BUSINESS

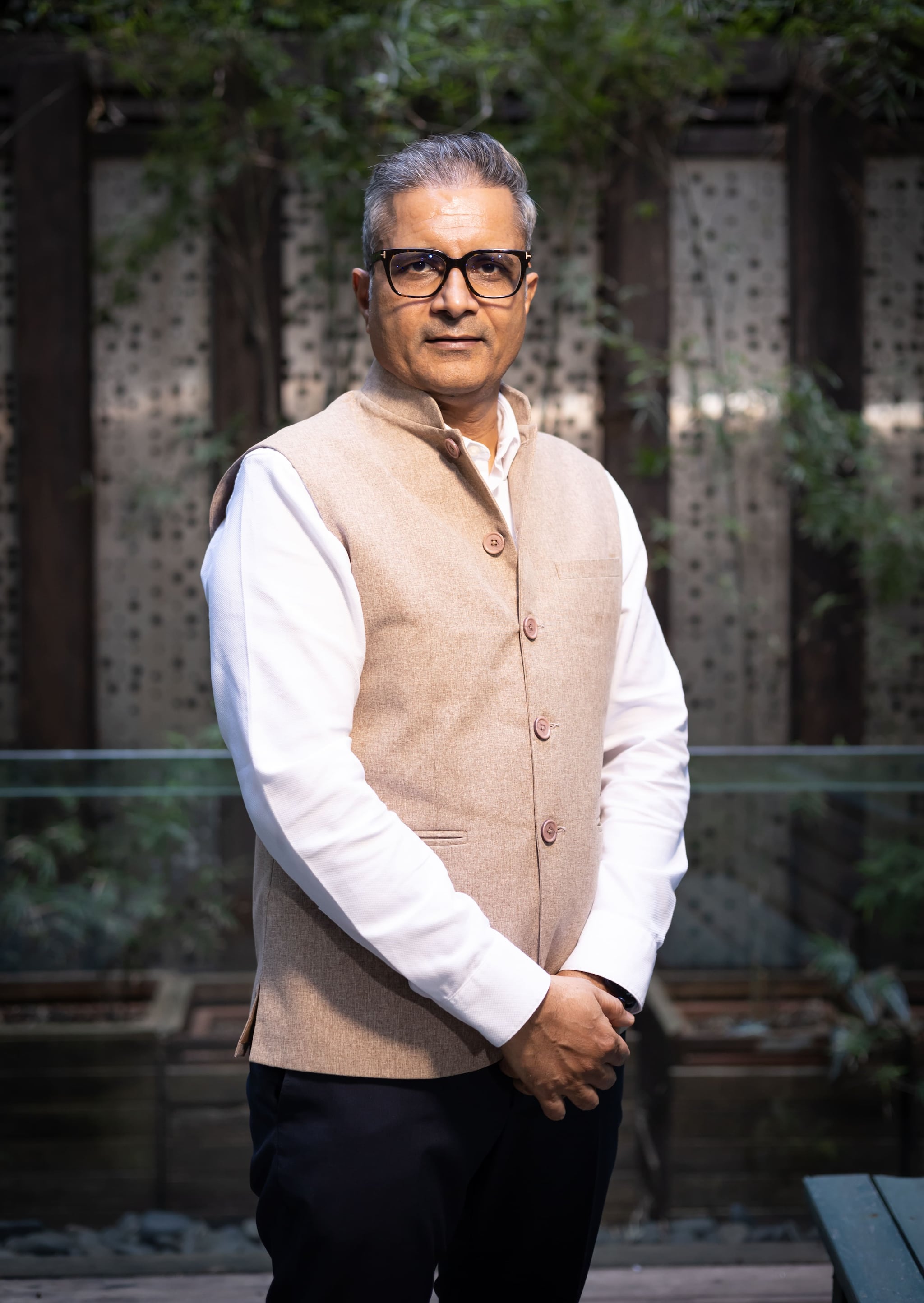

HDFC ERGO to maintain lean bancassurance exposure, targets above-industry growth in FY26: CEO Anuj Tyagi

Tyagi says, the company will instead bet on its agency network, direct-to-customer rural outreach, and commercial lines

BUSINESS

Customer complaints to RBI Ombudsman rise to 2.96 lakh in FY25

The majority of these complaints were directed against banks, followed by NBFCs, other non-bank system participants, and CIGs

BUSINESS

India's services sector outpaces manufacturing and agriculture in FY25: RBI annual report

This is despite the fact that the total GVA at basic prices rose by 6.4 percent in FY25, down from 8.6 percent in the previous year, signalling a moderation in economic momentum

BUSINESS

India's gold hoard up 7% at 879.59 tonnes in FY25

A combination of fresh purchases, a 30% increase in the price of the precious metal and the depreciation of the rupee against the dollar added to the surge

BUSINESS

Bank fraud losses surge three-fold to Rs 36,014 crore in FY25

Public sector banks (PSBs) accounted for the bulk of the losses, while private sector banks reported the highest number of fraud cases, RBI's annual report has said

BUSINESS

Private banks maintain credit momentum but profitability under pressure: RBI Annual Report

While credit growth continued to remain in double-digit in FY25, public sector banks outpaced their private counterparts in expanding credit

BUSINESS

India leads global real-time payments with 48.5% share in FY25, driven by UPI surge: RBI Annual Report

In March 2025 alone, UPI recorded its record-highest of 19.78 billion transactions, amounting to Rs 24.77 lakh crore in value.

BUSINESS

RBI's balance sheet for FY25 expands by 8.2% to Rs 76.25 lakh crore

This marks a significant increase from Rs 70.47 lakh crore in the previous year

COMPANIES

LIC nears stake acquisition in health insurance firm, eyes higher AAA bond investments in FY26

Unlike typical acquisitions where a committee might determine stake size, LIC has opted for internal deliberations to decide the quantum of investment

BUSINESS

Rationale behind composite licensing remains unclear, says Shubhra Goel

The MD of the global professional services Firm also says that life insurance companies are likely to continue scaling back their exposure to ULIPs in FY26, particularly in the face of market volatility

BUSINESS

India is the only market with falling bank employee productivity and decreasing operating leverage: BCG’s Saurabh Tripathi

While Indian banks are benefitting from emerging trends like mutual fund distribution and insurance sales, much of the fee income is volume-driven and not rooted in differentiated, high-value services, he said.

BUSINESS

Shriram Life Insurance to steer clear of banca channels, says CEO Casparus Kromhout

Banca tie-ups might give a short-term boost but they come with the risk of abrupt loss if a bank switches partners, says Kromhout

BUSINESS

Fusion Finance auditors issue qualified report after Q4 FY25 results, flag ECL issue

The auditors flagged the company’s decision not to retrospectively adjust previous financials for expected credit loss (ECL) provisions to the tune of Rs 1,864.91 crore, citing impracticability.

BUSINESS

For IndusInd Bank, MFI issues are larger than derivative woes

March quarter financials take a hit of Rs 4,975 crore, which includes accounting adjustments and reversals on account of derivative instruments as well as rectifying lapses in the bank’s microfinance portfolio. Auditors say incorrect accounting of derivatives started as back as FY16.

BUSINESS

Crisis of confidence at IndusInd Bank, say analysts, lender assures clean-up is underway

While IndusInd Bank has said that all known discrepancies have now been accounted for, and auditors have combed through its financials extensively, analysts and the market remain wary.

BUSINESS

Insurance Amendment Bill likely in monsoon session, composite licenses and nod for 100% FDI on cards

The Insurance Amendment Bill is expected to simplify the capital structures of companies by proposing key reforms including composite licenses and increasing the foreign direct investment (FDI) cap.

BUSINESS

Shareholders reject board seat to Warburg-backed investor in IDFC FIRST Bank

The special resolution, which required at least 75 percent of votes in favour to pass, received only 64.10 percent approval, the filing says

BUSINESS

MC Exclusive | Star Health data breach may trigger CXO exodus amid cybersecurity probe

According to sources, the ongoing investigation into cybersecurity lapses could lead to financial repercussions of approximately Rs 200 - 250 crore, primarily due to potential legal penalties stemming from the company’s security failures.

BUSINESS

Axis Max Life to see ULIP moderation by 3%, eyes IPO simplification in FY26: CFO Amrit Singh

In FY25, ULIPs accounted for approximately 42 percent of the company’s portfolio, while non-participating comprised 23 percent and par comprised of 15 percent.

BUSINESS

LIC outpaces industry in April with nearly 10% growth in New Business Premium

According to data released by the Life Insurance Council, LIC collected Rs 13,610.63 crore in NBP for the month, up from Rs 12,383.64 crore in April 2024

BUSINESS

Non-life insurers' premium grows 13.5% in April 2025, driven by health and general segments

The growth was led primarily by the general insurance and standalone health insurance sectors, while specialised insurers witnessed a notable decline, data shows

BUSINESS

Niva Bupa targets 6-7% growth rate above market average in FY26: CFO Mahendra

Promoter Bupa increasing its stake in Niva Bupa would depend on liquidity conditions, he said. "We’ll continue to look for opportunities in group accounts, but retail will remain our primary focus," Mahendra said.

INDIA

Banks keep a close watch on border states as India-Pakistan conflict escalates

Jammu & Kashmir, Punjab, Rajasthan, Gujarat, and Himachal Pradesh collectively account for 12.81% of India’s total bank deposits and 13.41% of advances

BUSINESS

Union Bank of India Q4 FY25 net profit rises 51% to Rs 4,984 crore

For the full financial year, Union Bank of India posted a net profit of Rs 17,98,714 lakh, marking a year-on-year growth from Rs 13,64,831 lakh in FY24