BUSINESS

Tata Steel’s Q4 earnings take a hit from pricing erosion

Higher volume sales partly offset headwinds

BUSINESS

Coal India: A sequential rise in volume off-take in Q4 in an overall challenging year

Recent price increases, expected production growth, and other factors augur well for the current fiscal

BUSINESS

L&T: Navigating external risks with strong order book, robust balance sheet

The company enjoys a robust order book, and diversified business portfolio. The company’s consolidated order book reached Rs 5.8 lakh crore, reflecting a 22 percent YoY increase.

BUSINESS

Jindal Steel and Power: Worth a look amid the volatile global backdrop?

There is a supply glut in China, and this has led to a surge in cheap Chinese steel entering India. While India’s 12 percent safeguard duty on imports may curb low-cost imports, it falls short of the stronger tariffs in other countries

BUSINESS

Why this renewable energy stock deserves a serious look

Project pipeline, access to capital, and other factors should help in long-term value creation

BUSINESS

JSW Energy plugs into strategic renewable power acquisitions

The company is emerging as a dominant play in the power sector, with a strong balance sheet and the most efficient operational assets in the renewable and thermal power space

BUSINESS

Weekly Tactical Pick: KEC International is plugging into the opportunities in power T&D

Earnings visibility is improving, so is execution

BUSINESS

ION Exchange: Will the two-pronged strategy work?

The company has a multi-faced revenue stream and it is focused on international markets

BUSINESS

Will Germany’s fiscal boost fire up Indian defence stocks?

Germany’s upper house late last week voted in favour of reforming the German “debt brake”, paving the way for a €1-trillion defence and infrastructure investment package

BUSINESS

KEC International: A spike in order book improves medium-term earnings outlook

The company’s order book is healthy and with better execution, particularly in the T&D segment, the management is optimistic about achieving double-digit margins from Q4FY25

BUSINESS

EMS: Strong execution, order book to drive growth

The company follows an asset-light model, maintaining relatively low fixed assets and minimal reliance on debt for working capital. This disciplined approach has allowed it to sustain healthy margins and a strong balance sheet

BUSINESS

IEX: Good bet with earnings visibility; industry environment positive

A favourable industry environment and new ventures like coal exchange position IEX well, making it one of the safe bets in the current environment

BUSINESS

Inox India: Promising, post correction

An order backlog of Rs 1,341 crore, strong order inflows in Q3FY25, and large international deal wins place the company on a strong turf

BUSINESS

Engineers India: Recovery likely in the next few quarters, robust order book should help

With improved execution, operational efficiencies are expected to drive margin expansion

BUSINESS

Weekly Tactical Pick: Why one should consider this defence PSU

Bharat Dynamics' strong order book, rising exports, and improving execution make it a good bet in the current market

BUSINESS

ABB India: Growth momentum intact despite order inflow challenges

Strong demand and the company’s strategic positioning in automation and infrastructure provide good visibility

BUSINESS

Quality Power IPO: An attractive play in the T&D space

Leveraging international reach, acquisitions, and capacity expansion

BUSINESS

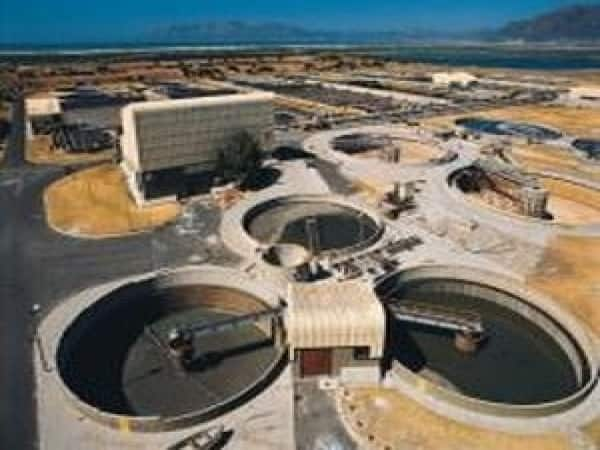

Va Tech Wabag: Robust order book, international expansion support growth outlook

The company’s order execution momentum remains strong, with large projects in Chennai and Saudi Arabia reaching final stages. A majority of the orders are expected to be executed in the next 2-3 years

BUSINESS

Tata Power: Strong renewable growth amid operational challenges

The company’s long-term growth story remains compelling, driven by its strategic focus on renewables, solar manufacturing, and well-established T&D infrastructure.

BUSINESS

Cummins delivers strong Q3 growth amid competitive pressure

The company is focusing on long-term cost efficiency, superior technology, and stronger product positioning.

BUSINESS

Power Grid Corporation: Growth to resume in the next few quarters

With projects worth Rs 1 lakh crore expected to be awarded annually, Power Grid is well-positioned to benefit from these developments

BUSINESS

JSW Energy: Generation growth strong, but profitability under pressure

With a strong portfolio of assets, pipeline of projects, cash in books, and expected recovery in realisations, the company should perform well in the coming months

BUSINESS

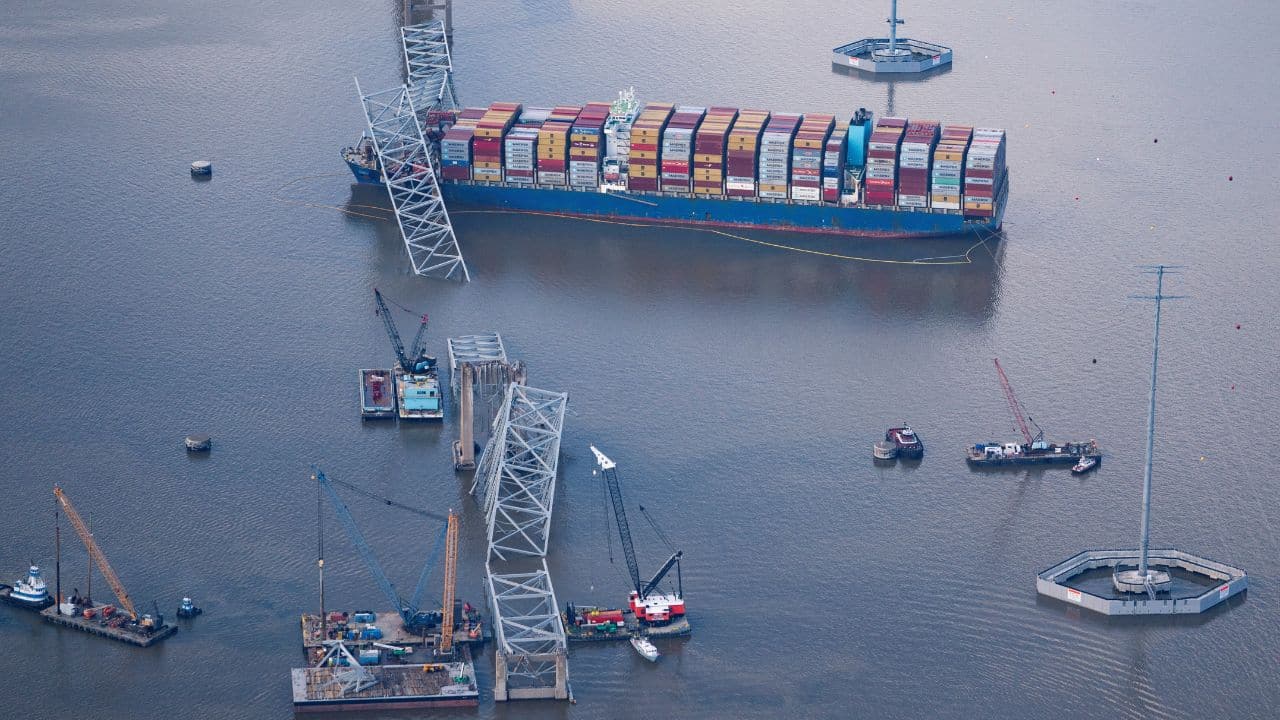

There could be more pain for railways, but shipbuilders to gain from Budget 2025

Capex and engineering stocks take a hit while policy support buoys defence scrips

BUSINESS

Shipbuilding, repair get a boost from Budget with long-term policy support

Investment prospects brighten for key players in the public and private sectors