BUSINESS

NBFCs poised to grow in FY26 despite challenges in microfinance & personal loans

Analysts feel that while the MFI sector has been grappling with asset quality stress, the short-term nature of these loans suggests that the worst could be over, unless macroeconomic conditions worsen.

BUSINESS

Tamilnad Mercantile Bank to bet on transaction business unit to engage HNIs: CEO Salee S Nair

TMB CEO also says the bank aims to grow its advances by at least 15-18 percent in FY26

BUSINESS

Ajay Seth, Giridhar Aramane lead race for IRDAI Chairman role

With Anuradha Thakur appointed as successor to Seth, he is seen as likely the frontrunner for the position.

BUSINESS

Life insurers' new business premiums rise 2% in March 2025 after a sluggish February

This rebound comes after a sluggish February and was led by improved performance in group business segments, although individual policy sales remained under pressure.

BUSINESS

Inflation to stay benign, say minutes of RBI MPC, as food prices ease and crude cools off

The MPC now projects CPI inflation for 2025-26 to average 4.0%, with quarterly readings expected to range between 3.6 and 4.4%

BUSINESS

Global headwinds pose downside risk to India’s growth: RBI MPC minutes

The RBI revised its GDP growth projection for 2025-26 slightly downward to 6.5%, citing heightened global trade tensions, softening external demand, and growing investment uncertainty.

BUSINESS

High small savings rates a potential concern for bank deposit growth, says RBI bulletin

These rates, currently 16-66 basis points above formula-based levels, could pose a challenge for bank deposit growth in a rate-easing cycle where deposit rates are expected to decline, says RBI

BUSINESS

Only 138 of 725 NBFC-ICC applications approved by RBI since 2021

About 468 applications were either returned or withdrawn by the applicants, while 66 were rejected outright.

BUSINESS

Deloitte foresees more banks expanding wealth management services to mid- and high-income groups

In an interaction with Moneycontrol, Deloitte India partner Himanish Chaudhuri also said that public-private partnerships are expected to enhance and accelerate value-added services in Indian banking apps.

BUSINESS

In-demand ULIPs drive topline, but insurers cautious to limit over-exposure

ULIPs being market-linked, are inherently volatile and have relatively lower margins and persistency ratios, insurers have said hinting that they aim to reduce its share further, to achieve a more ‘balanced’ product mix.

BUSINESS

HDFC Life eyes protection growth and unit-linked moderation in FY26: CFO Niraj Shah

CFO Niraj Shah also says he anticipates the company transitioning to a risk-based capital regime within the next 12 to 18 months

BUSINESS

Yes Bank follows industry leaders, cuts savings rates to boost profitability: CEO Prashant Kumar

Prashant Kumar also sidestepped questions on October leadership reappointment, says board holds decision-making authority

BUSINESS

Nearly half of Indians still skip term insurance: Policybazaar report

Jargon-filled terms and conditions and lack of clear communication from insurers have made insurance a product that people either delay or avoid altogether, the report added.

BUSINESS

Pramerica Insurance retains Rs 3,000-crore FY26 target despite MFI slowdown impact: CEO

Pankaj Gupta also says the company is set to significantly boost its ULIP portfolio, aiming to increase its exposure from 10 percent in FY25 to 25-50 percent by FY28.

BUSINESS

Term insurance purchases by self-employed surge 58% in FY25

Policybazaar data reveals over Rs 1-crore cover gaining traction among Gen z and Millennial entrepreneurs

BUSINESS

Non-life insurers’ premium grows 6.2% in FY25 at Rs 3.08 trillion

Gross direct premium underwritten crosses Rs 3.07 lakh crore, with standalone health insurers seeing a 15.99 percent annual growth

BUSINESS

Economists see 75–100 bps rate cuts as RBI trims FY26 GDP growth forecast to 6.5%

Despite domestic strengths, the RBI’s Monetary Policy Report cautioned against external risks such as rising protectionist measures, geopolitical tensions, supply chain pressures, and volatile global financial conditions.

BUSINESS

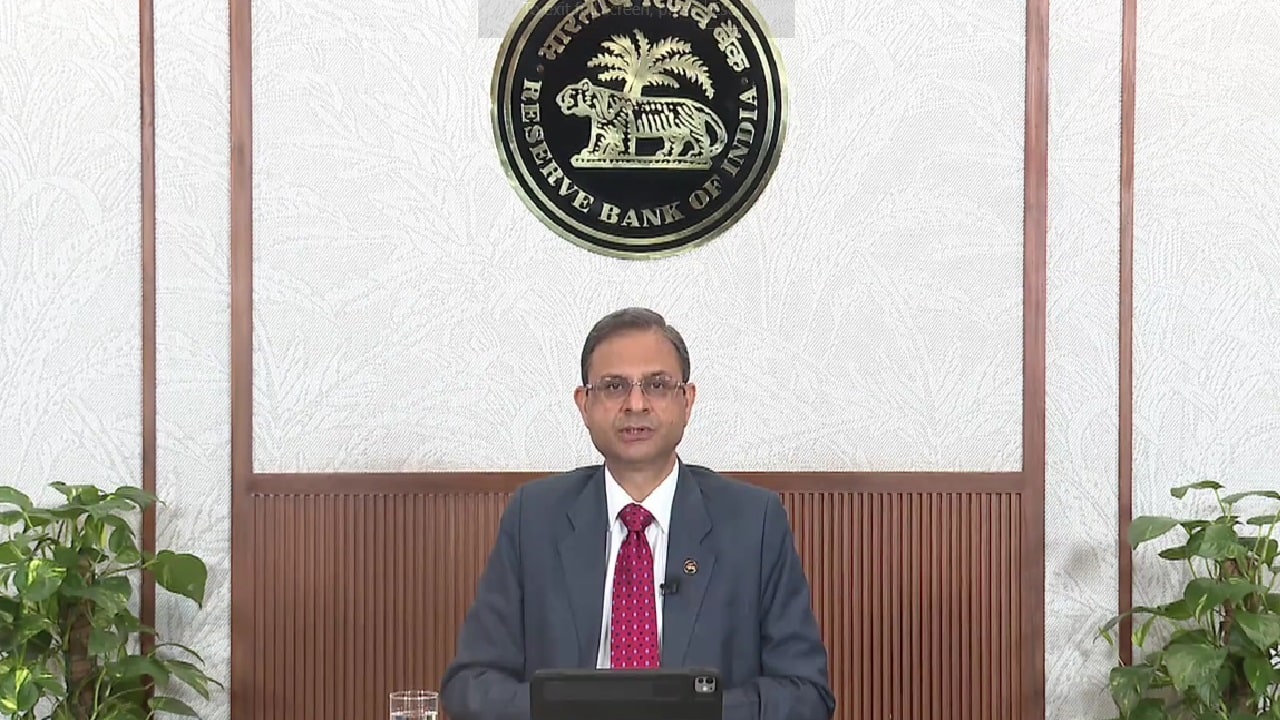

Trump tariffs: India relatively better placed due to low export dependency, says RBI governor

India’s exports to the US are pegged at roughly 2 percent of its GDP, China's is 19 percent and Germany37 percent

BUSINESS

IndusInd crisis an episode and not failure, banking system is secure, says RBI governor

An investigation is underway and based on its findings, appropriate action will be taken and those responsible identified, RBI Deputy Guv Swaminathan Janakiraman has said

BUSINESS

Insurance Q4 FY25 outlook: Muted quarter likely owing to margin pressure, weak growth

Life insurers may see lower VNB margins, while general insurers may face weak profits due to high claims, analysts say.

BUSINESS

General insurance poised for 13% growth in FY26 despite under-penetration woes

This projected uptick comes as the industry grapples with persistent under penetration challenges

BUSINESS

MC Exclusive | Warburg expected to lead troubled MFI Fusion Finance’s rights issue

However, sources say that Creation Investments, another stakeholder in Fusion, is hesitant to fully back the initiative.

BUSINESS

Standalone health insurers eye 20% growth in FY26 as retail segment expands

While retail health insurance will remain the cornerstone of growth, competition will continue to challenge pricing and profitability, says analysts.

BUSINESS

LIC refutes USTR's allegations of preferential treatment by govt

Its leadership is entirely due to the trust of policyholders, the company's commitment to excellence and its financial strength, LIC has said