BUSINESS

Bharat Dynamics: Is the defence stock appealing enough after impressive rally?

With a strong focus on innovation and quality, BDL is a key player in India's defence capabilities

BUSINESS

Indian textile industry: Recovery and growth patterns visible

Rebound in textile exports on the back of lower cotton prices, decline in inventory levels, and government boost

EARNINGS

Shivalik Bimetal: Bright outlook in spite of recent softness

While short-term headwinds in the international market persist, focus on high-profile clients, major expansion plans, and capacity build-up will support growth.

BUSINESS

Discovery series | TBO TEK: Riding the global outbound travel theme

An opportunity to capture highly fragmented offline channel of travel booking.

BUSINESS

Should investors milk the profit in Heritage Foods now?

The dairy company’s growth trajectory is promising, but the stock valuation is pricey

BUSINESS

Le Travenues Technology (Ixigo) IPO: Will it be a rewarding affair for you?

Riding the wave of a booming travel industry, this IPO could turn out to be a good proxy play on tourism and hospitality. Valuation, however, leaves little room for comfort.

BUSINESS

Shaily Engineering puts up a strong Q4 show

New business confirmations from existing clients, along with addition of marquee clients across diversified industries, augur well for the company

BUSINESS

IRCON International Q4: Order intake falling, valuation stretched

While the opportunity remains immense, lower order inflow a key concern in the near term

BUSINESS

V-Guard Q4: Robust performance across categories

VIL’s growth trajectory looks promising on the back of its financial track record, geographical diversification strategy, and competitive market positioning

TRENDS

Sirca Paints Q4: Outlook strong for this paint company

Expanding product portfolio and adding distribution network

BUSINESS

AWFIS Space Solutions IPO: Should you subscribe to this workspace solutions provider?

The company seeks to raise funds for expansion and technological enhancements to win India’s booming co-working space market

BUSINESS

Amber Enterprises Q4 FY24: Soft quarter, long-term outlook strong

The contract manufacturer continues to focus on diversifying revenue mix

BUSINESS

Crompton Consumer Q4: Right levers in place for future growth

Focus on the premium product portfolio during summer and a revival in the lighting business will be key growth drivers

BUSINESS

Berger Paints Q4: why we see limited upside

Current valuation and potential competition take shine off the stock

BUSINESS

Dixon Technologies: Aggressively tapping favourable market conditions

The company has a long growth runway owing to massive opportunities in the industry, but the stock is expensive

BUSINESS

Voltas Q4: Strong off-take in RAC, but margins remain under stress

Though the company continues to maintain its market leadership in RAC, the sluggish performance in the EMPS business drags the bottom line

BUSINESS

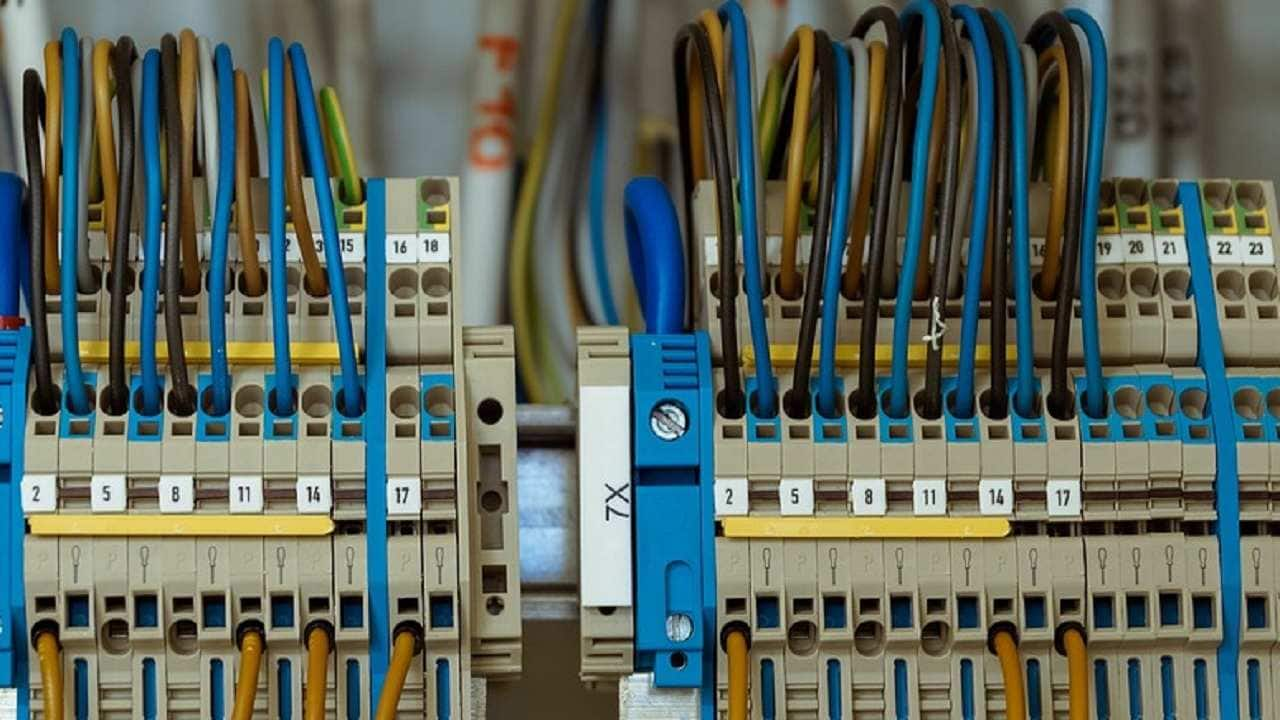

Polycab India Q4: Asserting dominance over competitors

Favourable demand momentum from infrastructure and power sectors supporting the strong performance of wires & cables

BUSINESS

Asian Paints Q4 FY24: Dull show despite strong volume growth

Though Asian Paints is a quality business, the competitive intensity in the sector is likely to jump manifold in the medium term

BUSINESS

Pidilite Q4: Encouraging volume trends

Operating margins improve, but PAT declines

BUSINESS

TBO TEK IPO: Should you go with this proxy for travel and hospitality?

Riding the wave of a booming travel industry and having a unique business model, this IPO stands out as a compelling choice for subscription

BUSINESS

Blue Star: Q4 results soothe investors amid harsh summer

Revenues jump, operating margins expand but PAT dips

BUSINESS

Havells India: Q4 tops Street expectations

Revenues and EBITDA both showed improvement on the back of a rebound in the ECD business

BUSINESS

Discovery Series | Shaily Engineering: Moving towards higher-margin business model

Well positioned for Make-in-India initiatives and consumer shift towards India-made products

BUSINESS

Discovery Series | Cello World: Enter the high-growth world

The company is poised to benefit from rising consumer incomes, surge in nuclear families, and the shift from the unorganised to organised markets