BUSINESS

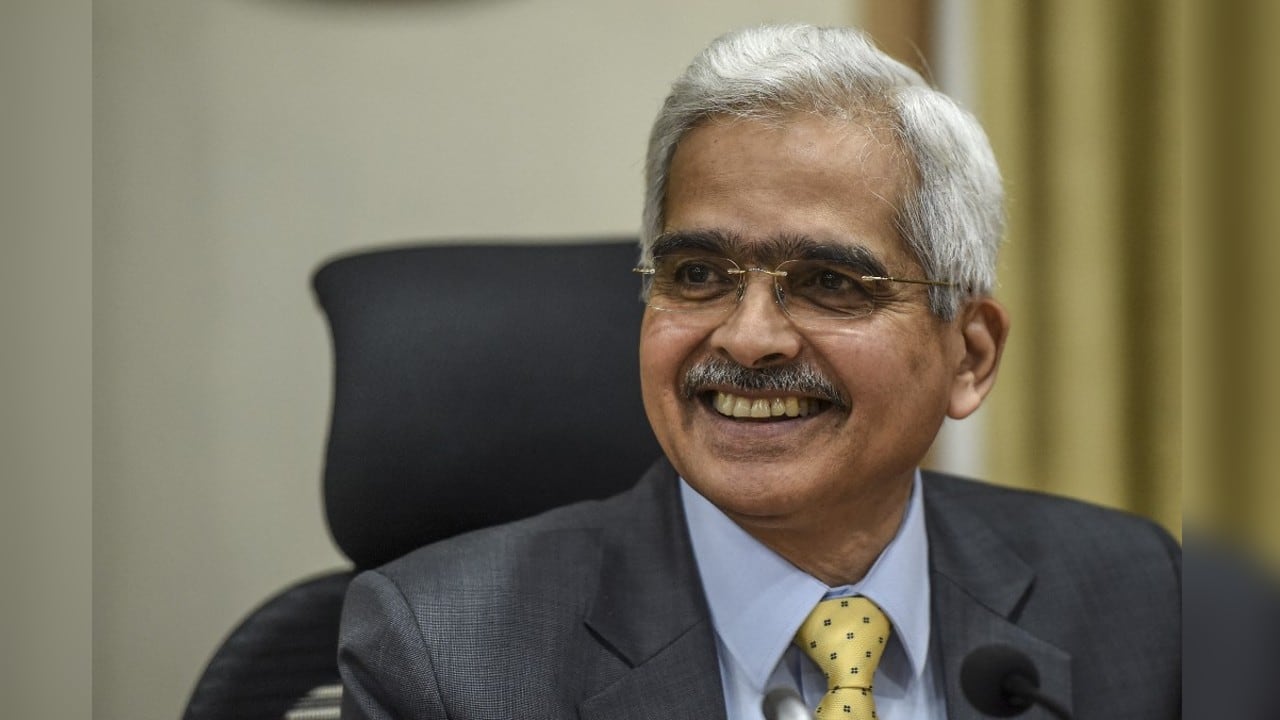

RBI governor expects new external members of MPC to be in appointed on time

RBI MPC comprises of six members. These include three central bank officials and three external members.

BUSINESS

Fundamental drivers of economy gaining momentum, despite slowdown in GDP growth: RBI governor

With the monsoon progressing well and healthy kharif sowing raising prospects of better harvest, there is greater optimism that food inflation outlook would become more favourable during the course of the year, said the RBI governor

BUSINESS

Bajaj Housing Finance’s primary capital from IPO will be used for organic growth, says MD Atul Jain

Bajaj Housing Finance’s IPO will open between September 9 and September 11, according to the firm's red herring prospectus (RHP).

BUSINESS

MC Exclusive | 'We want to be the financial life cycle partner to every Indian': Sanjiv Bajaj, Chairman & MD, Bajaj Finserv

Speaking exclusively to Moneycontrol, Sanjiv Bajaj, Chairman & MD, Bajaj Finserv said Bajaj Housing’s ability to go public within seven years from starting the business is reiteration of the level of comfort the company gives to its customers and lenders by being a part of Bajaj group.

BUSINESS

IDFC First Bank plans to grow deposits by 25% CAGR until FY27, says V Vaidyanathan

Total deposits of the bank increased by 38.7 percent on-year from Rs 1. 45 lakh crore as of March 31, 2023 to Rs 2.01 lakh crore as of March 31, 2024.

BUSINESS

RBI may launch ULI platform within a month, says NABARD’s Goverdhan Rawat

Rawat also said that 'Agri-SURE' fund, a Rs 750-crore agri fund for startups and rural enterprises, which was announced in July, will be launched on September 3.

BUSINESS

Banks to lose on opportunities if they don't work with fintechs: Axis Bank’s CEO Amitabh Chaudhry

Going ahead, Axis Bank will offer a service on its mobile app where customers of other banks will be able to undertake transactions rather than just being able to view the account details as is offered today, Chaudhry said

BUSINESS

Fintech SROs to work consciously, consistently to create favourable conditions for competition, say RBI DG

On the Central Bank Digital Currency (CBDC) front, Sankar said that clear use cases that are going to be established by programmable tokens, programmable CDDCs, this segment of the market can become as liquid or as heavy as any other segment.

BUSINESS

Aditya Birla Capital to integrate FDs, insurance in SIMPLiNVEST on ABCD app in 90 days

Pankaj Gadgil, head–digital platforms and payments strategy, tells Moneycontrol that the company will launch a B2D application in November

BUSINESS

IDFC First Bank to get transaction data of new customers from payment aggregators, says V. Vaidyanathan

Last month, RBI Governor Shaktikanta Das held meetings with the MDs and CEOs of public sector banks and select private sector banks in Mumbai and urged them to step up their efforts against 'mule accounts'.

BUSINESS

Banks provide over Rs 18 lakh crore in 12 years to post record-low NPA levels

As per the analysis of the 25 state-owned and private banks, gross NPA ratios of Bank of India, Indian Bank, Punjab & Sind Bank, Federal Bank and Union Bank of India reduced to lowest since 2014, while IDBI Bank, Indian Overseas Bank, UCO Bank, among others reported lowest level of NPA vis-a-vis their best seen in FY11- FY13.

BUSINESS

RBI unlikely to follow US Fed on rate cut, may monitor domestic cues, say economists

In the August monetary policy, the central bank left the benchmark repo rate at 6.5 percent for a ninth time

BUSINESS

Rupee sinks deepest in red against greenback among peer Asian currencies so far this fiscal

According to the Bloomberg data, Indian rupee has depreciated 0.51 percent since April 1 till date. Indian rupee depreciated around 50 paise since April 1.

BUSINESS

50 bps rate cut needed soon as downward trend in inflation clearer, more robust, says MPC member Jayanth Varma

'I do not see any evidence of excess demand or overheating in the economy,' says Varma

BUSINESS

Growth is below potential since core inflation is below target, says Ashima Goyal

This is because if the demand and growth exceed the potential, then inflation should be rising, not falling, the veteran economist told Moneycontrol

BUSINESS

RBI MPC Minutes: Food inflation may ease amid good monsoon, improvement in kharif sowing

India’s inflation declined to a 59-month low of 3.5 percent in July compared with 5.1 percent in the previous quarter.

BUSINESS

Corporate loan grows 21% in Q1, hints at revival in private sector capex

With capacity utilisation at a 11-year high of 78 percent in FY24 and the pipeline of sanctions and disbursements strong, a healthy growth in corporate loans is expected this year

BUSINESS

RBI sold net $2.11 billion in spot market in June

In May, the central bank had bought a net of $4.222 billion in the spot market.

BUSINESS

RBI Bulletin | Lagging deposit growth push banks to raise huge funds from CDs

CP issuances also increased to Rs 4.86 lakh crore during 2024-25 (up to July 31), surpassing Rs 4.72 lakh crore in the corresponding period of the previous year, driven by NBFCs’ higher borrowings in the CP market.

BUSINESS

RBI Bulletin | Prices of cereals, pulses, edible oil moderates in August, shows high frequency food price data

Despite the moderation in headline inflation and overall food inflation, year-on-year inflation in cereal prices remains high at 8.1 per cent in July.

BUSINESS

Bank of India makes a pitch for Karnataka government deposits

The Karnataka government on August 12 ordered all departments to close their accounts in SBI and PNB but four days later, it decided to keep the circular in abeyance for 15 days on the request of the two lenders

BUSINESS

CP, CD yields ease 25-30 bps in a month as banking system sees surplus liquidity

The liquidity in the banking system, which was in the deficit mode for the so long has started getting in to surplus mode since June 27 due to government spending.

BUSINESS

CD ratio of Indian banks was over 100% in 6 states and union territories in FY24

In the financial year 2023-24, bank credit rose 19.12 percent in the FY24 to Rs 169.14 lakh crore, as compared to Rs 142 lakh crore in the year ago period. On the other hand, deposit grew 13.4 percent on-year to Rs 212.54 lakh crore by the end of FY24.

BUSINESS

MC Exclusive| Kanpur, Indore municipal corporations to raise funds via municipal bonds in 2-3 months

Municipal bonds are similar to corporate bonds. The only difference is that they are issued by civic bodies to finance urban infrastructure projects.