Madhuchanda DeyMoneycontrol Research

Every time you buy something, you check the label, a small but important part of every package. Manufacturing labels is going to be an important business in India as the organised sector in India gets a boost from GST (Goods & Services Tax). There will be many more products that will mandatorily require a label and this spells good news for the coding and marking industry. A prominent homegrown player in the industry is Control Print. With its attractive financials and return ratios, this company beckons our attention.

Background

Control Print has been in existence for the last 26 years and has technology collaboration with KBA-Metronic GmbH, Germany and Macsa ID, S.A, Spain. The company’s state-of-the-art manufacturing facilities are located in Nalagarh, Himachal Pradesh and Guwahati, Assam.

The product portfolio includes Continuous Inkjet Printer (CIJ), Large Character Drop on Demand Printer (LCP), Thermal Ink Coders, Thermal Transfer Over Printer (TTO), Laser Coders, Thermal Inkjet Printer, High Resolution Piezo Inkjet Printer and related consumables (ink/ fluids) and spare parts. Control Print caters to a variety of manufacturing industries including personal care, food & beverages, pharmaceuticals, construction materials, cables, wires & pipes, metals, automotive & electronics, agrochemicals, chemicals & petrochemicals and many more.

What are the unique moats?

Regulatory Requirement: The coding and marking industry primarily consists of printers coders/markers along with consumables that are required to print essential product details like manufacturing date, expiry date, batch number, maximum retail price, manufacturing location, etc. on any manufacturing product. It is used across sectors.

Demand factors that will drive the usage of printers and associated consumables are: legal requirements (providing product information to customers), inventory control, traceability (tracking products by date of manufacture, batch numbers), branding (printing of logos, customer perception) and counterfeit prevention. Therefore, with growing consumer awareness, consumers’ shift towards branded products, higher disposable per capita income coupled with greater application of coder and markets, the domestic industry is on a strong footing.

Growth linked to GDP: The global coding industry is estimated at USD 4.5 billion and is expected to grow at a rate of 4-5 percent over next 5 years. In developed markets it is growing at 1-1.5x GDP growth and in developing markets at 2-2.5x GDP growth.

Oligopolistic market: The company has successfully transformed itself from a distributor of printers and consumables to an indigenous manufacturer. The Indian coding industry is estimated at Rs 900 to Rs 1000 crore as of FY16. The industry is dominated value-wise by 4 players and Control Print is a prominent player. The sector has witnessed consistent growth of 15 percent+ over the last decade and is estimated to grow at similar rates of approximately 10-15 percent revenue growth in the near future as well.

The main players are Videojet, Domino Printech, Markem-Imaje and Control Print. Domino is strong in the food & beverages segment while Markem-Imaje is strong in the pharmaceuticals sector. Control Print, on the other hand, is strong in the industrial and packaging segment commanding a domestic market share of ~18 percent.

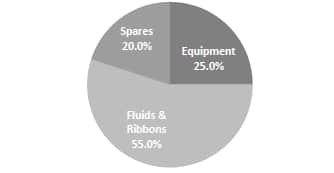

Increasing share of consumables: With increasing sales of spares and consumables, players can look forward to sustaining a very decent margin.

Control Print is working on localising production of certain inks to improve margins. It has launched RFID-enabled printers to restrict usages of consumables supplied by unorganised players. Currently, ~25 percent of its printers run on spurious consumables, which is expected to come down as old printers are replaced by RFID-enabled ones.

The company has recently commissioned a new manufacturing facility in Guwahati (capex of Rs 25 crore). This facility is initially being ramped up for manufacturing consumables, which is a high margin business.

Stickiness of clients: The average cost of a coder/marker/printer is ~ Rs 1.5 lakh per machine. However, the average consumables supply required by the printer is ~ Rs 1.0 lakh/year or Rs 10 lakh over the life of printer (eight to 10 years). Thus, any shift of existing customer towards competitors for purchase of consumables is an investment risk. However, the migration trend is not more than ~10 percent.

Entry barrier: Customers are inelastic towards having a second supplier for service. Nearly over 70 percent sales are from repeat customers for all major players. Any player needs to stock comprehensive range of spares & printers irrespective of individual sales and would require gestation period of 5 to 7 years to build a pan India brand. The sustained growth in the after-market coming from large installed base of printers gives the incumbents a competitive edge.

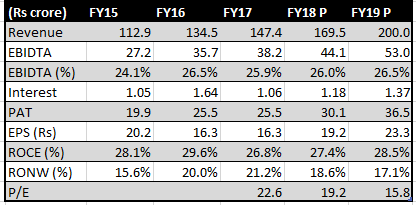

Healthy financials: Control Print boasts of a lean balance sheet and very strong return ratios. However, it has an extremely stretched (close to 193 days in FY17) working capital cycle. The working cycle is elongated vis-à-vis its competitors (unlisted players) as they mainly import machines and necessary spare parts from foreign countries into India and does that on a need-to-use basis. Control Print, on the other hand, maintains a whole lot of inventory of spare parts of printers and finished goods so as to provide timely delivery of the same to its customers.

The company witnessed 17 percent CAGR (compounded annual growth rate) in topline and 23 percent growth in profit in the past three years. Given the multiple emerging tailwinds, we expect 16 percent CAGR in revenue and 20 percent in profitability in the coming two years.

Future growth drivers: Control Print is launching new products of TIJ Printer and High Resolution Piezo Inkjet Printer. It is leveraging its Indian experience to tap new markets and has successfully entered Nepal and Bangladesh and actively developing a strategy to focus on Burma, Pakistan and African markets.

Valuation: While there is no listed competitor for the company, if we look at the other listed players in the packaging space, the quality of earnings of Control Print justifies the premium valuation.

Given the industry dynamics and track record of execution, the stock at 15.8X FY19 estimated earnings looks interesting for the long-term investors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!