BUSINESS

India’s big plans for cleaner jet fuel face a string of hurdles

There -- on a sprawling 300 acre tea estate where leopards and deer can be spotted -- scientists are working with partners including Boeing Co. to get global approvals for their biofuel, which is made from waste cooking oil and the seeds of plants like pongamia and jatropha that aren’t consumed.

BUSINESS

Elon Musk fires more Twitter sales workers after ‘hardcore’ purge

Some of those who were fired started to receive notice on Sunday, according to two people familiar with the matter, though it’s unclear how many will be impacted in the current round. Platformer earlier reported the news.

BUSINESS

Bob Iger takes first steps to Disney in memo to staff

“Over the coming weeks, we will begin implementing organizational and operating changes within the company,” Iger said Monday in a memo. “It is my intention to restructure things in a way that honors and respects creativity as the heart and soul of who we are.”

BUSINESS

This KKR-backed startup is tapping PM Modi's decarbonisation drive

Prime Minister Narendra Modi is encouraging the gradual phase-out of fossil fuels after it set a target of getting to net zero by 2070.

BUSINESS

Mideast KFC operator Americana Restaurants looks to raise up to $1.8 billion via IPO

The books for the deal, a dual listing in Abu Dhabi and Riyadh, are multiple times covered and orders below 2.62 dirhams or 2.68 riyals per share risk not being allocated, according to the terms. At that price the company would have a market capitalization of $6 billion.

BUSINESS

Goldman Sachs strategists say bear market will last in 2023

The strategists estimate the S&P 500 will end 2023 at 4,000 index points -- just 0.9% higher than Friday’s close -- while Europe’s benchmark Stoxx Europe 600 will finish next year about 4% higher at 450 index points.

WORLD

China seals one of the biggest LNG deals ever with Qatar

Qatar Energy will send Sinopec 4 million tons of LNG a year starting in 2026, the state-controlled companies announced in a virtual ceremony on Monday.

BUSINESS

Goldman sees India’s growth slowing next year as tailwinds fade

Gross domestic product may expand by 5.9% in calendar year 2023 from an estimated 6.9% this year, Goldman economists led by Andrew Tilton wrote in a report Sunday.

BUSINESS

Goldman Sachs paid over $12 million to Bury Partner's claim of sexist culture

The bank settled with the departing partner two years ago, in a deal that kept secret her detailed account of senior executives making vulgar and dismissive comments about women, according to people with knowledge of the matter.

WORLD

Qatar’s tarnished World Cup is too big for brands to boycott

Qatar 2022 is arguably the most scrutinized World Cup in history, and executives are faced with a dilemma as pundits and politicians raise concerns over the host country.

BUSINESS

Humbled central bankers scale back their ambitions

US Federal Reserve Chair Jerome Powell acknowledged in June that “with the benefit of hindsight, clearly we did” underestimate inflation.

TRENDS

Gamers seek fame, riches in world’s next esports hub India

Unlike other gaming markets where play is console- or PC-based, Indian users access live-streams mainly via their mobile devices - thanks to cheap data.

WORLD

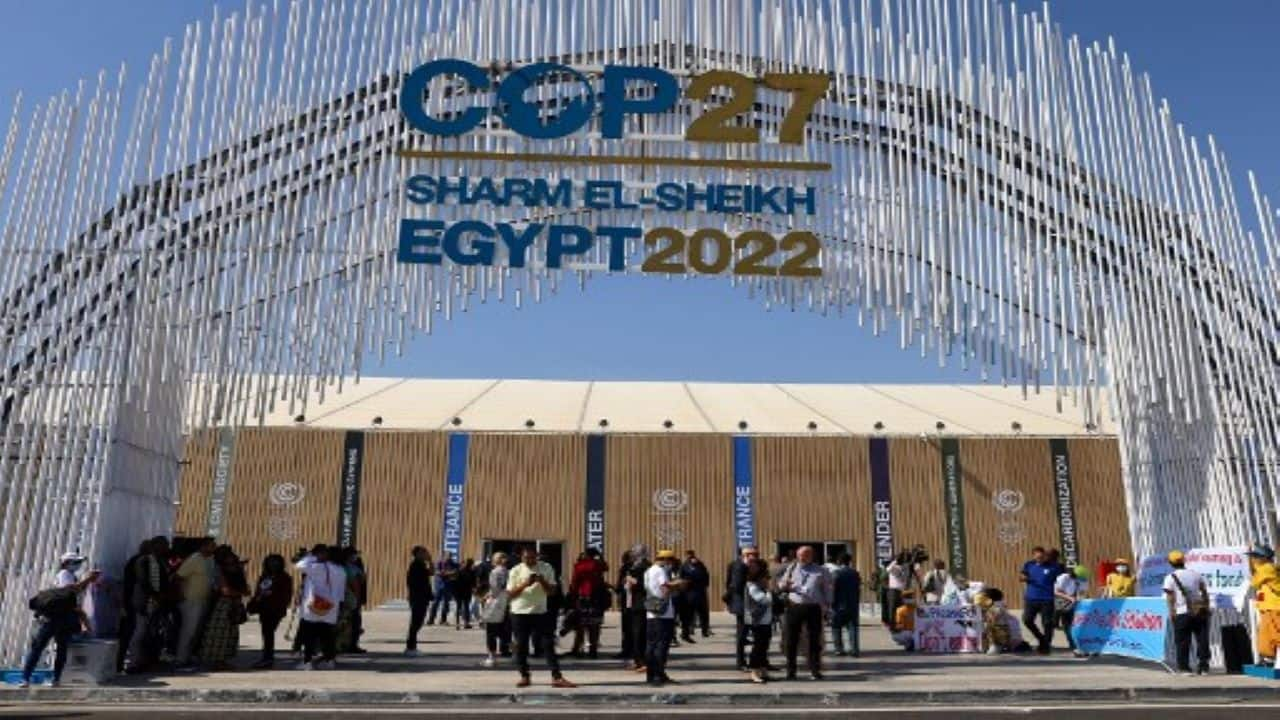

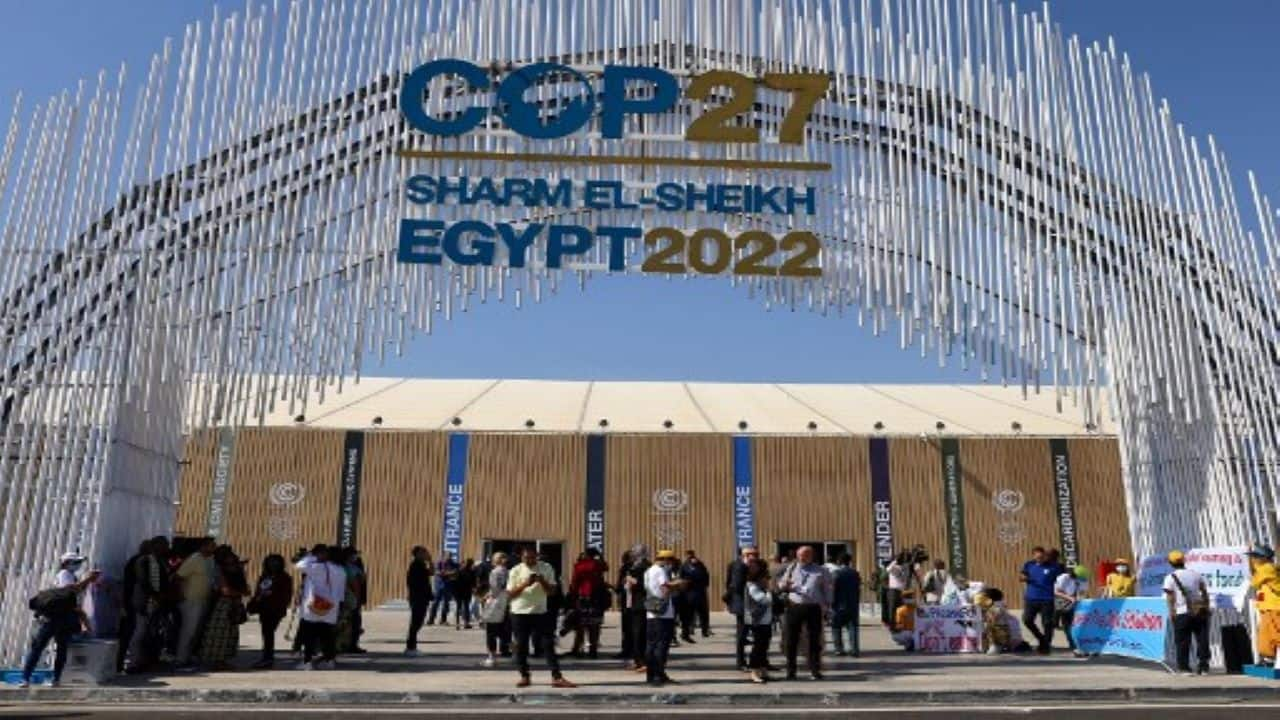

COP27 poised for deal after breakthrough on climate payments

In return Europe, pushed for tougher language on reducing emissions. After hours of wrangling with countries including China, Brazil and Saudi Arabia, changes were agreed to that part of the deal, putting a final text within reach.

WORLD

IMF chief says trade divide could cost global economy $1.4 trillion

For Asia, the potential loss could be twice as bad, or more than 3% of GDP, because the region is more integrated into the global value chain

BUSINESS

After FTX, crypto exchanges struggle to convince customers they’re safe

In a bid to retain investors Crypto firms are disclosing their assets, however investors remain jittery after FTX's crash.

BUSINESS

India, EU standoff over clearing houses to affect BNP to HSBC

The potential damage stems from the European Securities and Markets Authority’s move to withdraw recognition -- effective May 2023 -- to six Indian central counterparties after the Reserve Bank of India resisted ESMA’s request to be allowed to join the RBI in overseeing Indian transactions.

BUSINESS

Masayoshi Son now owes SoftBank $4.7 billion on side deals

Over the years, the Japanese billionaire’s controversial personal stakes in SoftBank’s investments drew fire from investors, who pointed to the mix of personal and company interests as a corporate governance concern.

BUSINESS

Tata Group plans to merge carriers under Air India, scrap Vistara brand

India’s largest conglomerate is considering scrapping the Vistara brand, which is Singapore Airlines Ltd’s local affiliate in the South Asian nation; Singapore Airlines is evaluating the size of the stake it should take in the combined entity.

BUSINESS

COP27 draft leaves out pledge to phase down all fossil fuels

The Egyptian presidency published the first draft of its so-called “cover decision” and largely kept last year’s pledge made at Glasgow to “accelerate measures towards the phase down of unabated coal power” and phase out fossil fuel subsidies.

BUSINESS

China asks banks to report on liquidity after sudden bond slump

The unscheduled regulatory queries coincided with the biggest slump in China’s short-term government debt since mid-2020.

BUSINESS

Investment giants with $2.3 trillion bet on more market turmoil

In interviews with Bloomberg News, seven institutional investors with about $2.3 trillion in combined assets under management from Beijing to Toronto and Melbourne outlined investment plans heading into what’s likely to be a challenging 2023.

BUSINESS

How the 2022 World Cup rebuilt a market for dodgy carbon credits

World Cup organizers have pledged to erase the event’s negative environmental impact. They plan to make the event “carbon neutral” by buying offsets — paying, in theory, for carbon to be removed or reduced from the Earth’s atmosphere somewhere else.

BUSINESS

Subsidy bill may top $67 billion in risk to PM Modi’s budget goals

Subsidies on food, fertilizer and fuel will cost at least 5.4 trillion rupees ($67 billion) in the fiscal year ending March 2023, against the budget estimate of 3.2 trillion rupees, the people said, asking not to be identified as the discussions are private.

BUSINESS

‘The reset has arrived’ for the technology industry, VCs warn

Venture capitalist GGV Capital warns that money is harder to come by for startups and valuations have sharply dropped. For General Atlantic, the top of their list of target markets now includes Southeast Asia and India.