BUSINESS

Want to buy an ETF? Check out these most liquid Equity ETFs

Although exchange-traded funds are superior to index funds in structure and tracking error, they lag behind on liquidity. Not all ETFs are liquid. Liquidity or the trading volume plays an important part in ETF selection. Choose ETFs with high liquidity, lower tracking error, expense ratio, and impact cost

BUSINESS

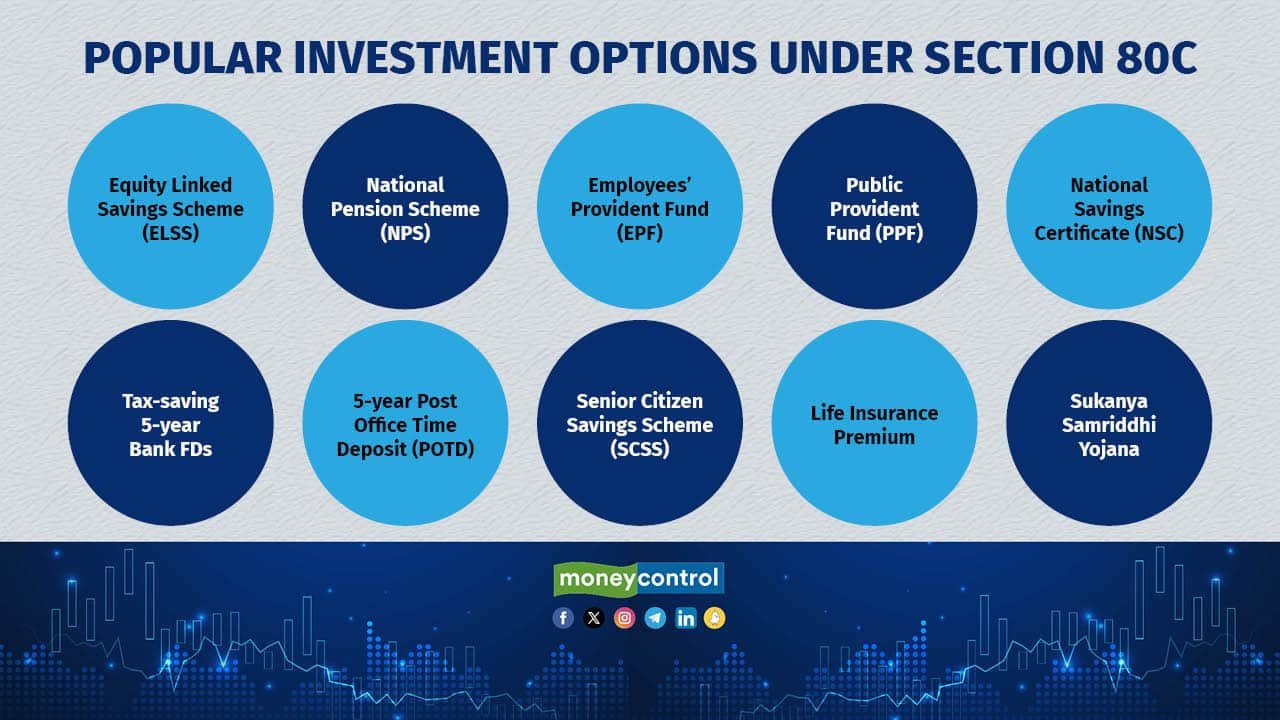

Top 12 ELSS Funds To Look For

Tax-Saving mutual funds: Equity-Linked Savings Schemes (ELSS) remains the only pure equity instrument, as par of the Section 80C tax deduction basket. And January – March is usually the time period when investors do their last-minute tax saving instruments. But these funds appeal to the long-term investor as well, even if your tax deductions are taken care of. Just mind the lock-in

BUSINESS

Switching between equity and debt: These ULIP BAF funds return up to 12.2% over 10 years

Not just mutual funds, even insurance companies offer dynamic asset allocation funds or Balanced Advantage funds (BAF). These schemes aim to deliver consistent returns across market cycles, with lower volatility than pure equity funds. Here are 5 such top BAF ULIP funds

BUSINESS

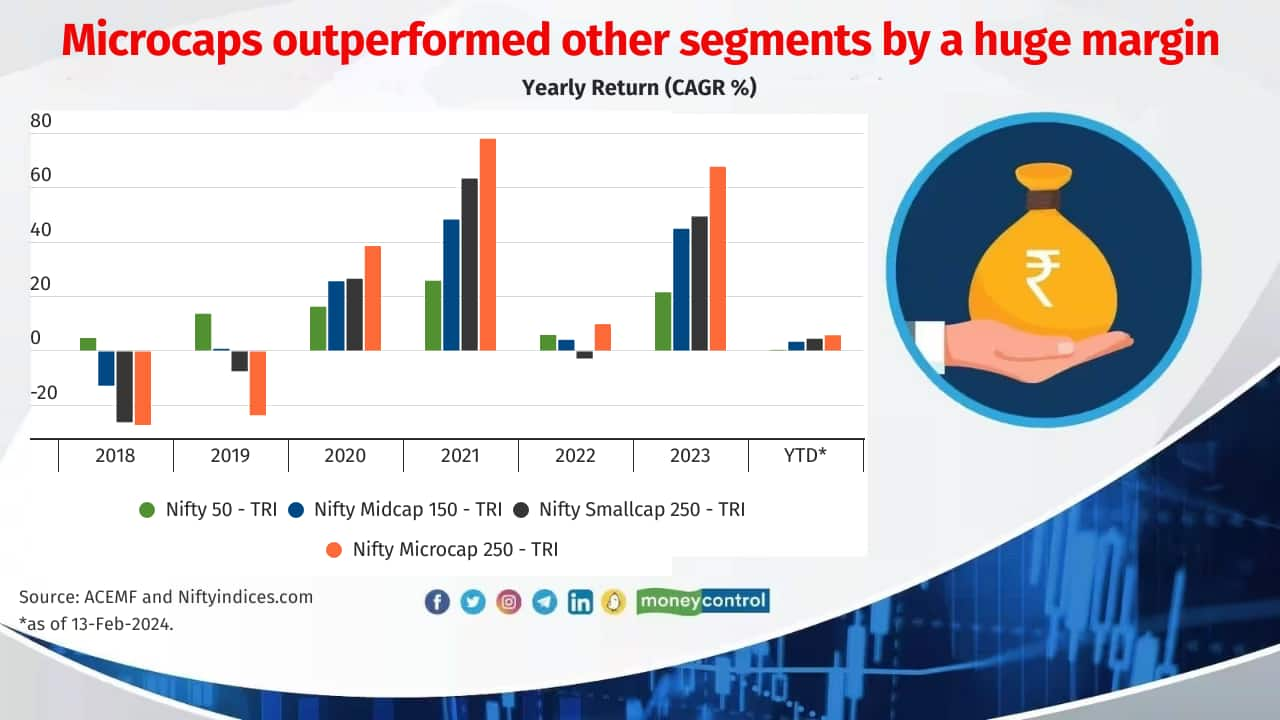

Microcap stocks that fund houses have sold in 3 months

Micro-cap stocks can turn multibaggers if fund managers choose them wisely. But sometimes, stock picks don’t go according to plan. These micro-cap stocks were shunned by mutual funds in the last 3 months

BUSINESS

Mid-Cap Multibaggers that retirement goal Mutual Fund schemes chase

There are 27 mutual fund schemes specifically aimed at building a neat retirement kitty. Despite the conservative goal, most of these schemes are targeted for long-term planning. And hence, invest significantly in mid-cap stocks

BUSINESS

Can Budget 2024 turn stocks into multibaggers? History says, it’s possible

Budget 2023 injected fresh lives in infrastructure and cyclical stocks, some of whose share prices were languishing. If Finance Minister Nirmala Sitharaman’s Interim Budget speech is any indication, it’s reasonable to expect the good run in such stocks to continue.

BUSINESS

Interim Budget’s push for infrastructure: Newly added smallcap stocks by infrastructure mutual funds

Experts believe that this could accelerate the infra development activities in the absence of much private capex spending. The Government increased capex outlay to 3.3% of GDP for FY 2023–24, nearly trebling its expenditure in 2019–20

BUSINESS

Top sectors that MF increased exposures, lately. Are you invested in them?

Fund managers of actively managed mutual funds have increased exposure significantly in these sectors over the last three months

BUSINESS

Chasing multibaggers: Micro-cap stocks that Flexicap MFs added

Quality microcap stocks have the potential to outperform over the long term. Despite market highs, Flexicap mutual funds can add small- and micro-cap stocks due to the flexibility

BUSINESS

Bracing for Volatility? Bet on these newly added large-cap stocks by PMS

After the mid-cap and small-cap indices gave returs of 45 percent and 49 percent in 2023, portfolio managers of PMSs have started to build safety nets to brace for a more volatile 2024

BUSINESS

Momentum mania: 12 new midcap stocks entered the Nifty 200 Momentum 30 Index

These new midcap stocks got relatively high momentum score among the peers within the Nifty 200 basket over the last one year

BUSINESS

Just 6% of MF schemes exited HDFC Bank in past 6 months

Though HDFC Bank’s Q3 results were subdued, mutual funds continue to hold the stock but there are contrarians among the pack. Of the 422 actively-managed equity funds that hold the banking stock, 27 diversified funds exited the stock over the past six months

BUSINESS

Is HDFC Bank a safety net for mid-cap and small-cap funds? Not always

Largecap stocks held by mid-cap and small-cap funds tend to cushion the fall whenever the market corrects. However, it is not a cause of concern for the long term investors

BUSINESS

Midcap gems that large-cap funds added lately

Despite stretched valuation in the midcap space, many large-cap funds have added fresh positions in quality midcap stocks in the last three months

BUSINESS

Good returns and tax-savings: A winning combo by top tax-saving MFs

The interim Budget 2023 might not have any goodies in store for those who were seeking a relaxation in the Section 80C tax deduction basket. But Equity-Linked Saving Schemes still remain a great catch

BUSINESS

Find the best asset allocation mix that will maximise your returns

The 60-40 equity-debt allocation — arguably the most popular asset allocation — appears to be losing its edge. A touch of gold works better

BUSINESS

Chasing multibaggers: 5 stocks that jumped from microcap to midcap in AMFI’s rejig

Seven stocks that were microcaps have been reclassified as midcap stocks over the last four years, as per AMFIs’ January 2024 classification rejig. Fund managers identified five of them to be in the early stage of their growth cycle and invested in them

BUSINESS

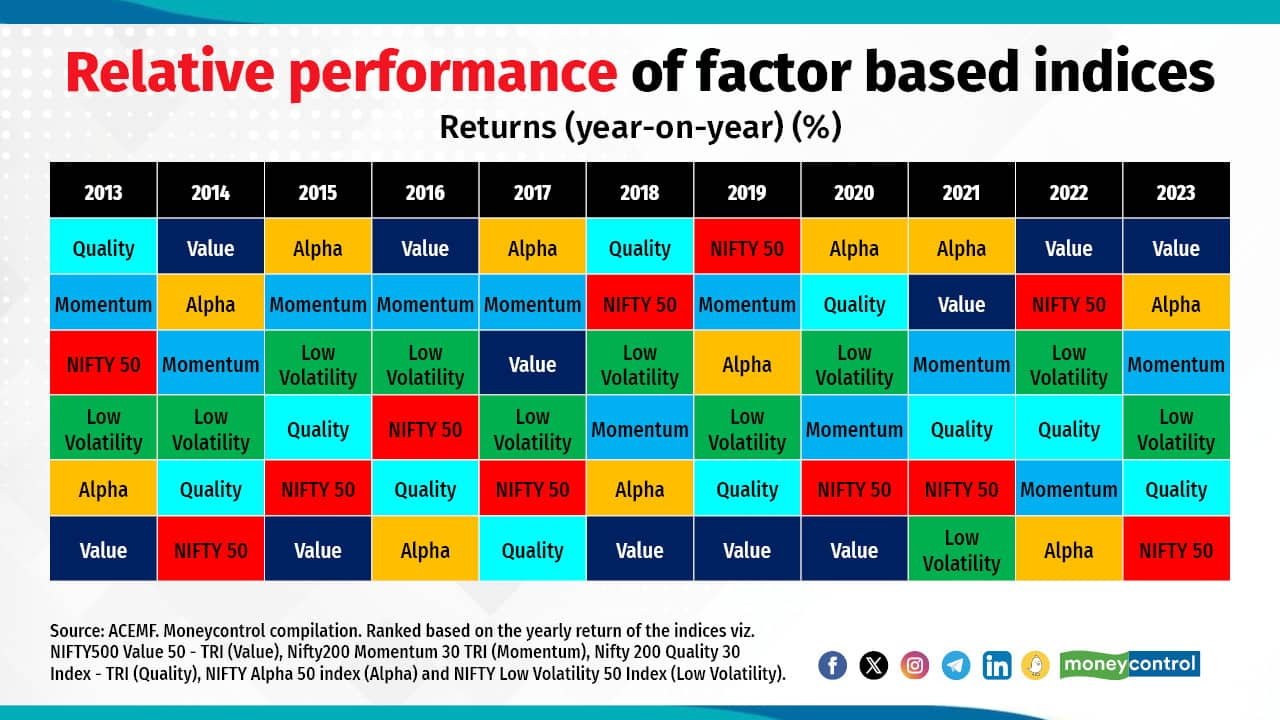

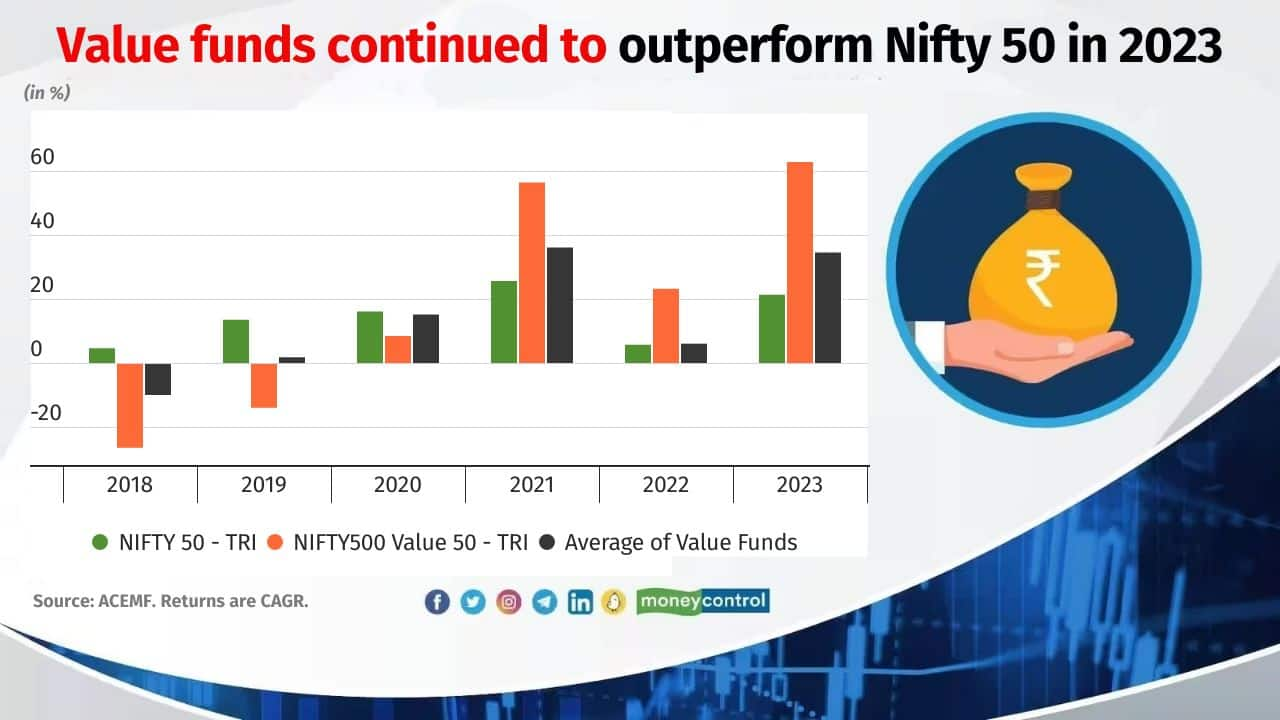

Momentum continues in value funds: Here are their top newly added stocks

Value factor tends to be overweight on government -owned and public-sector companies in Financial Services, Commodities, and Energy sectors. This has earned them good returns

BUSINESS

Sector and themes of 2023: Can the winners do an encore in 2024?

Sector and thematic mutual fund Categories such as PSU, infrastructure and auto funds were the winners while Banks & Financial Services, MNC and ESG funds categories were the laggards in 2023

BUSINESS

10 midcap stocks that rewarded MF investors in 2023

Within the midcap space, PSU stocks in power finance, capital goods, oil marketing, defence, and also power and realty stocks attracted healthy buying interest

BUSINESS

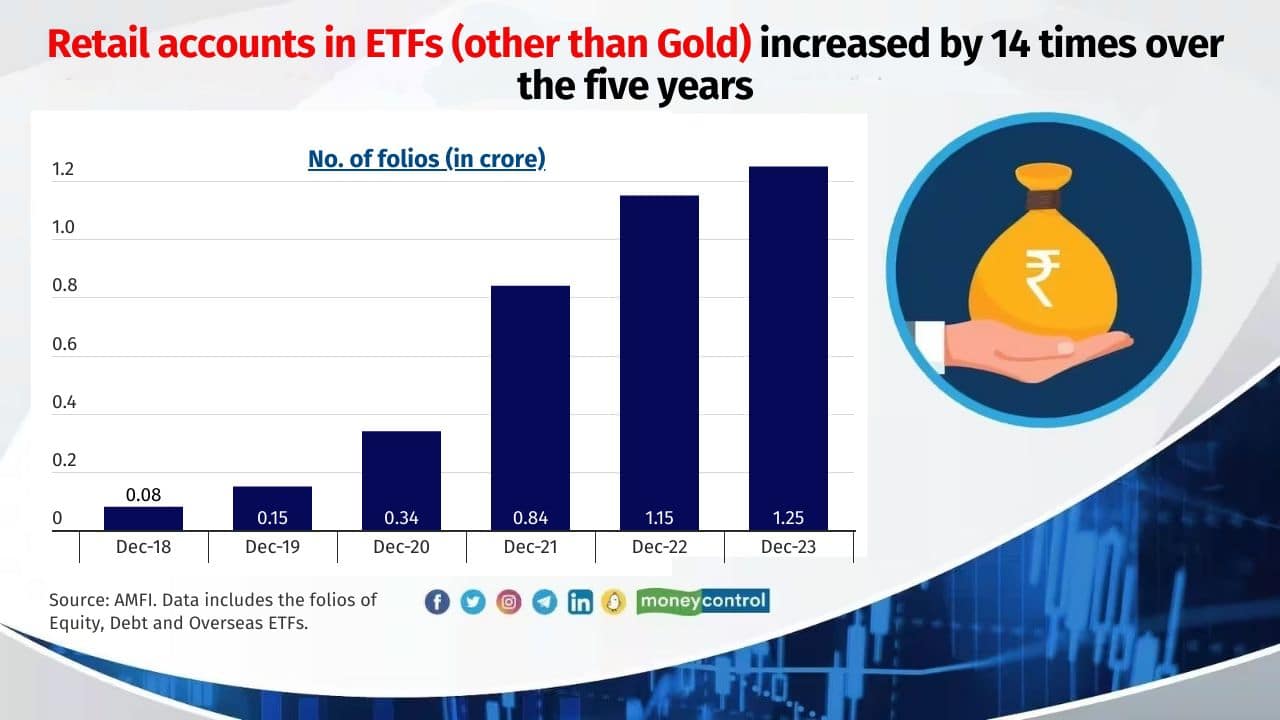

Mutual fund industry assets top Rs 50 trillion landmark: what helped achieve this number?

Steady and increasing inflows in mutual funds through systematic investment plans have led to retail investors incrementally allotting more of their corpuses in mutual funds.

BUSINESS

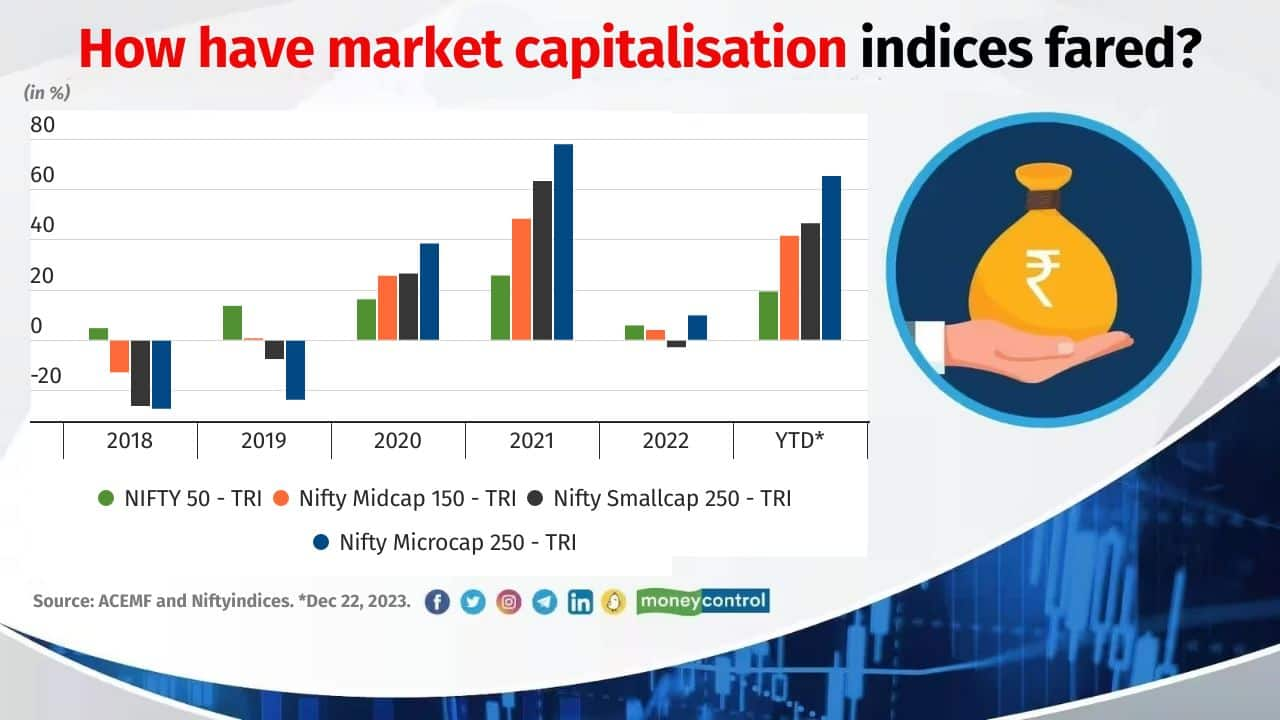

Mutual Funds Year-end Special 2023: 5 things that impacted how you invested in 2023

Year-ender 2023: From mid and small-cap funds burning the charts, to new mutual fund houses entering the industry, 2023 benefited the disciplined investor.

BUSINESS

Tax-Saving FDs: These largest banks offer up to 7% interest rate

Tax-saving FDs are one of the least risky investment options in the crowded 80C benefit. They have a lock-in period of five years and premature withdrawals are not allowed. The interest in this investment is taxable

BUSINESS

Most sold mid-cap stocks by active fund managers in November

As mid-cap indices climb to new highs, mid-cap fund managers have increased their activity in their portfolios. They may have chosen to sell their holding due to either the stocks reaching their in-house target prices, or an unfavourable change in the prospects making the stock unattractive