival in lighting business will be key growth drivers

BUSINESS

PG Electroplast – A lot of upside levers

Secular tailwinds in electronics manufacturing should propel the performance of the company