BUSINESS

India’s banks know climate is their biggest threat: Mihir Sharma

Indian regulators have been slow to respond. It wasn’t until earlier this year that the RBI finally released a draft framework that would require financial institutions to devise and disclose their strategies to mitigate climate-related risk.

WORLD

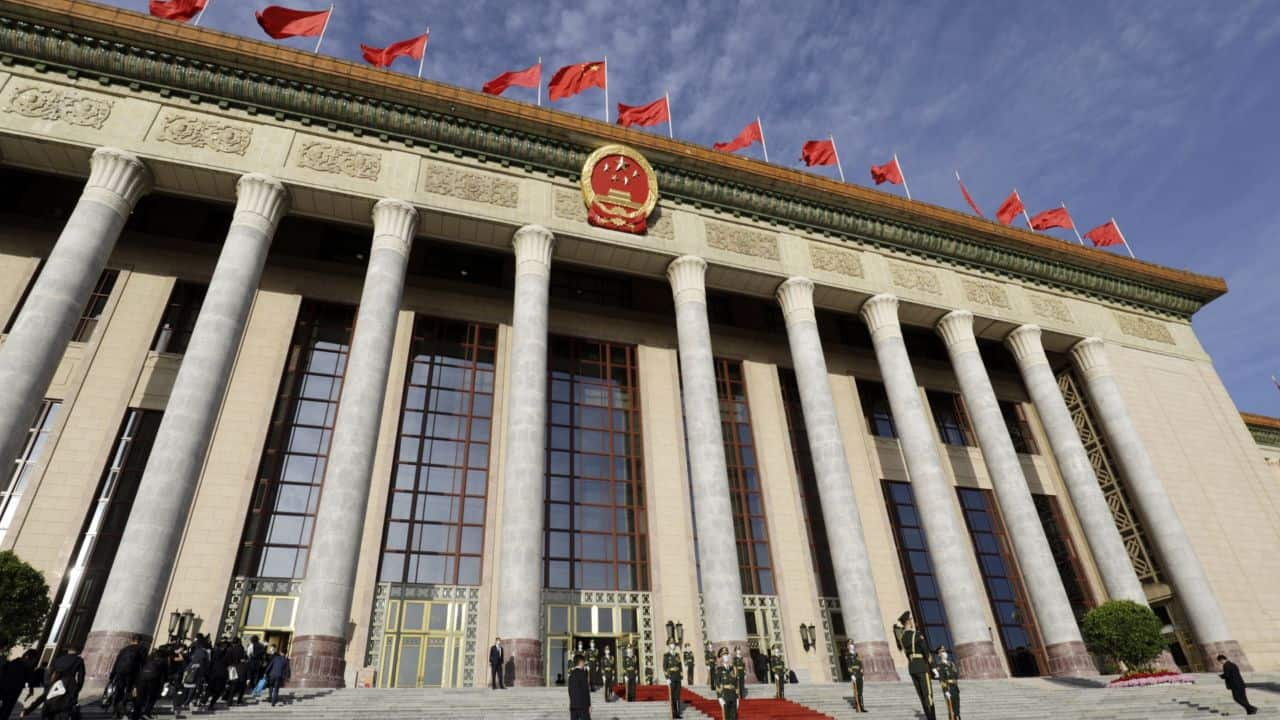

China's PBOC readies multibillion-yuan pool of bonds to sell by tapping major banks

After months of investor speculation about its intentions, the People’s Bank of China disclosed the clearest outline yet of its unprecedented plans in a statement to Bloomberg News on Friday.

WORLD

Donald Trump wasn’t going to prison anyway, neither was Hunter Biden

As first-time offenders convicted of non-violent crimes, it would be extremely unusual for either to serve time

BUSINESS

India’s LNG imports set to slump as monsoon hits power demand

“Electricity demand won’t be as high as it was in May and June, which is the prime driver of higher LNG imports,” said Ayush Agarwal, LNG analyst at S&P Global Commodity Insights.

WORLD

Pakistan imposed a milk tax, now the dairy staple costs more in Karachi than Paris

Pakistan raised taxes by 40%, the highest on record, in last week’s budget aimed at meeting conditions set by the International Monetary Fund for a new bailout

BUSINESS

India’s hopes for Tesla investment cool as Elon Musk ceases contact

Elon Musk in April scrapped a planned visit to India that would have included a meeting with Prime Minister Narendra Modi, citing pressing issues at the company

MARKETS

Do markets perform better under Labour? not quite: Merryn Somerset Webb

This week should see Labour winning power with a pretty hefty majority. The consensus has been that this is not an election anyone would particularly want to win, but as the dust of the election clears, the new government should see that they have been dealt a perfectly reasonable hand.

BUSINESS

UBS loses another senior India banker with strategy yet unclear

Aditya Goenka, a Mumbai-based managing director in structured lending, is leaving to join HSBC Holdings Plc in its commercial banking business, the people said, asking not to be named as the information is private.

WORLD

Foxconn to invest $551 million in two projects in north Vietnam

The company has been granted a license for a $264 million project in Song Khoai Amata Industrial Park to produce smart entertainment products, with designed capacity of about 4.2 million units per year, according to a posting on the provincial government’s website.

WORLD

Joe Biden struggles to contain mounting pressure to drop out of race

The White House and Biden’s campaign quickly denied the Times report suggesting the president had vocalized to a supporter that he could ill-afford another misstep that would irrevocably damage his campaign. Biden himself insisted to campaign staff he intended to remain in the race.

BUSINESS

PM Modi’s budget to send India’s soaring stocks higher, survey says

The upcoming government budget will likely boost consumer spending and infrastructure building, which bode well for businesses, strategists and investors surveyed by Bloomberg said.

BUSINESS

Jeff Bezos to sell $5 billion of Amazon as shares hit record high

Bezos sold shares worth about $8.5 billion over nine trading days in February — the first time he disposed of company stock since 2021.

BUSINESS

JPMorgan’s Kolanovic to exit amid string of poor stock calls

Kolanovic, who has been at JPMorgan for 19 years, is “exploring other opportunities,” the memo stated

WORLD

UK Election 2024: Hour-by-hour guide to how the results come in

Pollsters say the question is less about a Labour win than the scale of it. Starmer’s party has led the Conservatives by more than 20 points through the 6-week election campaign, according to Bloomberg’s poll of polls

BUSINESS

MUFG’s talks for minority stake in HDB Financial said to be stalling

HDFC could consider an initial public offering of the consumer lending unit as an alternative, one of the people said

BUSINESS

Bain’s India lender plans to double portfolio ahead of listing

Tyger Capital Pvt Ltd., acquired by Bain Capital from the Adani Group, aims to expand its loan portfolio twofold as it prepares for a listing on India’s stock exchanges in the upcoming fiscal year.

BUSINESS

India’s long bonds have become a crowded trade, Edelweiss warns

Traders have fueled expectations of policy rate cuts and increased foreign fund purchases, creating a crowded trade scenario.

TECHNOLOGY

Google’s emissions shot up 48% over five years due to AI

Google’s emissions rose by nearly half over five years, reaching 14.3 million metric tons in 2023, driven by AI integration and higher data center energy use. This complicates its 2030 carbon elimination goal.

WORLD

Apple poised to get OpenAI board observer role as part of AI pact

Apple Inc. is set to secure an observer role on OpenAI’s board in a significant partnership expansion. Phil Schiller, Apple’s App Store head and former marketing chief, will assume the role, according to sources.

BUSINESS

Novo, Lilly fall after Biden calls for cheaper obesity drugs

Novo Nordisk A/S and Eli Lilly & Co. saw their shares drop after President Joe Biden called for price reductions on their weight-loss and diabetes drugs, criticizing what he called "unconscionably high prices."

WORLD

China is building and testing lethal attack drones for Russia

Chinese and Russian companies are developing a drone akin to Iran’s Shahed, raising concerns over increased support for Russia despite warnings from Western powers.

BUSINESS

HSBC curbs hiring, reins in banker travel in cost-cutting push

HSBC’s belt-tightening is the latest sign that lenders are starting to prepare for central banks around the world to begin to cut interest rates in the coming months.

INDIA

Wizz Air expects response to India entry plans in six months

Budapest-based Wizz is in the process of negotiations with Indian authorities to be granted so-called designation which would throw the door open to the start of services to India, Chief Executive Officer Jozsef Varadi said.

WORLD

Tesla beats estimates with less-drastic drop in EV sales

While sales were down 4.8% from a year ago, Tesla improved on a sequential basis from the 386,810 vehicles delivered in the first three months of the year.