Sector and themes of 2023: Can the winners do an encore in 2024?

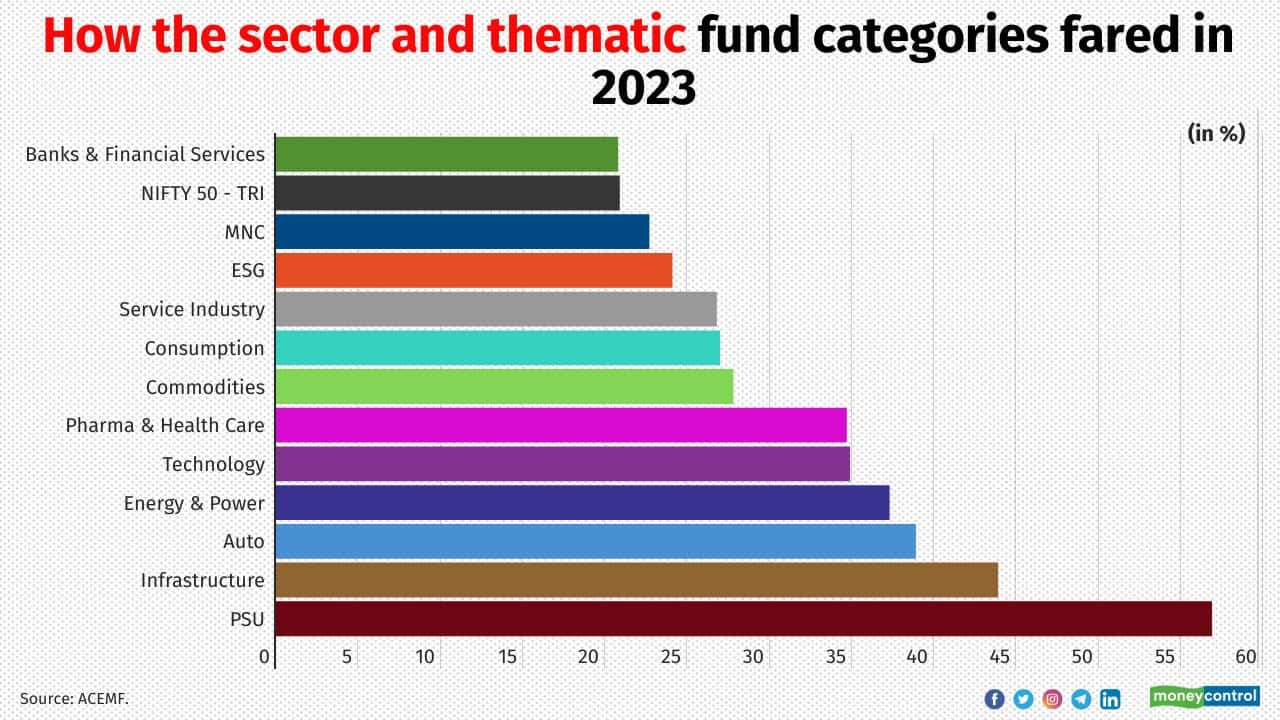

Sector and thematic mutual fund Categories such as PSU, infrastructure and auto funds were the winners while Banks & Financial Services, MNC and ESG funds categories were the laggards in 2023

1/14

Despite the sluggish start, the year of 2023 was good for equity markets. The S&P BSE Sensex crossed 70,000 points and the Nifty 50 index crossed 21,000 points. All the equity oriented mutual fund categories managed to register positive returns.

Performance of major equity fund categories (average return) in 2023:

• Largecap funds: 23%

• Midcap funds: 38%

• Smallcap funds: 42%

• Flexicap funds: 28%.

Performance of major equity fund categories (average return) in 2023:

• Largecap funds: 23%

• Midcap funds: 38%

• Smallcap funds: 42%

• Flexicap funds: 28%.

2/14

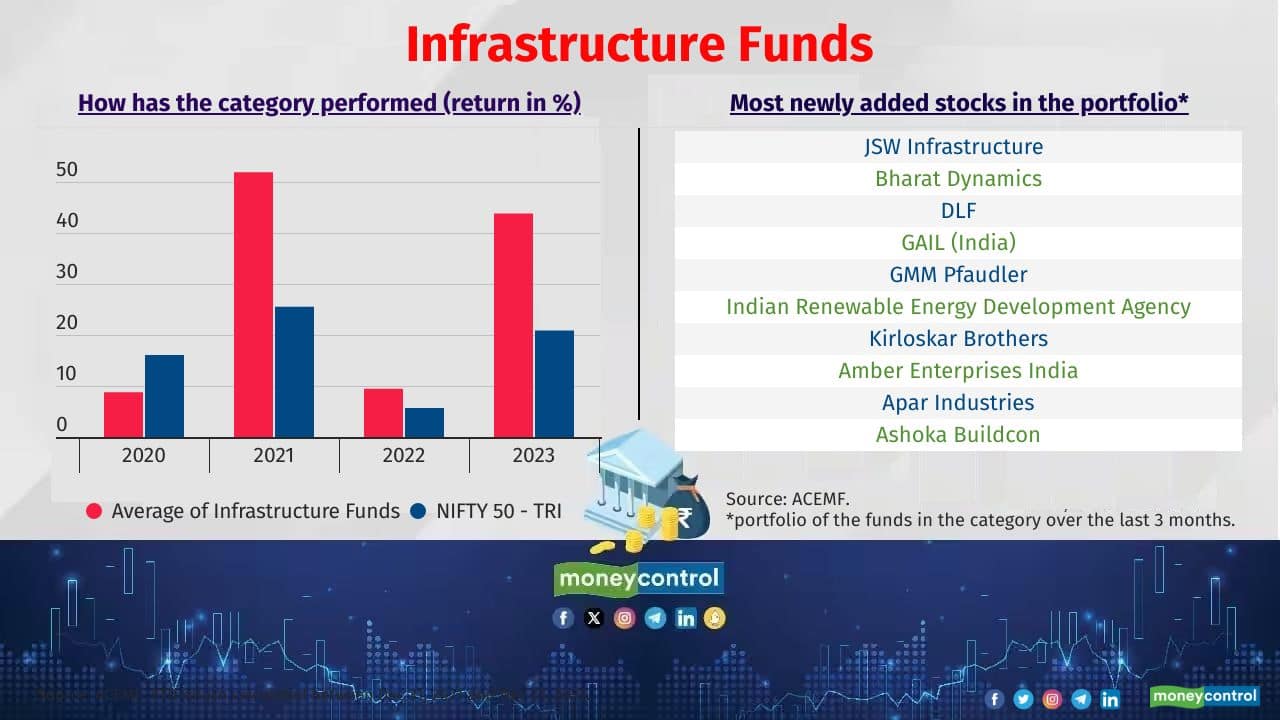

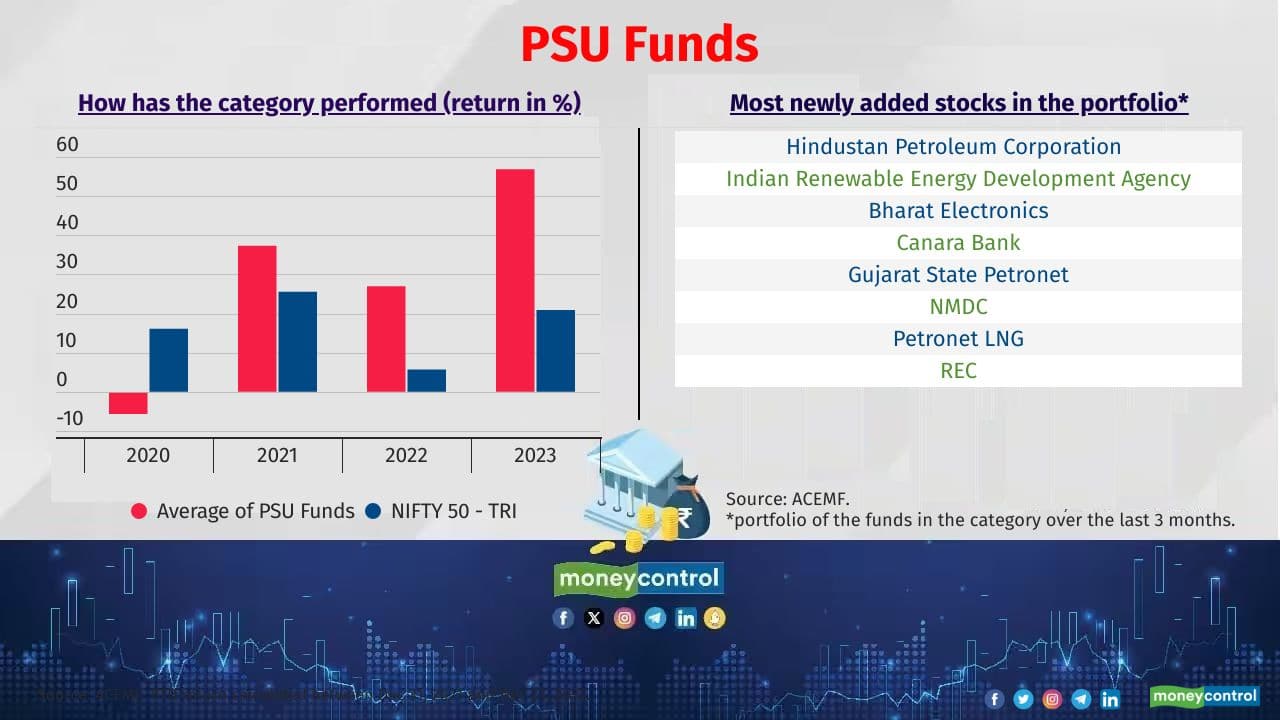

All the sector and thematic mutual funds registered impressive returns in 2023. Sectors funds categories such as PSU, infrastructure and auto funds were the winners while Banks & Financial Services, MNC and ESG funds categories were the laggards. But will these sectors continue to perform in 2024 as well?

Moneycontrol takes a look at the latest additions to their portfolios to gauge how they are gearing up to face the year ahead.

Below graphs exhibit the yearly performance and the new stock additions in the portfolio of major sector and thematic funds. Portfolio data as of November 2023. Source: ACEMF.

Moneycontrol takes a look at the latest additions to their portfolios to gauge how they are gearing up to face the year ahead.

Below graphs exhibit the yearly performance and the new stock additions in the portfolio of major sector and thematic funds. Portfolio data as of November 2023. Source: ACEMF.

3/14

2023 rank # 12: Banks & Financial Services Funds

Top performing schemes in the category: Sundaram Financial Services Opportunities and Invesco India Financial Services

Top performing schemes in the category: Sundaram Financial Services Opportunities and Invesco India Financial Services

4/14

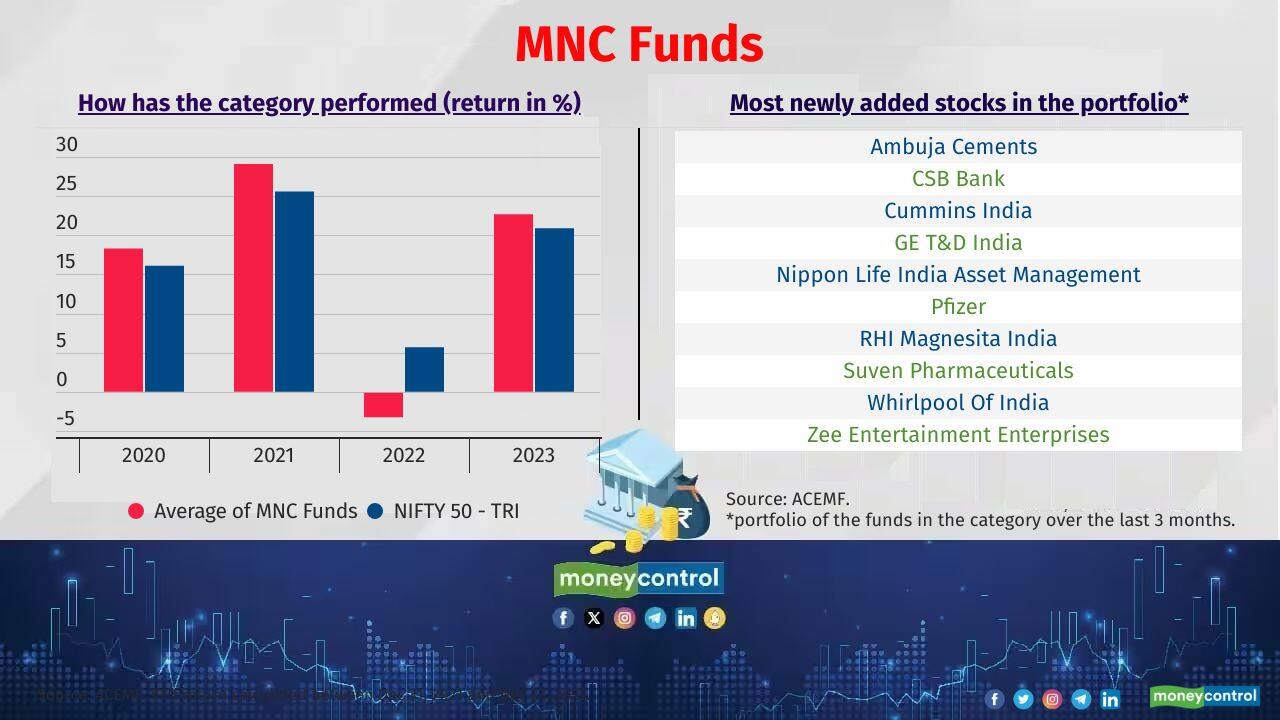

2023 rank # 11: MNC Funds

Top performing schemes in the category: ICICI Pru MNC and SBI Magnum Global

Top performing schemes in the category: ICICI Pru MNC and SBI Magnum Global

5/14

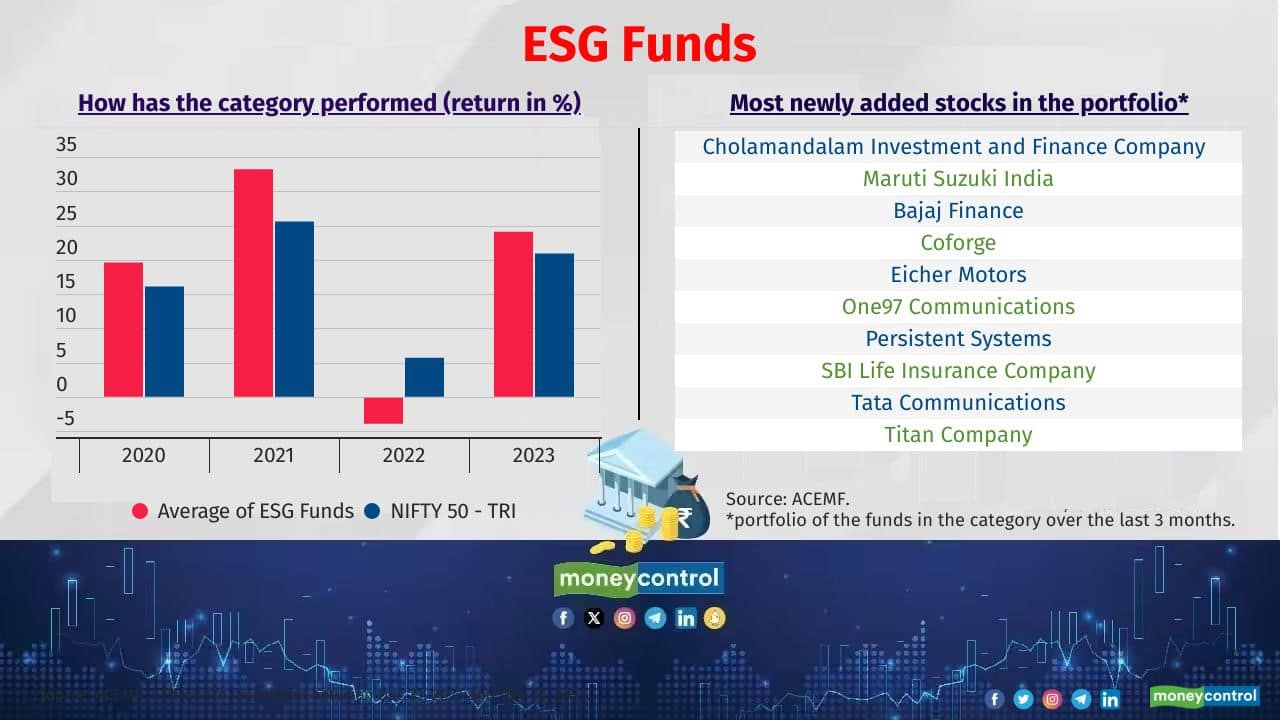

2023 rank # 10: ESG Funds

Top performing schemes in the category: ICICI Pru ESG and Quantum India ESG Equity

Top performing schemes in the category: ICICI Pru ESG and Quantum India ESG Equity

6/14

2023 rank # 9: Service Industry Funds

Top performing schemes in the category: Sundaram Services and ICICI Pru Exports & Services

Top performing schemes in the category: Sundaram Services and ICICI Pru Exports & Services

7/14

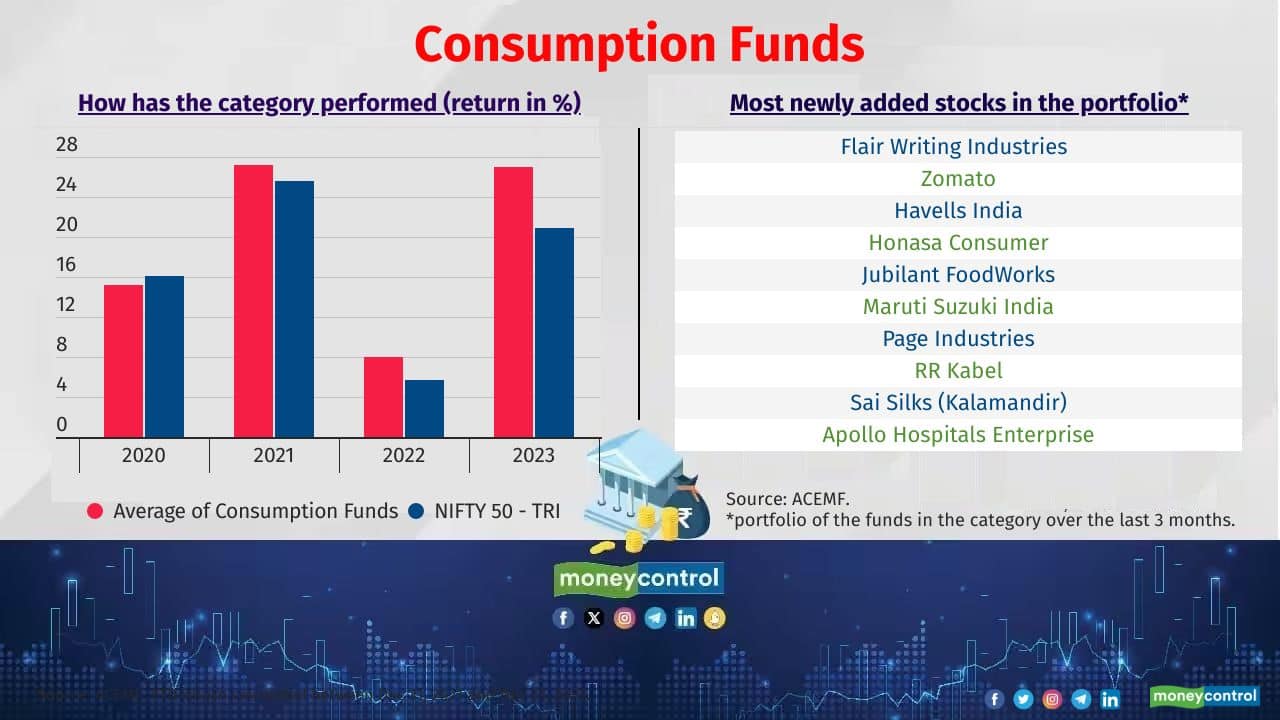

Top 8: Consumption Funds

Top performing schemes in the category: Tata India Consumer and ICICI Pru Bharat Consumption

Top performing schemes in the category: Tata India Consumer and ICICI Pru Bharat Consumption

8/14

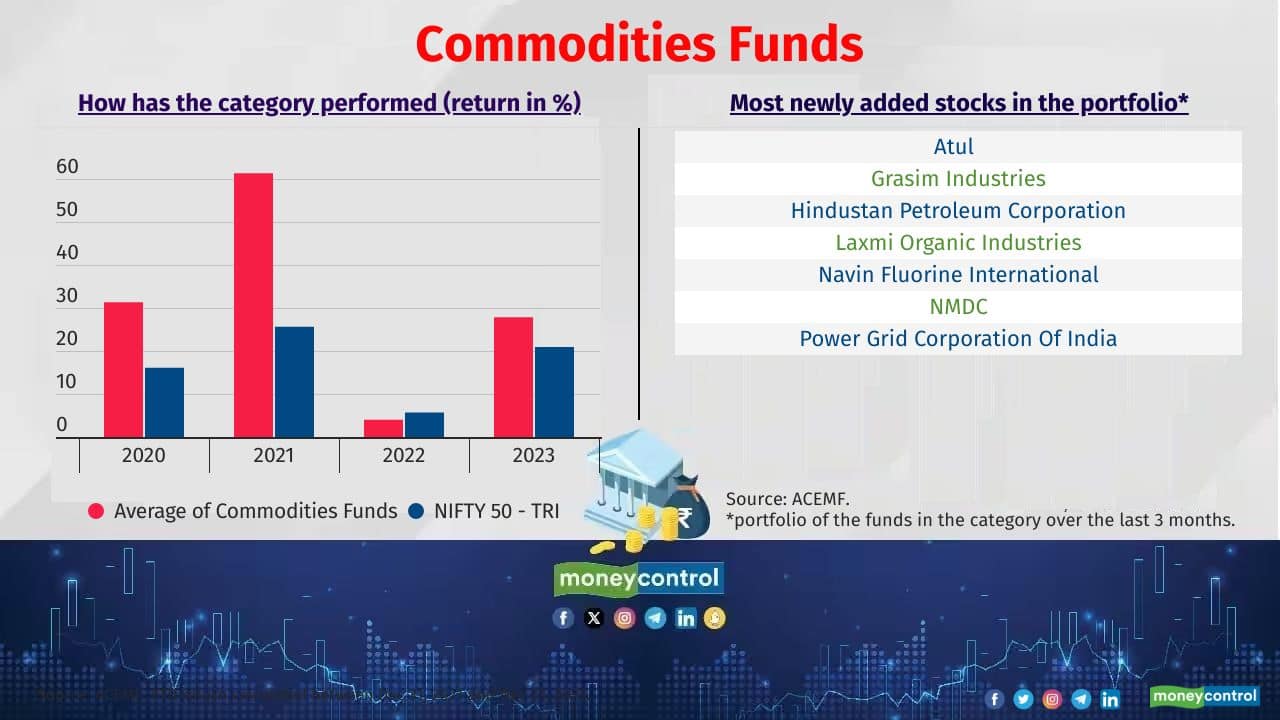

Top 7: Commodities Funds

Top performing schemes in the category: SBI Magnum Comma and ICICI Pru Commodities

Top performing schemes in the category: SBI Magnum Comma and ICICI Pru Commodities

9/14

Top 6: Pharma & Health Care Funds

Top performing schemes in the category: ICICI Pru Pharma Healthcare & Diagnostics (P.H.D) and Nippon India Pharma

Top performing schemes in the category: ICICI Pru Pharma Healthcare & Diagnostics (P.H.D) and Nippon India Pharma

10/14

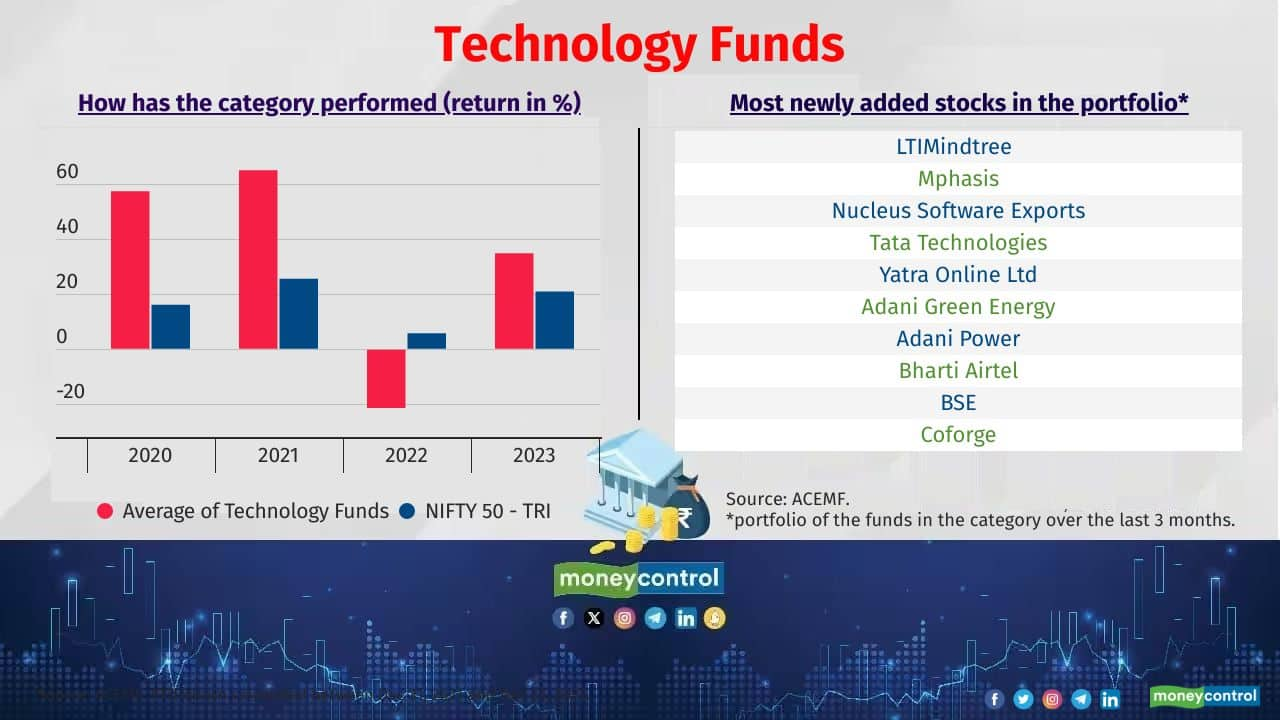

Top 5: Technology Funds

Top performing schemes in the category: Franklin India Technology and Aditya Birla SL Digital India

Top performing schemes in the category: Franklin India Technology and Aditya Birla SL Digital India

11/14

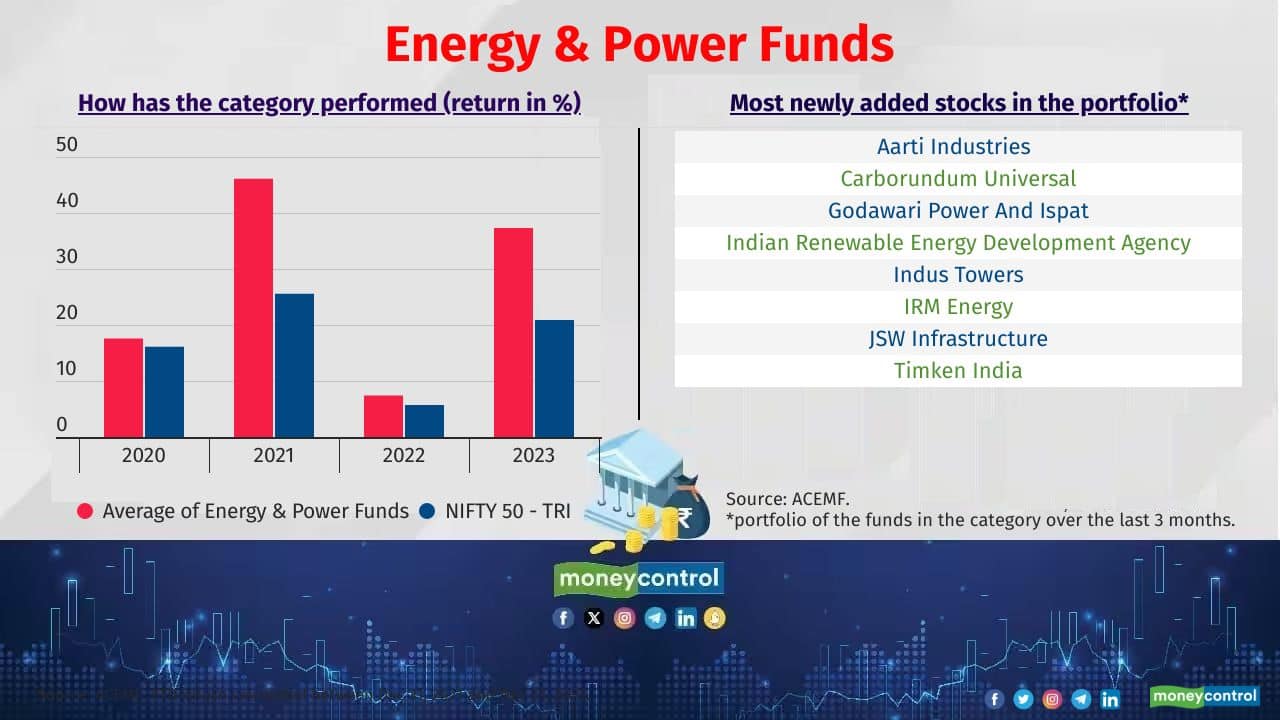

Top 4: Energy & Power Funds

Top performing schemes in the category: Nippon India Power & Infra and DSP Natural Res & New Energy

Top performing schemes in the category: Nippon India Power & Infra and DSP Natural Res & New Energy

12/14

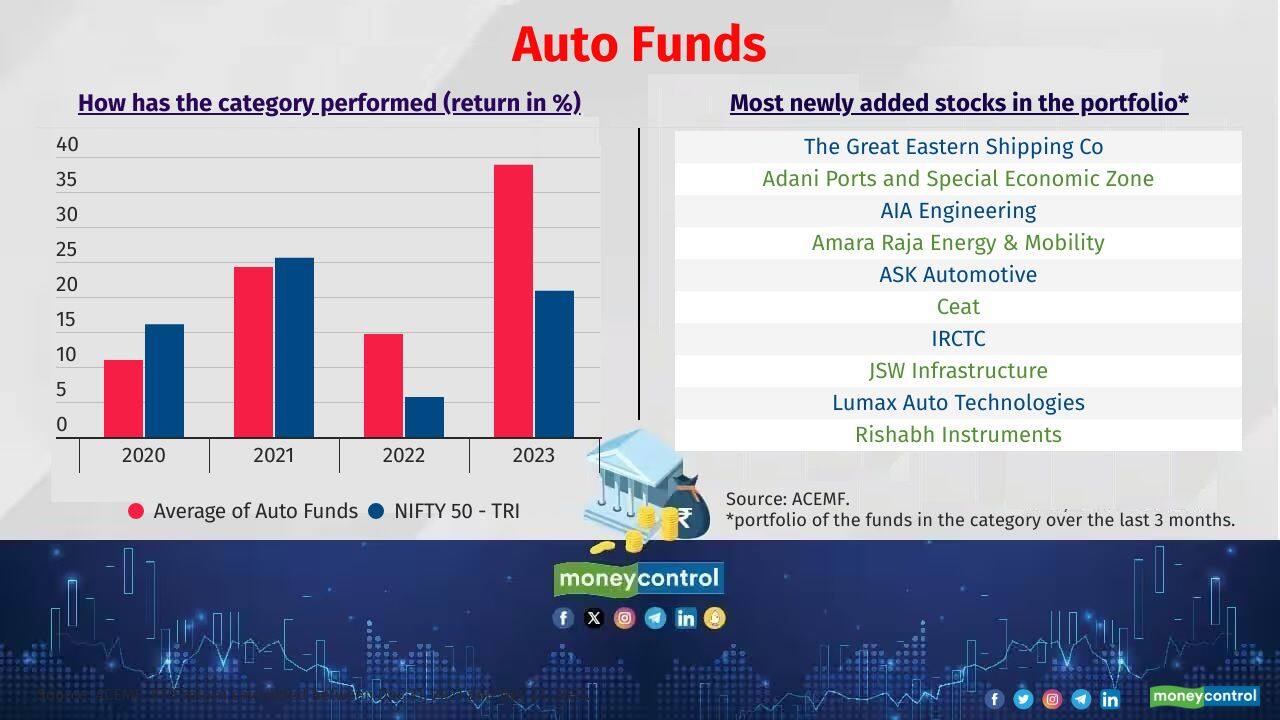

Top 3: Auto Funds

Top performing schemes in the category: ICICI Pru Transportation and Logistics and UTI Transportation & Logistics

Top performing schemes in the category: ICICI Pru Transportation and Logistics and UTI Transportation & Logistics

13/14

Top 2: Infrastructure Funds

Top performing schemes in the category: HDFC Infrastructure and Franklin Build India

Top performing schemes in the category: HDFC Infrastructure and Franklin Build India

14/14

Top 1: PSU Funds

Top performing schemes in the category: CPSE ETF and Bharat 22 ETF

Top performing schemes in the category: CPSE ETF and Bharat 22 ETF

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!