BUSINESS

Affordable housing seen as unpriced dark horse from cement GST cut

Analysts say lower input costs could ease margins, revive demand and re-rate valuations for affordable housing developers, while cement stocks have already priced in the gains

BUSINESS

GST 2.0: Beyond blue chips – Watch these under-the-radar movers

Analysts say this simplification could boost consumption, formalise the economy, and improve corporate earnings over the medium term.

BUSINESS

Markets likely to react positively to GST booster dose for FMCG, auto, insurance, consumer durables and MSMEs, say experts

Experts say that the decision of merging GST rates into 5% and 18% -- while reserving 40% for sin goods -- will benefit many sectors like FMCG, auto, insurance, consumer durables and MSMEs among others ahead of the festive season.

BUSINESS

India better placed as dollar weakness looms, says economist

India is better placed than many emerging markets to benefit from a weaker U.S. dollar, thanks to its strong domestic demand and policy credibility, according to Adam Wolfe of Absolute Strategy Research.

BUSINESS

NJ Asset Management set to launch retail mutual fund at GIFT City; PPFAS in pipeline

PPFAS Mutual Fund is also preparing to launch a retail mutual fund from GIFT City, could take at least four months before a formal launch, said a source familiar with the matter.

BUSINESS

Top gainers and losers: Stocks that moved the most on August 29

RBL Bank, ITC were among gainers on August 29

BUSINESS

SEBI’s accessibility audit mandate burdening small advisers: Noble intent, impractical roll-out, they say

In July, SEBI issued a circular mandating that every investor-facing digital touchpoint — websites, client portals, mobile apps, even investor communications like PDFs and emails — must be made accessible to persons with disabilities.

BUSINESS

Rural India could see a recovery in FY26 on wage revival, monsoon, says Ambit AMC

A strong start to the monsoon, real wage growth turning positive since mid-FY25, and easing inflation are reviving household savings and boosting demand for FMCG, low-end two-wheelers, durables, and affordable housing.

BUSINESS

Saurabh Mukherjea says chasing the ‘lottery effect’ in small and midcaps can erode long-term returns

Marcellus' latest newsletter said that for nearly two decades, low-beta stocks in India have consistently outperformed riskier names, challenging the textbook belief that higher risk delivers higher reward.

BUSINESS

Derivatives traders unwind positions ahead of holiday-shortened expiry week

With a trading holiday on Wednesday and expiry of August series on Thursday, market participants are unwilling to carry aggressive bets, and instead, call writers, or those betting against an upside have turned aggressive, capping meaningful gains.

BUSINESS

LRS remittances via GIFT clock 19% CAGR over 2 years, crossing a billion consistently for 3 years

Based on the pace of growth, the figure could approach USD 2.5 billion in medium term, says Mihir Shirgaonkar, Vice President, Alternative Investments at Phillip Ventures IFSC.

BUSINESS

Market valuation stretched, a lot depends on earnings growth, says Waterfield’s Vipul Bhowar

Even with the buzz around defence, capex, and manufacturing, India’s equity rally is resting on a narrow base. While valuations remain elevated, the trajectory of the market’s next leg will depend on whether earnings begin to broaden out across sectors.

BUSINESS

Top 10 Portfolio Management Strategies for July

InCred Asset Management’s Healthcare Portfolio delivered the highest return at 11.96 percent, followed by Valcreate’s Lifesciences and Specialty Opportunities strategy, which gained 8.48 percent, followed by Green Portfolio’s MNC Advantage at 6.89 percent.

BUSINESS

SEBI proposal to tighten index options limits may dent expiry-day trading volume, as prop traders will be more watchful

Financial penalties for breach of position limits on expiry-days could keep prop traders, algo firms watchful.

BUSINESS

Majority of new-age IPOs leave investors holding the bag, says study

Client Associates finds only a third of new-age IPOs delivered returns better than the index, with post-listing buyers nurse negative returns.

BUSINESS

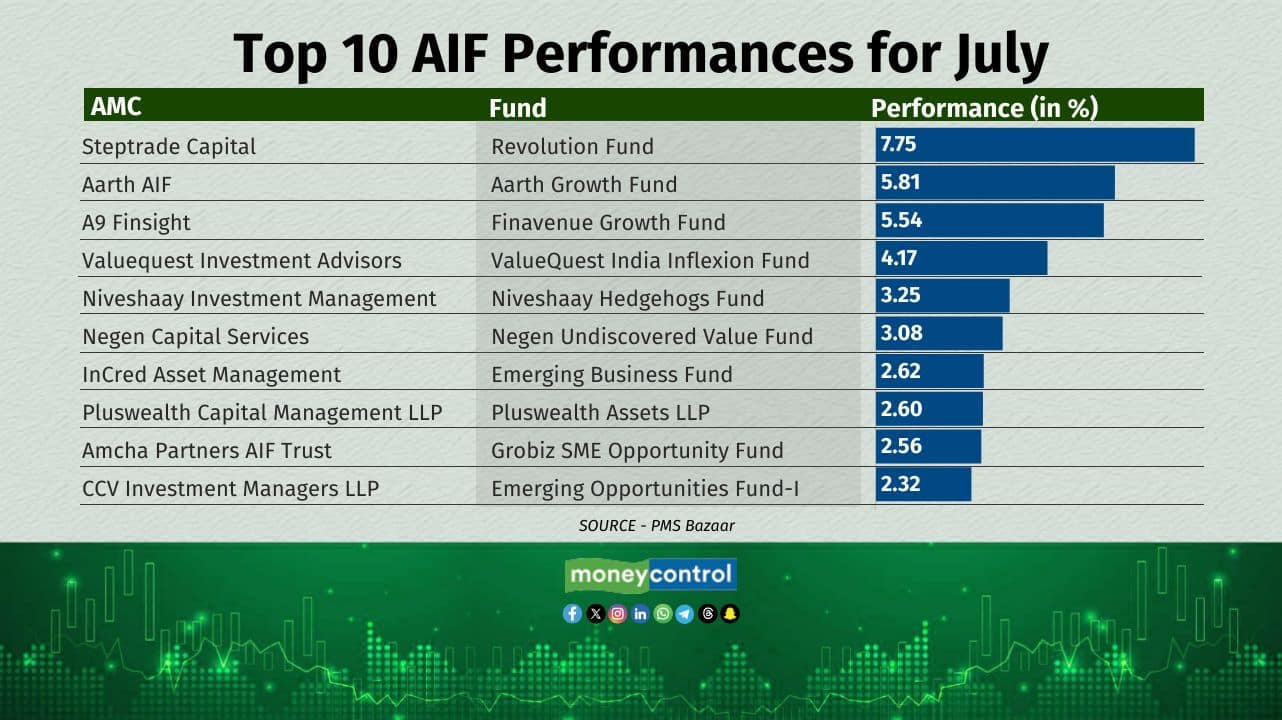

Top 10 AIF performances for July show thematic plays delivering returns

Midcap, growth-oriented and SME-focused Alternative Investment Funds were among the top performers in July, with returns ranging between 2 to 8 percent, showed data.

BUSINESS

India tumbles to bottom of Asia allocations in BofA survey, but overall story intact

The survey links the sharip fall in exposure directly to trade-policy risks rather than domestic fundamentals. in fact, it gives enough signals that investors have not abandoned India’s long-term story.

BUSINESS

‘Another FAD in the making’: Carnelian's Vikas Khemani warns of brewing bubble in unlisted shares, preferential allotments

Founder Vikas Khemani draws parallels to the 2021 tech IPO frenzy, cautioning investors against chasing hype over fundamentals.

BUSINESS

Up to 70% of India’s top family businesses listed; next-gen blending professional talent with growth capital

Counterintuitively, this mindset, say the people behind the Barclays Private Clients Hurun India Most Valuable Family Businesses 2025 report, is not far removed from that of the previous generation.

BUSINESS

‘Pure-play AI’ Fractal Analytics IPO grabs analyst attention on valuation stretch, exit overhang

Institutional debate is set to focus on whether its growth trajectory and profitability turnaround can justify the premium multiples it is expected to seek, and the extent to which the offer is dominated by private equity exits.

BUSINESS

Apollo to list HealthCo–Keimed by Q4 FY27; targets Rs 25,000 crore revenue

Management is guiding to revenue of about Rs 25,000 crore with around seven percent EBITDA margin at the time of listing, helped by scale benefits, operating leverage and tighter cost controls.

BUSINESS

Top 10 family-owned businesses control half of the total market value on Barclays-Hurun list

The Barclays Private Clients Hurun India Most Valuable Family Businesses 2025 report shows that the top 10 families have a combined valuation of Rs 69 lakh crore, up from Rs 59.5 lakh crore last year.

BUSINESS

Apollo Hospitals Q1FY26 earnings preview: Analysts expect expansion and higher volumes to drive positives

The quarter is expected to deliver healthy double-digit growth in revenue and profitability, supported by capacity expansion, increased inpatient volumes, and a richer case mix.

MARKETS

Industrial products, autos, chemicals dominate family business wealth at over Rs 31 lakh crore

Industrial products, automobiles, and chemicals together account for over Rs 31 lakh crore of cumulative value in the Barclays Private Clients Hurun India Most Valuable Family Businesses 2025 list. Automobiles top the chart on a per-company basis, with an average valuation of Rs 52,324 crore.