Sachin Pal

Moneycontrol Research

Highlights:

- Q3 volumes came in higher by 11 percent

- Consumer & Bazaar products drove overall volume growth

- Decline in VAM prices and price hikes should ease cost pressures- Valuations rich at 50 times FY20 estimated earnings

-------------------------------------------------

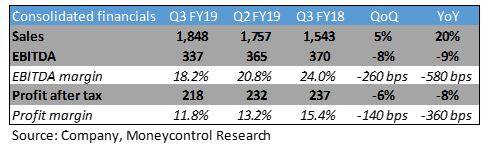

Pidilite Industries, popularly known for its brand Fevicol, reported a mixed set of earnings in Q3 FY19. The company delivered another quarter of double-digit volume growth which resulted in a robust topline growth. Profits, however, declined on account of contraction in gross margins and a slight increase in interest costs.

Key positives

- The growth in topline was largely driven by an 11 percent increase in overall business volumes. This was primarily added by 13 percent volume jump in the Consumer & Bazaar products segment, offset by 2 percent volume contraction in industrial business. Double digit jump in volumes was particularly strong as the company had 23 percent volume growth in the corresponding quarter last year.

- Overall, the demand environment seems to be on an uptrend as the company has delivered sixth successive quarter of strong volume growth and has gained some market from both organised and unorganised segment in some of its product categories.

- The volume uptick in the past few quarters suggests that the company has been a key beneficiary of GST as the sector has seen a minor shift from unorganised to organised trade.

Key Negatives

- Domestic industrial business reported a volume decline of 2 percent amidst increase competitive intensity and subdued demand environment from textile and leather industries.

- The prices of Vinyl acetate monomer (VAM), the key raw material for Pidilite, had seen a sharp increase from USD 800 to USD 1,200-1,250 over the course of last year. The increased in input costs has resulted in a gross margin contraction of more than 600 bps year-on-year and 200 bps quarter-on-quarter. However, the VAM prices have seen a reversal in recent months and are currently hovering around USD 1000. This along with the recent prices hikes (1-2 percent across some categories) should lend support to margins going forward.

Outlook and Recommendation

- Pidilite trades at rich valuations on account of numero-uno position in the adhesive market on the back of strong brand presence (Fevicol, Dr Fixit, Fevikwik, M-Seal). While the broader market continues to remain volatile, the stock has outperformed the index and is trading near lifetime highs with gains of more than 25 percent in the last 12 months. In terms of valuation, it is now valued at around 50 times FY20 earnings.

- While the superior business execution has resulted in a strong double digit topline growth on a consistent basis, the current valuations factor in leave little room for upside. We, therefore, maintain a cautious view on the stock at these levels as we anticipate a pick-up in competitive intensity from large players such as Asian Paints, Astral Polytechnik and Kansai Nerolac.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!