BUSINESS

NPA divergence disclosures meant to increase transparency, rules remain same: RBI

After a regulatory diktat, Yes Bank, Axis Bank and those mentioned above had reported divergences in their NPAs worth over Rs 12,000 crore cumulatively for the financial year 2016-17. ICICI Bank, Axis Bank and Yes Bank also reported such divergences in 2016-17.

BUSINESS

Monetary Policy: Debit card transactions to get a boost as RBI caps Merchant Discount Rate

The revised MDR aims at achieving the twin objectives of increased usage of debit cards and ensuring sustainability of the business for the entities involved.

BUSINESS

Is there a case for RBI to cut policy rate on Wednesday?

The fifth monetary policy for the financial year 2017-18 is likely to be a non-event as most experts predict a status quo.

BUSINESS

Recap plan to help banks absorb losses on NPAs. But will it reform banking?

The recapitalisation plan means banks now have more cash in their pockets in order to provide for more loans.

BUSINESS

Recap plan a chance to put all policy pieces of jigsaw puzzle in place: Urjit Patel

Urjit Patel calls it a “real chance” to put in place comprehensive and coherent, rather than piece-meal, strategy to address the banking sector challenges

BUSINESS

HDFC Bank adds 2,700 employees in Q2; opens only 14 branches from Apr-Sep

This brought the total employee base to 86,450 at the end of September.

BUSINESS

Govt may push RBI to ease provisioning norms for insolvency accounts

With banks burdened with a spike in bad loans and shortage of capital availability, the government may push the RBI to help them in meeting capital requirements.

BUSINESS

RBI clarifies that linking Aadhaar to bank accounts is mandatory

The RBI clarified that everyone who is eligible to enroll for Aadhaar will have to submit it to banks under the Prevention of Money Laundering Act.

BUSINESS

Bankers look to grow SME loans as sector becomes more formalised under GST

GST will formalise the unorganised micro, small and medium sector enterprises (MSME), helping banks to get data on the borrowers' cash flows and repayments thereby easing fund access to the segment.

BUSINESS

Piramal to raise Rs 7000 cr through QIP and rights issue to grow financial service businesses

The drugs-to-financial services conglomerate's Board announced it would raise Rs 4,996.2 crore through qualified institutional placement (QIP) and Rs 2,000 crore via rights issue.

BUSINESS

Axis Bank reports NPA divergences of Rs 5633 cr, reveals exposure to 20 insolvency a/cs

The third largest private sector lender reported a 35.5 percent rise in net profit backed by lower provisions towards the bad loans, fee income growth and stable loan growth

BUSINESS

Banking sector wrap: Banks kickstart results season amid insolvency struggles

In an attempt to promote interoperability in the usage of prepaid payment instruments (PPIs), the RBI directed all financial companies to make KYC-compliant PPIs interoperable within the next six months

BUSINESS

Lakshmi Vilas Bank looks at building retail base; lending is still slow: CEO

The old private sector lender, which reported a deterioration in its asset quality in the second quarter, will look at pulling itself up in the next two years as it aims to raise Rs 800 crore this year.

BUSINESS

IndusInd aims to grow microloan book to 6% with Bharat Fin merger; deal likely on Saturday

The Bank’s board members will meet on Saturday, October 14, and most likely announce the merger deal with Bharat Financial

BUSINESS

Banks a stressed lot as promoters of bad a/cs play hardball, buyers bargain

Banks are struggling to make headway in the insolvency proceedings amid non-cooperation from some promoters, even as they try to find buyers for the assets at the right value.

BUSINESS

You can now use cheque books of SBI's former associate banks till December 31

Customers can apply for the new SBI cheque books at their home branches, all SBI ATMs or through Internet banking and Mobile Banking.

BUSINESS

Banks set to report grim September quarter financial results

Banks are set to report a troubled second quarter from July to September given the slow loan growth, insolvency accounts facing weak asset quality and higher provisioning.

BUSINESS

Price rise may be on cards for Mahindra & Mahindra as input prices firm up

Given the robust growth and increase in input prices, there could be a surge in prices for the cars to that extent going forward, according to Mahindra & Mahindra's Group Chief Financial Officer V S Parthasarathy.

BUSINESS

SBI gets new Chairman, RBI keeps rates unchanged

The Reserve Bank also initiated a few other measures to improve policy interest rate transmission, on banking regulation and supervision and measures to improve financial and securities markets

BUSINESS

Credit growth in SBI is an unfinished agenda: Arundhati Bhattacharya

A day before, Rajnish Kumar, Bhattacharya's successor, told the media that reviving credit growth and resolution of stressed assets will be his top priority.

BUSINESS

Arundhati Bhattacharya leaves behind a rich legacy at SBI

Arundhati Bhattacharya leaves behind a rich legacy at the State Bank of India. As her four-year term comes to an end today, it is worth while to take stock of what she has achieved.

BUSINESS

RBI group suggests linking lending rates to 3 external benchmarks by April 2018

RBI's internal group report on lending rates has suggested that pricing should be linked to external benchmark rates in a time-bound manner to improve transmission of policy rates

BUSINESS

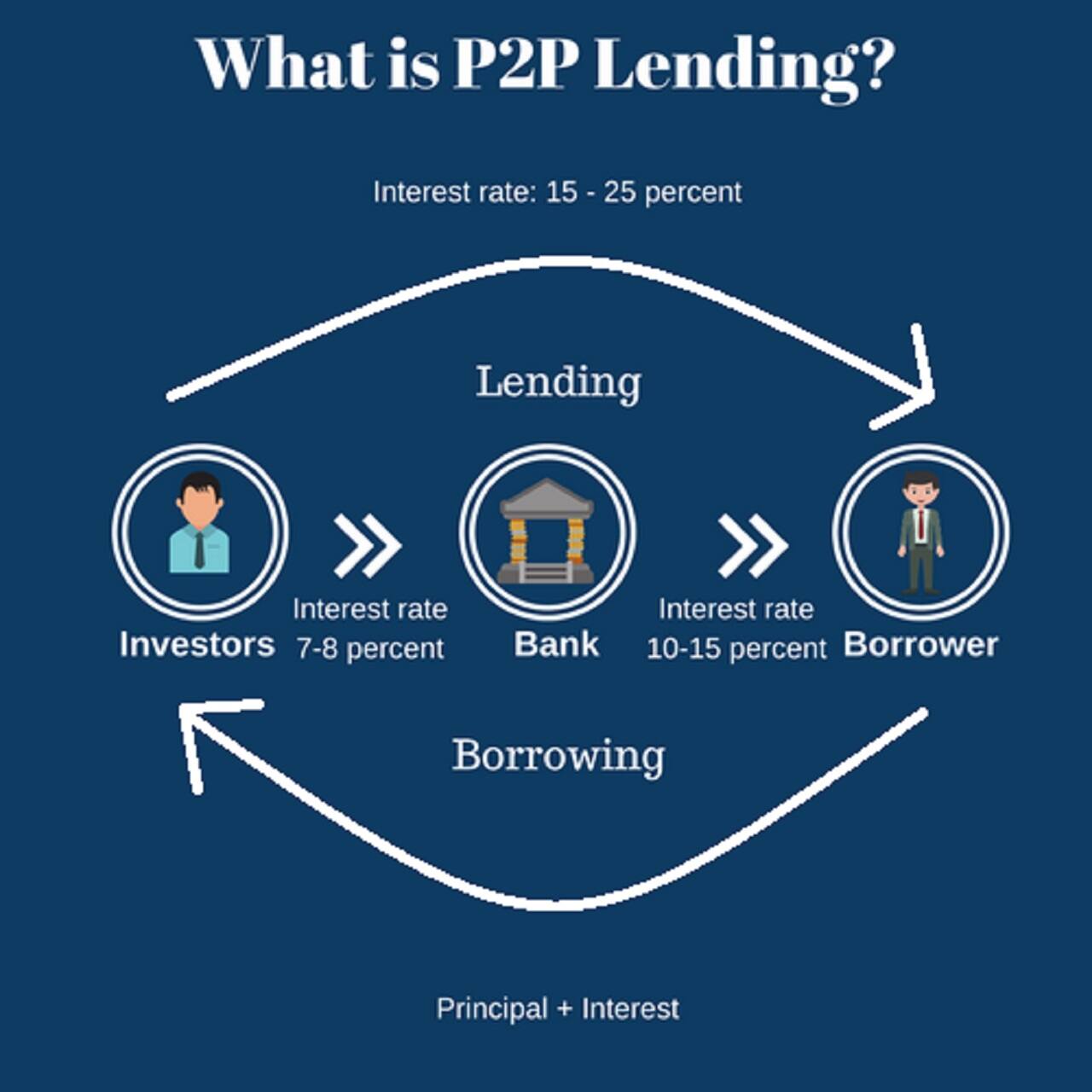

RBI releases guidelines for P2P lenders; caps loans exposure at Rs 10 lakh per borrower

The aggregate exposure of a lender to all borrowers at any point of time, across all P2Ps, shall be capped at Rs 10 lakh and aggregate loans taken by a borrower at any point of time at Rs 10 lakh

BUSINESS

Ahead of RBI policy, SBI cuts 1 year FD rates to 6.50%, base rate to 8.95%

Currently, SBI, HDFC and ICICI Bank are offering home loans starting from 8.35 percent for women borrowers and 8.40 percent for the rest