BUSINESS

Tata Technologies: Why you should wait before investing

Deceleration in IT service growth is attracting IT firms to the high-growth engineering domain, especially to the spending-driven automotive ERD

BUSINESS

eMudhra: Digital growth story continues

The new pricing policy by the CCA from July 2024 onwards may have some impact in the near term, but the management appears confident that it can sail through

BUSINESS

KPIT: No speed breaker for this auto ERD company

KPIT has retained a dominant position in the auto ERD space and has been delivering a strong double-digit YoY growth, quarter after quarter

BUSINESS

Mphasis: Weak quarter as expected, delivery on outlook remains key watch

The results of Microsoft, & Alphabet indicate that growth for hyper-scalers are on a robust trajectory. Large transformation deals may augur well for Mphasis.

BUSINESS

Cyient: Soft quarter and weak outlook; no upside from here

For FY25, the management sees sustainability. Aerospace, semiconductors and connectivity verticals to spur growth

BUSINESS

Cyient DLM: Defence demand fuels solid numbers

Rising defence spending and aerospace modernisation are the key themes that are going to translate into a strong growth for the company

BUSINESS

RIL Q4: Superb execution, upbeat outlook

RIL’s consumer businesses now contribute to nearly half of consolidated operating profit. Meanwhile, a strong capex pipeline will sustain its growth momentum through newer verticals such as renewable and clean energy

BUSINESS

Oil on boil: What should investors do?

Softness in LNG prices has led to domestic demand picking up, which should result in strong performances by GAIL's gas marketing & transmission businesses

BUSINESS

Israel, Iran trade punches – What it means for Indian markets

Though the domestic economy looks promising, equities may remain volatile in the near term

BUSINESS

PVR Inox: Pain in the near term, but valuation holds out hope

A part of the valuation discount can be justified because of the recent performance

BUSINESS

Discovery Series: Intellect Design Arena, a long-term growth play

A rise in the platform business and deal wins put Intellect in a sweet spot to grow revenue at a double-digit rate and achieve margins, like global players which enjoy over 30 percent operating margins.

BUSINESS

Saregama: Stock correction adds to the investment case

Negative impact of OTT transition is already priced in and rising paid subscription would deliver secular multi-year revenue growth for Saregama

BUSINESS

Should one go in for Tata Technologies or KPIT?

The large pool of competitively priced engineering talent and technology service providers make India a major outsourcing destination.

BUSINESS

ZEEL: Tough media environment, weak investment case

The company’s anticipated turnaround story has not played out, and it is consistently losing market share. We are stopping our coverage of the stock

BUSINESS

CMS Info Systems: Why do we see more upside?

CMS has multiple mid-term growth drivers, including growth in organised retail for cash logistics, fresh cycle of PSU ATMs, and private sector ATM expansion for managed services

BUSINESS

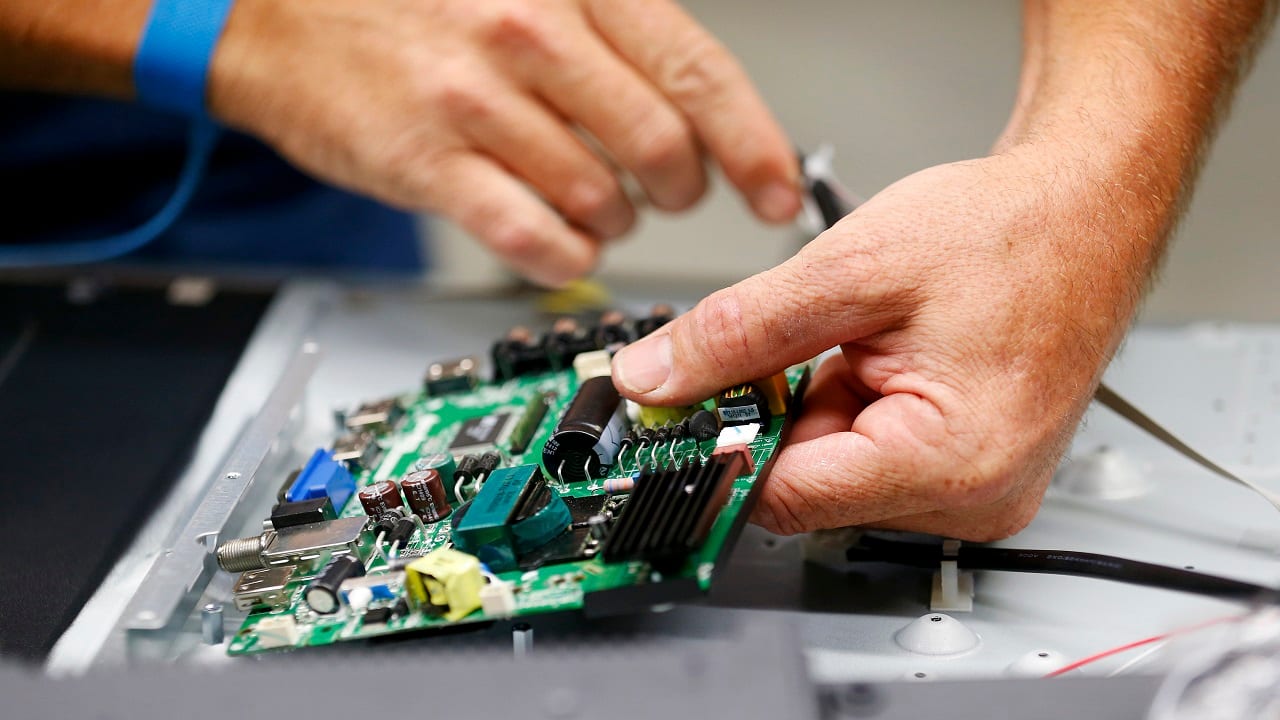

Avalon and Elin: Are these EMS players worthy of investor attention?

The Indian EMS market has grown at a CAGR of 20 percent in the last 3-5 years and it is estimated to grow at 32-35 percent, going forward. Avalon and Elin have underperformed their peers

BUSINESS

eMudhra: Should you buy it after the recent run-up in the stock price?

The digital firm has posted decent Q3 numbers and is focusing on international markets

BUSINESS

CGD sector: Time to book profit?

Falling APM gas allocation has forced CGD companies to meet the shortfall through term gas and HPHT gas for priority sector volume, thereby raising average gas costs

BUSINESS

Info Edge: Tough hiring environment to continue

Info Edge continues to face obstacles in its growth journey due to the IT hiring impact on the recruitment solutions vertical which is its largest revenue and profit contributor.

BUSINESS

Kaynes Technology: Why it is the star of the Indian electronics manufacturing story

In FY24, Kaynes is ahead of its peers on revenue growth and margins and is likely to sustain this momentum

BUSINESS

Zomato: Should you add it to your menu?

The company’s growth trajectory should translate into margin improvement going forward

BUSINESS

Syrma SGS: Disappointing Q3, cut in long-term margin guidance

In the months of FY24, revenue growth has been an impressive 48 percent, yet EBITDA and PAT have contracted by 3 percentand 1 percent, respectively, on material margin compression and higher revenue share of low-margin segment

BUSINESS

Rashi Peripherals IPO: Why investors need to be cautious

IT product distribution business is a working capital-intensive, low- margin one that necessitates high inventory maintenance to keep the supply chain smooth.

BUSINESS

Mphasis: Not yet out of the woods, unfavourable risk-reward ratio

A turnaround in the current tech spending environment could help the stock re-rate.