BUSINESS

ITR filing 2024: How tax harvesting can slash the tax payable, boost returns

In tax harvesting, long-term capital losses can only be set-off against long-term capital gains, while short-term capital losses can be set-off against either short-term or long-term capital gains.

BUSINESS

SEBI’s proposal on new risky asset class for mutual funds: Blessing or a curse?

The product category with a minimum ticket size of Rs 10 lakh will curb the proliferation of unauthorised investment products and creates a structure for differentiated and higher risk strategies. At the same time, it will allow derivatives to be used for other than hedging.

BUSINESS

We look to invest in companies that may become part of the index in 2030: Kenneth Andrade

Andrade, Chief Investment Officer, Old Bridge Mutual Fund says he will stay away from industries where business is fragmenting significantly and the economics are fairly weak. For him, it is about bottoms-up stock picking and having a macro viewpoint of how that industry and the competitive profile is changing.

BUSINESS

How AMFI suggestions for Union Budget can help mutual fund investors

Budget 2024-25: AMFI has suggested that the LTCG on listed equity shares or units of equity-oriented fund schemes, held for more than one year and up to three years be subject to LTCG tax at the rate of 10 percent on capital gains exceeding Rs 2 lakh in a financial year

BUSINESS

Edelweiss MF launches business cycle fund based on factor investing. Will it work?

Edelweiss Business Cycle Fund is different because it will follow factor based investing where it will pick stocks based on the highest momentum, value, quality and growth, primarily focusing on large and mid-cap stocks.

BUSINESS

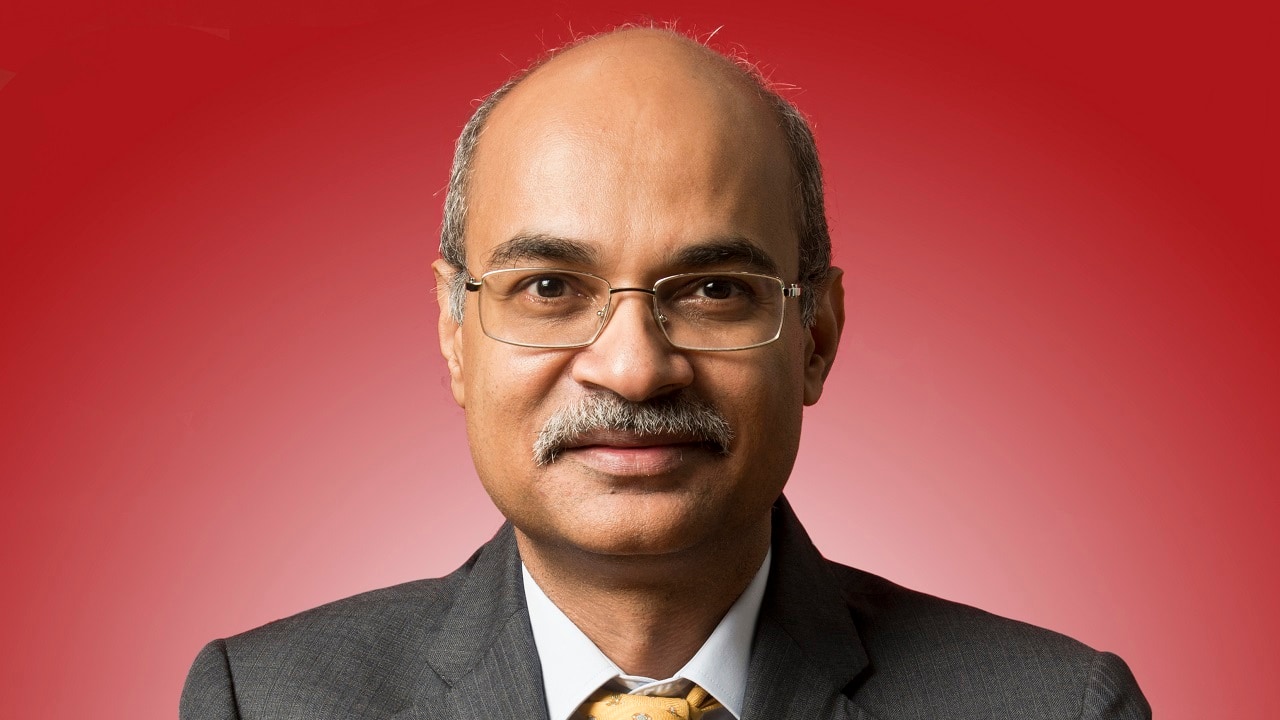

Sold shares, mutual funds or property? Here's how to make accurate disclosures in ITR | Simply Save

What are capital assets and how are taxes levied on gains from such assets? Which income tax return (ITR) form to select when filing for capital gains? Naveen Wadhwa, Vice President-Research and Advisory Division at Taxmann answered all these questions and also talked about key things to keep in mind while filing for capital gains in ITR.

BUSINESS

Equity fund inflows rise by 17% to Rs 40,608 crore in June, a fresh high: AMFI data

The investment via systematic investment plans rose to Rs 21,262 crore in June against Rs 20,904 crore in May. Monthly investments via SIPs had topped the Rs 20,000-crore landmark for the first time ever in April 2024.

BUSINESS

Tata Mutual Fund launches India’s first tourism thematic fund; should you invest?

Consider investing in a sectoral/thematic fund only if you hold a positive outlook on that sector or have reliable access to quality advice. For thematic funds, achieving profitability requires precise timing for both entry and exit.

BUSINESS

Motilal Oswal MF’s Defence Index Fund garners Rs 1,676 crore in NFO; highest ever for equity index fund

The open-ended fund tracking the total returns of the Nifty India Defence Index saw participation by 2,48,000 unique investors from across 16,900 pin codes in India.

BUSINESS

Budget 2024-25: Crypto firms call for tax reductions, regulatory clarity

Industry experts believe that the introduction of the crypto tax was a positive step that showcased India’s willingness to adopt a progressive approach, but now is time for the government to treat the crypto sector on a par with other industries.

BUSINESS

Sensex tops 80,000 level for the first time, what should be MF investors strategy?

Remember that Sensex milestones are a journey and not a destination. Long term investors who have well-diversified portfolios and have their long-term monthly investments through SIP, should continue to stay invested.

BUSINESS

Should you invest in ICICI Prudential Energy Opportunities Fund? A Moneycontrol review

While the Nifty Energy Index has beaten the S&P BSE 500 TRI over the past five years, it underperformed the broader markets in the previous five years. A thematic fund is suitable for tactical allocation by experienced investors who are aware of the higher risks involved.

BUSINESS

SEBI issues consultation paper on ‘Mutual Funds Lite Regulations’ for passive schemes

SEBI has also proposed lower requirements in terms of net worth and net profit for sponsors and asset management companies (AMCs).

BUSINESS

Budget 2024: Will government offer capital gains tax relief to investors?

Rationalising and standardising the capital gains regime by streamlining the holding period and uniformity in long and short-term tax rates across asset classes would be good for investors, says experts

BUSINESS

Explained: How will JPMorgan’s inclusion of India bonds impact debt mutual funds?

Those into debt mutual funds are advised to invest in long-term government securities as the inclusion is expected to bring in flows. This would lead to a rise in prices that translates into a drop in yields

BUSINESS

Why Zerodha Fund House is looking at solution-oriented funds

In an interview with Moneycontrol, CEO Vishal Jain talked about the schemes launched by the fund house, the schemes that it plans to launch, and why passive schemes are more suitable for mutual fund penetration in India

BUSINESS

MC Explains | Groww case: What are the key learnings for investors?

While a repeat of the Groww case is unlikely, with the regulators filling in the gaps with regards to the payment trails and the realisation of the NAV units in the client’s account, the role of investors doesn’t stop once they have invested the money.

BUSINESS

Front-running case: Is Quant Small Cap Fund liquid enough?

While there are fears that there might be some redemption pressure on Quant Small Cap Fund, which has assets of Rs 21,243 crore, the scheme looks comfortable on the liquidity parameters.

BUSINESS

Can Mirae Asset MF’s electric vehicle ETF supercharge your portfolio? A Moneycontrol review

Mirae Asset Nifty EV and New Age Automotive ETF is India’s first fund focused on the electric vehicle theme. While the outlook for the segment is bullish, the performance of theme globally has been lukewarm in the past two years. Consider investing only if you have a positive outlook on the theme and access to quality advice.

BUSINESS

Smallcase sets sights on profits, doubling growth in FY25

Smallcase has seen the amount transacted on the platform grow 2.5X to Rs 80,000 crore in FY24. Its client base stood at over one crore at the end of March 2024.

BUSINESS

MC Explains | Quant MF under scrutiny: What is front-running and how does it hurt investors?

Front-running is an illegal practice where intermediaries such as dealers or brokers exploit their position for profit. The practice undermines market fairness, harming the interests of the mutual fund house and its investors.

BUSINESS

Special Situations mutual funds: Identifying hidden investment opportunities | Simply Save

Three special situations funds have been launched by the Indian mutual funds industry over the last two months. ICICI Prudential Mutual Fund’s Principal-Investment Strategy, Chintan Haria spoke with Moneycontrol about the strategy that such schemes follow.

BUSINESS

Moneycontrol review | ABSL Quant Fund, which will bet on top picks of the mutual fund industry

Quant funds such as Aditya Birla Sun Life Quant Fund represent a modern approach to investing, leveraging the power of technology and data analysis to drive investment decisions. While they offer many potential benefits, they also come with risks and complexities that investors need to understand.

BUSINESS

Allocate at least 70% to large-caps now, keep small-caps in single digits: Mirae Asset MF's Harshad Borawake

Harshad Borawake, Head of Research & Fund Manager, Mirae Asset Investment Managers (India), talks about how he reacted after the June 4 crash, how investors should position their portfolios, and the biggest risks Indian markets face.