BUSINESS

PFRDA to allow 100% equity exposure to NPS subscribers under a new framework

The pension regulator to introduce multiple scheme framework (MSF) to offer greater flexibility, more choices to pension fund managers and NPS subscribers

BUSINESS

How to retire comfortably with a smaller corpus

Smart financial choices, lifestyle adjustments, and careful planning can help you retire securely even with a modest retirement fund.

BUSINESS

5 credit card myths you shouldn’t fall for

Credit cards often get a bad reputation, but many of the fears around them come from myths rather than facts.

BUSINESS

Income Tax Return filing deadline extended by a day to September 16

However, the e-filing portal will be in maintenance mode until 2:30 am to enable change in utilities

BUSINESS

Personal loans explained: Should you opt for a top-up or a fresh loan?

Both provide you with extra money, but the knowledge of how they differ makes you select the better and more cost-saving choice.

BUSINESS

Secured vs unsecured loans in India: What borrowers need to know

Understanding the difference between the two will be able to lead you in making the right decision and avoiding unnecessary financial trouble.

BUSINESS

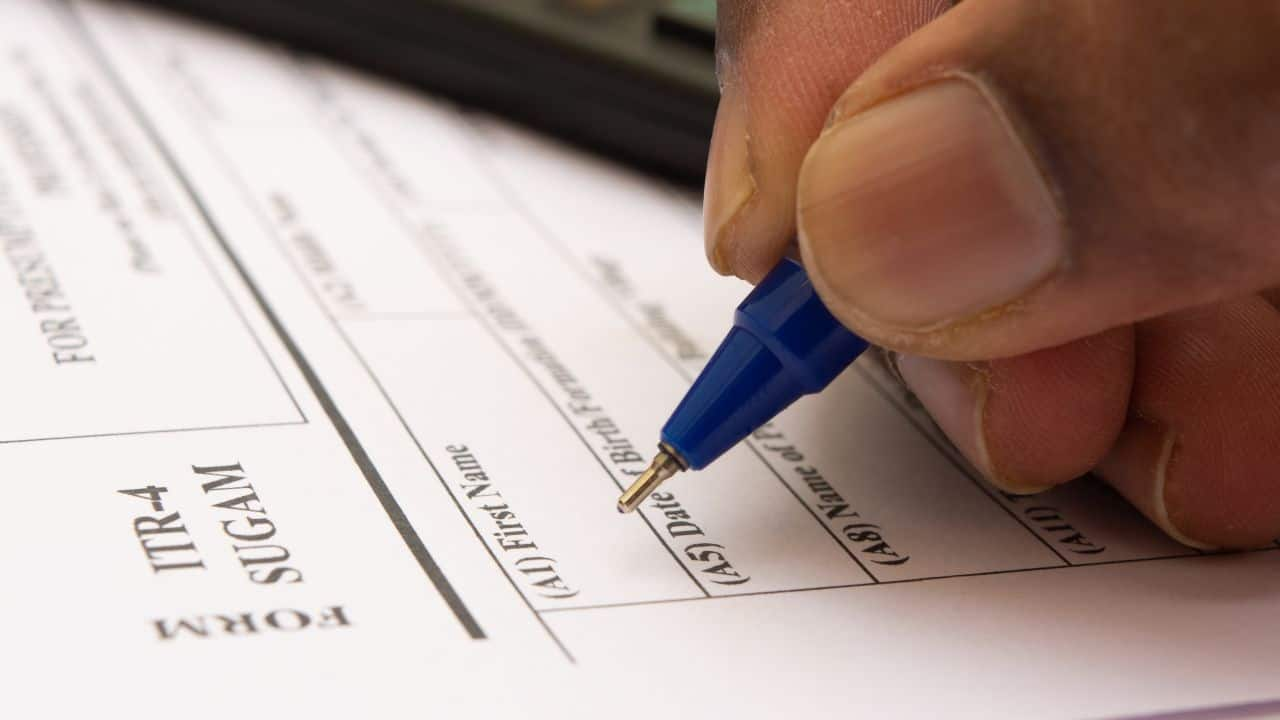

ITR filing 2025: Why individual taxpayers must file their tax returns on September 15

While you can file belated returns by December 31, 2025, not adhering to the September 15 deadline will attract late-filing fees of Rs 1,000–Rs 5,000, besides other restrictions

BUSINESS

ITR Deadline Today: Nearly 1 crore filings expected amid last-minute rush

So far, 6.29 crore returns have already been filed for AY 2025–26 (till September 13, 2025) compared to 7.28 crore returns filed in total for AY 2024–25.

BUSINESS

ITR filing 2025: Why checking AIS and Form 26AS is critical before submitting tax returns

Difficulty in accessing AIS has been the chief complaint of many tax professionals ahead of the September 15 ITR filing due date. It is important to review AIS to avoid missing out on disclosures, which can then trigger scrutiny and notices from the tax department.

BUSINESS

ITR filing 2025-26: Yet to file tax returns? Know the consequences of missing September 15 deadline

Completing the ITR filing process after September 15 will mean coughing up penalties of Rs 1,000-5,000.

BUSINESS

What is a core-and-satellite portfolio and why it matters for mutual fund investors

The core-and-satellite strategy balances between stability and growth by combining passive funds with active methods for more informed investing.

BUSINESS

September 15 ITR filing deadline: TDS on fixed deposits explained

File ITR by September 15, 2025; understand TDS on fixed deposits, threshold limits, rates and refund process.

BUSINESS

Switching tax regimes while filing ITR: What you need to know

The Income Tax Act provides taxpayers the choice of making a selection between the old and new regimes, yet the selection depends on whether you are experiencing salary income or business income.

BUSINESS

Tax filing tips: How to claim exemptions on interest income

Taxpayers can claim exemptions on interest income under Section 80TTA (up to Rs 10,000 for those under 60) and Section 80TTB (up to Rs 50,000 for senior citizens).

BUSINESS

Tax rebate vs deduction vs exemption: What every taxpayer should know

Knowing how these three words work can help you file your Income Tax Return properly and save more money.

BUSINESS

ITR filing 2025: How the Updated Return facility gives taxpayers a second chance to get it right

Tax return: If a taxpayer misses the December 31 deadline for filing belated return, she can still file an updated return (ITR-U) under Section 139(8A) of the Income-tax Act within four years from the end of the relevant assessment year.

BUSINESS

Sold your house, land, or industrial property? Nine income tax sections can help save on capital gains tax

Nine different sections of the Income Tax Act allow property sellers to reinvest gains and cut down capital gains tax significantly.

BUSINESS

Filing ITR at the last minute: A complete guide for taxpayers

If you have lost the opportunity to file early, this step-by-step guide will ensure you avoid errors and fines while submitting your return on the deadline.

BUSINESS

Why you may need to file ITR even if your income is below the exemption limit

Filing isn’t always optional—specific transactions can make it mandatory, even with low income.

BUSINESS

Last-minute ITR rush overwhelms portals, millions of returns still pending

As of now, only 5.47 crore returns have been filed, leaving almost two crore still pending. With three days to go, the pressure is mounting on both taxpayers and professionals

BUSINESS

Last minute rush: Steer clear of these common ITR filing errors to avoid I-T queries, notices later

Filing income tax returns in a hurry can increase the risk of errors, defective returns and, thus, I-T notices. Here’s a last-minute guide to avoiding costly mistakes.

BUSINESS

When and why you should file a Nil Income Tax Return

Filing even without taxable income will gain compliance and access to financial entitlements.

BUSINESS

Disclosures you must make in ITR to avoid a defective return

Missing details like foreign assets, crypto or directorships can make your return invalid.

BUSINESS

Equity schemes saw inflows in August but smallcap and sectoral funds slowed down

Largecap funds attracted Rs 2,835 crore in net inflow, up from Rs 2,125 crore in July and broadly in line with August 2024. Midcap schemes continued their strong run with Rs 5,331 crore as inflow in August, a shade above July and significantly higher than August 2024.