BUSINESS

Varun Beverages: Capacity addition to drive growth

Company derives maximum revenues and profitability in the April-June quarter

BUSINESS

Housing gets a boost in election Budget

PMAY gets higher allocation which should be beneficial for affordable housing

BUSINESS

Dabur India: Cautiously optimistic

Rural market recovery and higher growth from healthcare verticals are the key factors to watch for

BUSINESS

Mahindra Finance: Healthy Q3FY24 performance, with asset quality in focus

Risk-calibrated growth will be key in hitting target RoA

BUSINESS

Cholamandalam Investment: Q3 margin stable on better asset mix

Healthy loan growth, stable margins, and better asset quality improve return ratios

BUSINESS

Marico: Core categories remain subdued

Foods and Premium portfolios to outperform core categories

BUSINESS

Shriram Finance: Merger synergies drive asset growth

Elevated operating and credit cost weighed on Q3 earnings growth.

BUSINESS

Home First Finance: In-line Q3 profit with encouraging loan growth target

Q3 growth momentum continued with stable spreads and asset quality

BUSINESS

Will banks face margin pressure with deposit slackness continuing in Q3?

With asset quality holding up, the key determinant of banks’ profit will be margins and operating efficiency in H2 FY24. In this context, deposit growth trend is very crucial

BUSINESS

Utkarsh Small Finance Bank: After a strong listing, is it still a good bet?

Stable margins, lower credit cost, and operating leverage to support return on assets.

BUSINESS

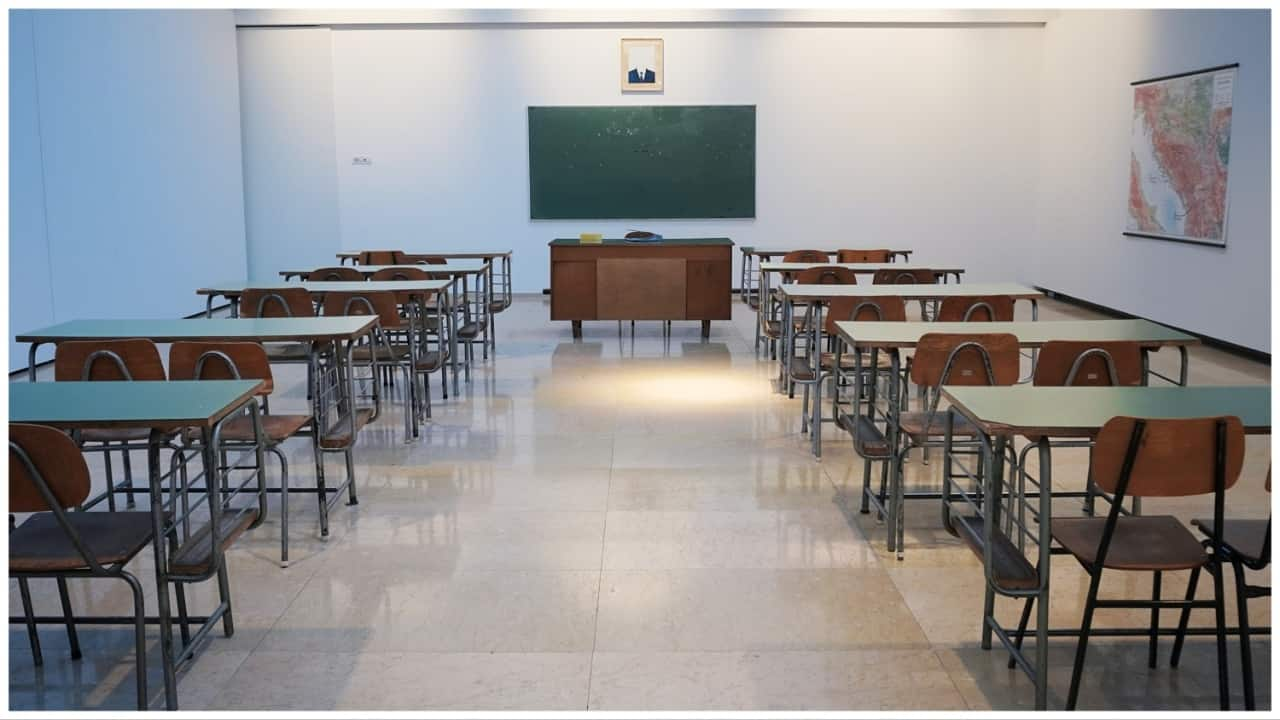

S. Chand: This publishing stock has a long-term growth imprint

A worthy bet on the education sector with a brand value

BUSINESS

Suryoday Small Finance Bank: Why this stock is for risk-takers

Portfolio diversification, lower credit cost and operating leverage remain key drivers to ROA

BUSINESS

Ethanol rule tweak — Is it a big relief?

The revised allocation of sugarcane for ethanol production is likely to have marginal impact

BUSINESS

India Shelter Finance: Should investors consider this housing finance IPO?

Strong sectoral tailwinds, large under-penetration, and increasing government initiatives augur well for the company

BUSINESS

Ethanol’s importance in powering Aatmanirbhar Bharat

The govt has directed sugar mills and distilleries to halt the use of sugarcane juice/sugar syrup for ethanol production in ethanol supply year 2023-24. Here are the reasons and the benefits.

BUSINESS

The big squeeze: Government curb renders sugar stocks tasteless

The ban on the use of sugarcane juice for ethanol is a double whammy for distilleries grappling with the suspension of rice supply

BUSINESS

Why is Navneet Education in focus despite weak results?

Margin contraction was on account of higher input cost and lower volumes

BUSINESS

Aptus Value: Is it a good time to add this high-growth housing finance player?

Improved earnings and healthy asset growth along with stable asset quality underlined the performance

BUSINESS

Why are paper stocks underperforming?

The paper industry is intrinsically cyclical, influenced by demand-supply dynamics and input costs. Hence, the performance of paper stocks is contingent on earnings growth.

BUSINESS

IREDA: Is this green finance IPO a worthy bet?

The issue will help accelerate renewal energy financing

BUSINESS

Uflex: Is the worst over for this company?

Healthy volume and margin recovery seen in flexible and aseptic packaging businesses. Better numbers expected in the upcoming quarters

BUSINESS

Is there more steam left in the Repco Home Finance stock?

A sharp rise in advances, backed by business model up-gradation. Asset quality and return ratios trending up; undemanding valuation

BUSINESS

Will the Balrampur Chini stock rally last?

Profit soars due to higher crushing and expansion in distillery segment

BUSINESS

Sundaram Finance: Is there more upside to the stock post the sharp rally?

Steady loan book growth in Q2 led by growth across businesses