BUSINESS

Gold rises to record after US Fed makes first rate cut since 2020

Gold, which tends to benefit from lower rates, rose as much as 1.2% before erasing gains after Fed Chair Jerome Powell said in a press conference that no one should see this as a “new pace.”

BUSINESS

US Fed cuts rates by half point in decisive bid to defend economy

The Federal Open Market Committee voted 11 to 1 to lower the federal funds rate to a range of 4.75 percent to 5 percent, after holding it for more than a year at its highest level in two decades

MARKETS

SEC approves its overhaul of stock pricing, exchange fees

That might help trading venues such as the New York Stock Exchange and Nasdaq Inc., among others, to better compete with wholesalers that can quote in finer increments outside of an exchange.

WORLD

Traders lock in Fed bets as rate-cut size debate to finally end

The market is fully pricing in a quarter-point rate reduction on Wednesday, when the US central bank is expected to kick off its rate-cutting cycle, with the chance of a bigger move viewed as a coin-flip. Treasuries have rallied into the decision, climbing for a fifth-straight month and driving short-dated yields — those most sensitive to Fed policy — to their lowest in two years

BUSINESS

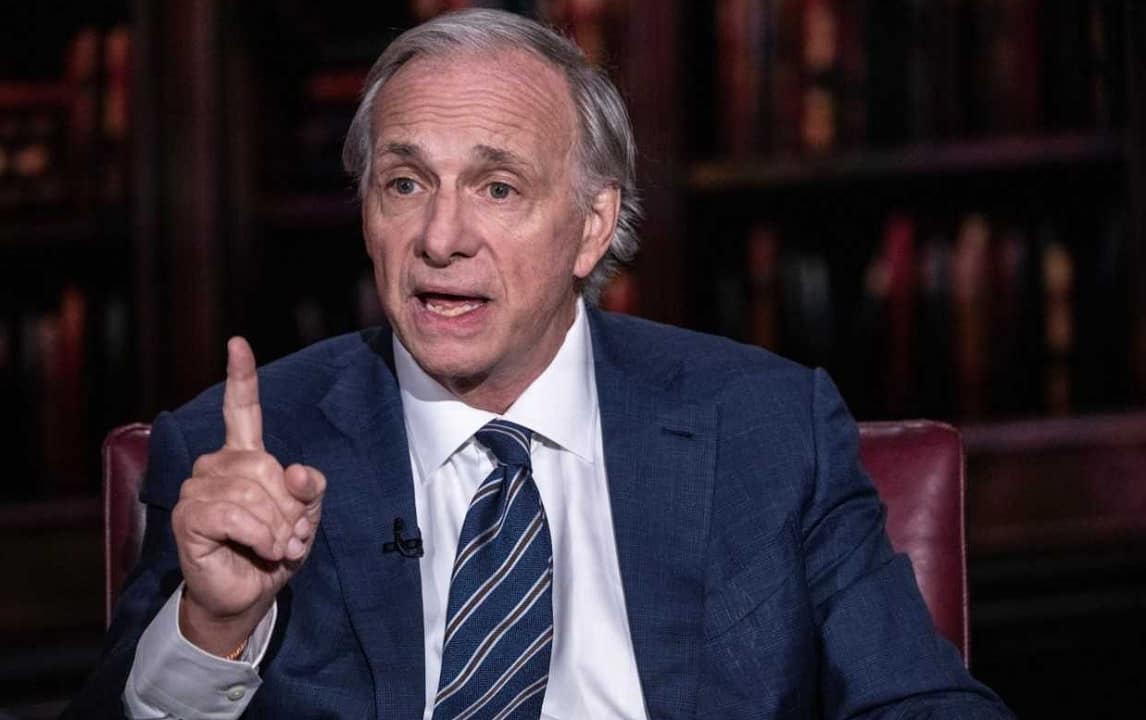

Ray Dalio downplays next US Fed move as investors flag China risks

Bridgewater Associates LP founder Ray Dalio said what the Fed will do this week “doesn’t make a difference” over the longer term as policymakers will ultimately need to keep real interest rates low to allow servicing of mounting debts.

WORLD

Exploding phone, toxic spray: A timeline of covert Israeli hits

Israel has neither confirmed nor denied responsibility for the attack, which came after almost a year of cross-border rocket fire between the two sides in a second front to the war in Gaza

BUSINESS

Centre considering easing rice export limits, aiding global supply

Any further efforts to remove export hurdles could help cool benchmark Asian rice prices, which reached the highest in more than 15 years in January and remain historically elevated.

BUSINESS

Maker of instant noodle brand Wai Wai plans pre-IPO funding for Indian unit in 2025

The Kathmandu-based group will use the pre-IPO funds for expanding operations, and then “hopefully” list the Indian arm within the first quarter of 2026, Binod Chaudhary, chairman of parent CG Corp Global said.

BUSINESS

Accenture to delay bulk of promotions by six months on outlook

The move by the New York-listed company is a further indication of the uncertainty roiling the professional-services industry as clients pull back on spending.

BUSINESS

Fed cut to serve as starting gun for central banks across Asia

Central banks in China, Taiwan and Japan are expected to hold rates, though there’s some chance of a cut in Indonesia. They’re followed by the Reserve Bank of Australia decision on Sept 24, which is also expected to keep rates steady.

BUSINESS

Asian stocks rise as traders await fed decision

Asian stocks climbed ahead of the Federal Reserve's policy decision, with uncertainty around the size of the expected rate cut boosting risk assets. Japanese shares surged as the yen weakened, favoring exporters.

WORLD

Lebanon accuses Israel of orchestrating deadly pager blasts

The blasts took place after batteries on the wireless devices likely overheated, indicating “foul play,” Lebanon’s Telecommunications Minister Johnny Corm told Bloomberg

BUSINESS

Bitcoin jumps most in more than a month amid Fed rate cut optimism

The largest digital currency gained as much as 6.4% to $61,337 on Tuesday, the biggest intraday increase since August 8. Smaller cryptocurrencies such as Ether, Dogecoin and Solana also rallied

BUSINESS

Markets hinge on Powell emulating Greenspan to avoid a recession

Like nearly three decades ago, bonds and stocks are rallying ahead of a critical Fed meeting. This time, the key question for Chair Jerome Powell is which approach — reducing rates by 25 bps or 50 bps — is most beneficial for the US economy.

BUSINESS

Bajaj Housing Finance, India's most valuable mortgage lender, sees housing market battle easing

Sanjiv Bajaj, chairman of the home-loan unit of India’s largest shadow lender and part of one of the country’s oldest conglomerates, said banks have focused on retail business in recent years, given softer demand from corporate borrowers and this has made housing finance “a very competitive market at this point of time”

BUSINESS

Arm of Uday Kotak's group joins the rush for private credit market

While private credit as an asset class has expanded globally, India has become a hotbed for the strategy, where institutions and funds make loans directly to companies, as investors hunt for higher returns.

BUSINESS

Two Walmart heirs top $100 billion wealth for the first time

For the first time ever, two Walton heirs have topped $100 billion each in net worth and a third sibling hovers just below that amount, according to the Bloomberg Billionaires Index.

BUSINESS

Tupperware brands plans to file for bankruptcy

The bankruptcy preparations follow protracted negotiations between Tupperware and its lenders over how to manage more than $700 million in debt.

BUSINESS

Buzzing IPO market is gearing up for bigger debuts

Swiggy is considering filing for a $1 billion-plus offering as soon as this week, people familiar with the matter said.

BUSINESS

Adani, AfDB get $1.3 billion concession for Kenya power lines

The Kenyan government has borrowed heavily and can ill afford to take on additional loans. To balance the need for continued investment in development, the government says it needs private money in public projects.

BUSINESS

Softbank-backed Swiggy said to eye IPO filing this week

Swiggy, backed by SoftBank Group Corp., would follow in the footsteps of other local and international companies seeking to tap the country’s economic growth

BUSINESS

Temasek said to near stake purchase in Blackstone-owned visa firm VFS

VFS has a large presence in India, where it provides visa application services for the US consulate across cities in the country

BUSINESS

China’s first retirement age hike since 1978 triggers discontent

The change will take place over 15 years starting January, and will allow more people to work longer. This could boost productivity, although it risks adding to public discontent with the economy growing at the worst pace in five quarters.

INDIA

India ready to give Maldives aid as Sukuk default risk looms

Maldives can immediately tap $400 million available under the Reserve Bank of India’s currency swap program that’s open to regional countries, Indian officials said