BUSINESS

Working in a bank and NBFC is no different, thanks to regulatory scrutiny: Sudipta Roy, MD & CEO, L&T Finance

In an interview, Roy said that the RBI's actions are not aimed exclusively at NBFCs but were instead meant for the financial services industry at large. He added that the central bank has been picking up themes that apply to banks, NBFCs as well as fintechs.

BUSINESS

Maharashtra to face fiscal pressure due to poll promises made by triumphant BJP-led Mahayuti alliance

This is the best-ever performance by a party/alliance in Maharashtra since 1990. The BJP has bettered its previous high of 122 seats won in 2014 assembly elections.

BUSINESS

Belstar MFI IPO may be deferred by a year due to stress in the sector, says Muthoot Finance MD George Alexander Muthoot

Muthoot during an interview said the lender does not find deficiencies in their gold loan portfolio after the review.

BUSINESS

Primary market subscription on RBI retail direct platform rises 78% YoY in November

While the primary market volume stood at Rs 5,624.85 crore as on November 18, 2024, secondary market total traded volume stood at Rs 941.57 crore, suggesting that activity in the secondary market remains muted.

BUSINESS

Rupee ends at record low of 84.5013 against US dollar on FPI outflows pressure, strong DXY

According to Bloomberg data, Indian rupee ended at 84.5013 against the US Dollar on November 21, as against 84.4137 close on the previous trading session.

BANKING

Economists back RBI's rate cut caution despite Cabinet ministers' nudge

In the last few months, India’s CPI inflation remained on the upward trajectory due to persistent pressure from the food prices. The consumer price inflation touched a 14-month high of 6.21 percent in October, which, according to economists, might have reduced MPC’s room to cut the repo rate in the immediate future

BUSINESS

Inflation can undermine prospects of real economy if allowed to run unchecked, says RBI Bulletin

There are early signs of second order effects or spill overs of high primary food prices - following the surge in prices of edible oils, inflation in respect of processed food prices is starting to see an uptick, the bulletin added

BUSINESS

Private consumption back to being driver of domestic demand, says RBI Bulletin

Private investment was lacklustre as reflected in sequentially lower investment in fixed and non-current assets during July-September 2024 on account of subdued corporate earnings, the bulletin said

BANKING

Banks have to give options to customers, no mis-selling, force selling should happen, says IRDAI Chairman Debasish Panda

Similarly, RBI Governor Shaktikanta Das on Nov 18 warned banks about unethical practices such as mis-selling of products or the opening of accounts without proper KTC verification

BUSINESS

Overall ecosystem looking at strategy of migration of low-ticket transactions to UPI Lite, says NPCI CEO Dilip Asbe

NPCI international is in talks with 10 other countries for the UPI and Rupay stack after partnering with five other countries, Asbe added

CRYPTOCURRENCY

DFS Secretary M. Nagaraju skeptical of cryptocurrencies, says need to exercise caution

Reserve Bank's Governor Shaktikanta Das had echoed similar views earlier this year

BUSINESS

Bank interest rates will have to be far more affordable, says FM Sitharaman

Last week, Piyush Goyal said that the RBI should 'definitely cut interest rates'. On this, RBI governor Shaktikanta Das quipped that he will 'reserve' his comments for the upcoming monetary policy in December

BUSINESS

India’s inflation rate to come off from December onwards, says Deepak Parekh

India’s retail inflation rose to a 14-month high of 6.2 percent in October from 5.5 percent in the previous month, as food inflation galloped on the back of rising vegetable prices

BUSINESS

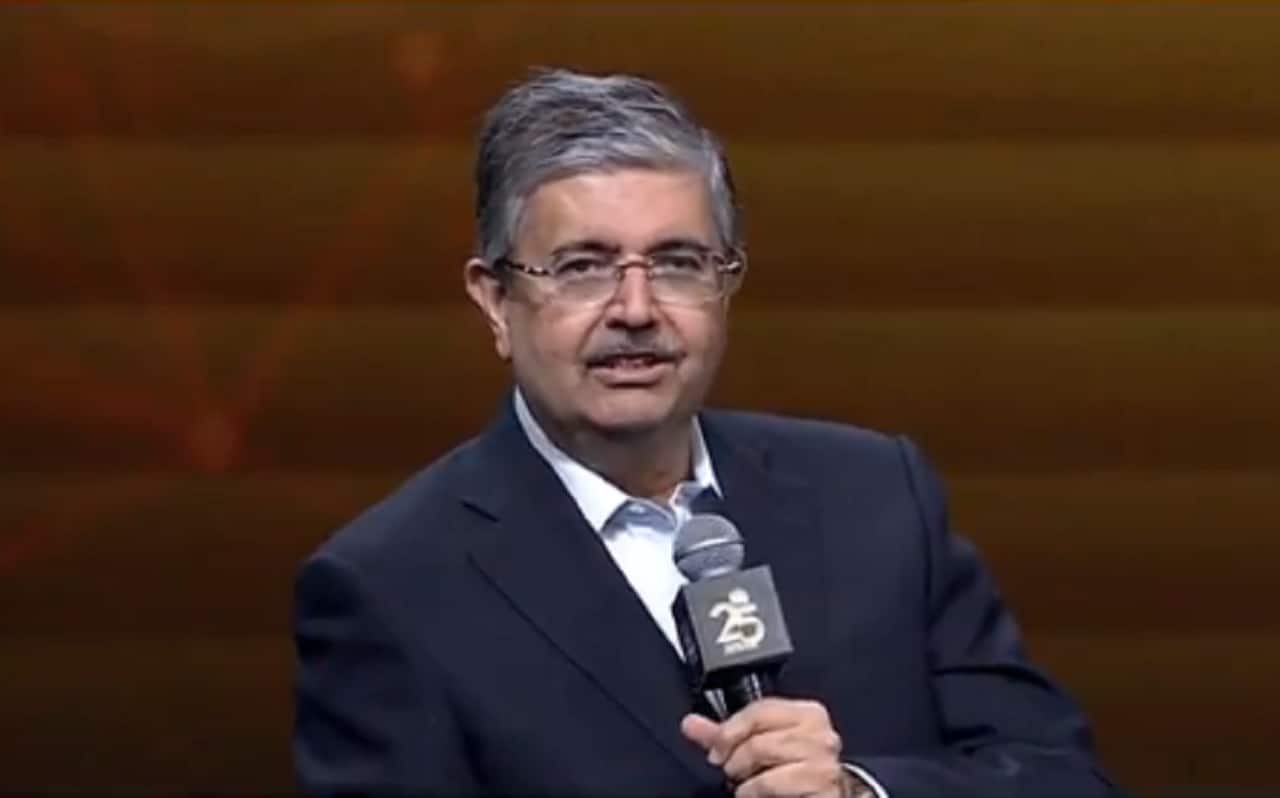

India needs to improve return on time invested (ROTI) to transform into future, says Uday Kotak

Kotak also said that if India has to become global power, we need to get stronger in defence

BUSINESS

Inflation expected to moderate despite periodic humps, says RBI governor Shaktikanta Das

Das said he "reserves" his comments on the monetary policy action in December when asked about Union minister Piyush Goyal's statement that the RBI should 'definitely cut interest rates'

BUSINESS

OBPP Association unhappy with securitised debt instruments proposals, to write to SEBI

Early this month, SEBI issued a consultation paper on review of issue and listing of debt instruments and security receipts

BUSINESS

Huge surplus liquidity drags weighted average call money rate below repo this month

Weighted average call money rate remained in range of 6.31-6.45 percent between November 1 and 12, whereas RBI’s repo rate stands at 6.50 percent

BUSINESS

Bank of India’s slippages rise on one telecom account in Q2FY25, says CEO Rajneesh Karnatak

On the special mention account (SMA)-2 accounts front, Karnatak said it has gone up in this quarter due to three to four big accounts missed the payments.

BUSINESS

Banks' SMA-2 loans rise in Q2FY25 even as overall asset quality improves

Even though few banks have seen an increase in SMA-2 loans, the asset quality of most banks have improved in the reporting quarter.

BUSINESS

LIC to complete stake buy in health insurance company by FY25-end, says Chairperson Siddhartha Mohanty

Further, on the surrender value norms, which got implemented from October 1, Mohanty said the company has redesigned its products and they are fully compliant with the regulations

BUSINESS

Indian rupee to depreciate further after Trump's win, say experts

In the last four days, the Indian rupee has been hitting record lows due to outflows from the equities, a strong dollar index, and other cues. Indian rupee today stood at 84.3600.

BUSINESS

Indian bond yield remains stable even after rate cut by US Fed

The US Federal Reserve on Thursday cut the key interest rates by another 25 basis points to 4.50-4.75 per cent.

BUSINESS

MC Interview | Canara Bank works to raise valuation of CanFin Homes after RBI draft norms on aligning businesses: CEO Satyanarayan Raju

Further, Raju during an interview said that the bank has not taken any exposure to the telecom sector in the last two to two and half year. While, the lender has taken some exposure in Jio recently.

BUSINESS

Higher subsidies may negatively impact Q2 GDP numbers, says RBI Governor

India's growth slowed to a five-quarter low of 6.7 percent in the June quarter from 7.8 percent in the January-March period