BUSINESS

The worst may not yet be over for Bandhan Bank even after weak Q4 show

Given the asset quality issues in the key states and the uncertainty induced by the second wave, Bandhan's valuation multiple is unlikely to jump to its previous level

BUSINESS

HDFC’s resilient performance in FY21 makes it a must-own financial conglomerate

While the performance of the core mortgage business inspires confidence, HDFC stands to gain from the equally strong performance of its subsidiaries and associate companies

BUSINESS

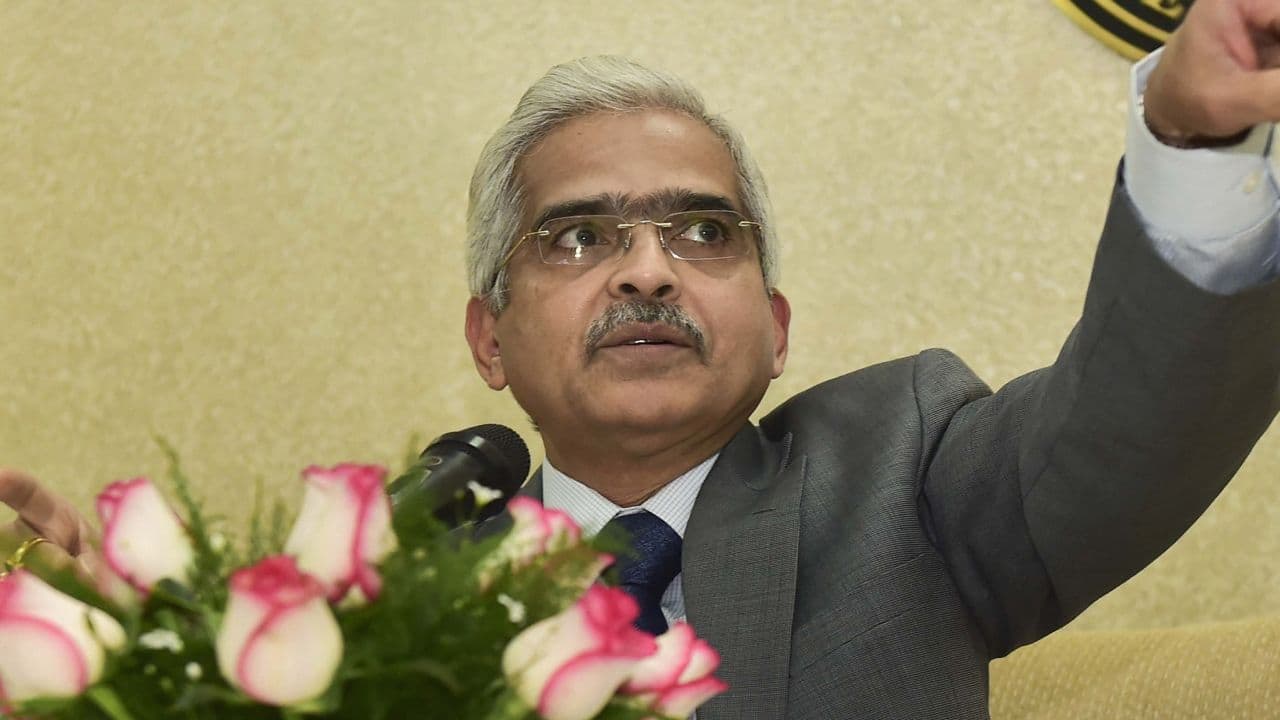

RBI’s liquidity booster shot offers partial relief, economic immunity will be raised only by mass vaccination

The RBI measures are welcome, but supply side measures can only help to some extent—the economy and the markets expect the government to do more

BUSINESS

Which AMC stock to bet on at a time domestic flows are set to improve in FY22?

Each of the three listed MFs -- HDFC AMC, UTI AMC and Nippon LIfe -- has some unique business strengths

BUSINESS

Bajaj Finance Q4 show stable, progress on digital plans will drive the stock

Bajaj Finance's funding profile keeps getting better and is well diversified

BUSINESS

Decoding ICICI Securities’ depressed valuation: Will the stock re-rate?

Despite a stellar performance, ICICI Securities' stock has underperformed in the past one year

BUSINESS

Will ICICI Bank stock price mirror the stellar earnings of the lender in FY21?

FY21 earnings amid the crisis reflect start of a growth phase for ICICI Bank, shrugging off asset quality woes of the past

BUSINESS

Can ICICI Prudential’s stock re-rate further even as it rallied after good earnings?

ICICI Pru is well on track to transit from a capital market player into a diversified franchise

BUSINESS

ICICI Lombard posts good numbers in FY21 under COVID cloud. Can it repeat the show?

The merger with Bharti AXA, which is due to be completed in 2021-22, is a key element to track for ICICI Lombard

BUSINESS

HDFC Bank FY21 earnings confirm that the strong has become stronger

Asset quality and growth are the two big issues confronting banks today. Remarkably, HDFC Bank scored well on both these parameters, remaining almost pandemic-proof

BUSINESS

Are MFs back in favour as equity schemes see net inflows and SIP flows hit all-time high in March?

The second Covid wave and partial lockdowns perhaps could limit investors’ enthusiasm for direct equity and draw them back to mutual funds

BUSINESS

LIC Housing Finance is likely to get re-rated

Investors can go with LICHF, given its rock bottom valuation and relative underperformance

BUSINESS

What do pre-earnings business updates of HDFC Bank, Bajaj Finance and CSB Bank say?

Loan growth in Q4: Strong for CSB bank, moderates slightly for HDFC bank and remains weak for Bajaj Finance

BUSINESS

Should investors bet on IDBI Bank?

LIC and the central government will seek premium valuation to give away the control of IDBI Bank that has been nursed back to health

BUSINESS

SEBI softens stance on valuation of AT1 bonds: A win-win for all

The regulator has done a fine balancing job as the revised valuation norms will protect investors while minimising the adverse impact on mutual funds and banks

BUSINESS

Fed maintains accommodative stance – a temporary sigh of relief for markets

While the Fed reassured markets that it won’t raise the federal funds rate, the biggest issue is the markets still have doubts about inflation given strong growth and the big stimulus package

BUSINESS

What makes SEBI’s move on AT1 bonds held by mutual funds a contentious issue?

SEBI’s move on valuing AT1 bonds will protect investors, but may kill the market for these bonds

BUSINESS

Why CDSL is the best stock to play the booming capital market

CDSL is a digital services/infrastructure provider for capital markets, a low risk business model with high potential returns

BUSINESS

Why continued equity outflow is a concern for mutual funds

The asset management industry is facing unlikely competition from the new-age discount brokers like Zerodha that are luring retail investors away from mutual funds into equity trading

BUSINESS

Oil prices: Decoding the forces and uncertainties driving crude

The limited growth in OPEC+ output, the US oil industry’s limited capacity for expansion, the demand-led economic recovery and vaccination are likely to keep oil prices sticky

BUSINESS

This technology-led financial services company ticks all the boxes of Buffett’s investment philosophy

Increased financialisation of savings and digitisation are going to shape the future of financial services and CAMS fits into both these themes well

BUSINESS

US equity market is likely to shrug off rising bond yields

History suggests equity fall induced by bond sell-off is just a blip in a long-term bull market

BUSINESS

NSE Trading Halt: Outage calls for regulatory action to restore retail investor confidence

Retail equity participants are most vulnerable to the harmful effects of technical failures in the financial market

BUSINESS

Privatisation of GIC Re: Will the government bite the bullet?

If the public sector reinsurer is privatised, it will unlock huge value