Highlights - Plant shutdowns and client end inventory destocking impacted top line - Negative operational leverage hit operating margin - The plants back at work; client destocking to stabilise in a couple of quarters - Mega capex plan to offer earnings visibility in the medium term

It turned out to be disastrous September quarter for Hikal Ltd (market cap: Rs 1,381 crore), the up-and-coming pharma and crop protection chemical company, as many operational challenges popped up.

A planned shutdown for its Bengaluru plant was factored in while shutdowns in Mahad and Taloja plants proved to be Black Swan events. Inventory destocking from clients of both the divisions too was not anticipated.

Other than the patchy results, the Street was disappointed by the delay in informing exchanges some of the aforesaid events. Having said that, the comforting part is most of the events had a temporary impact. All the plants have resumed normal operations and inventory destocking is expected to stabilise in the next two quarters.

Among the positives, the US FDA audit was largely successful except for a minor observation for the Bengaluru plant, which has been addressed.

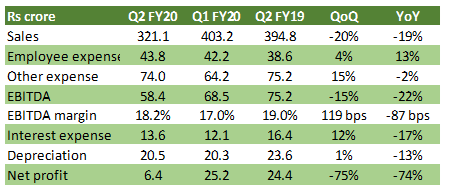

Table: Q2 financials

In Q2 FY20, revenues slumped by 19 percent year-on-year (YoY), hurt by 21.6 percent de-growth in crop protection business (41 percent of FY19 sales) and 17 percent decline in pharma (59 percent).

Crop protection was pressured by multiple headwinds. A few of the customers chose to defer volume offtake due to inventory destocking. Second, flooding had resulted in temporary plant shutdown at Mahad. Third, the Taloja plant was impacted by the reduced supply of water. Pursuant to an NGT (National Green Tribunal) order, water supply was cut by 50 per cent, which impacted the whole of Taloja MIDC industrial area.

Pharma business was also affected by the elevated inventory at the customer’s end. There was a planned shutdown at the Bengaluru facility to take care of the debottlenecking initiative to raise capacity.

Though gross margin improved, earnings before interest, tax, depreciation and amortisation (EBITDA) took a hit from an adverse operating leverage.

Net profit was further impacted by exceptional item of Rs 15.4 crore as Customs duty payment. This duty relates to past imports of raw material at the export-oriented unit, post GST.

Key positiveThe management has updated that, in the quarter gone by, the US FDA audited Bengaluru and Panoli facilities. As for the Panoli unit, there was zero 483 observation and for the Bengaluru one, there was a minor one 483 observation, which has already been taken care of.

Key observationsCapex plan: The company is investing in a capex programme of Rs 300 crore, of which Rs 100 crore have been invested till September 2019 with the rest expected in the next 18-20 months. Capex allocation is equally split between pharma and crop protection business. The management expects an asset turnover of 1.5x and looks to achieve a full ramp-up after two years of commissioning. The firm already has all the environment clearances for its expansion projects.

With the project debt to equity ratio of 0.5x and expected EBITDA margin in high teens, financial metrics are moderately better than the existing business. The current leverage ratio (debt/equity ratio: 0.8x) is a bit elevated, though not alarming. Of this capex, the company has allocated a certain amount for environment compliance and is investing in a zero discharge facility.

Hikal has identified a few molecules for the proprietary production in the crop protection business, . Currently, these molecules are imported with global demand. Validation quantities have already been supplied to customers and a scale-up is expected in the next few quarters. In this case, the company is looking at implementing a fully backward integrated manufacturing process to shield it from any China supply concerns.

In the pharma space, Hikal is targeting generic APIs and new products for expansion. For 2019, 2-3 intermediates and API products have been identified for commercialisation.

Backward integration: Because of the China factor, Hikal expects the shortages and pricing pressures for APIs to continue in the near term. However, it’s making efforts to offset the adverse impact by operational improvement and developing alternative raw material sources. It has developed alternative raw material sources for two of its major products - anti-convulsant drug and anti-cholesterol.

Risk factors: Concentration risk of products needs a close watch. Both pharma and crop protection segments have a product each, with high share of revenue in the range of 15-40 per cent.

OutlookHikal faced myriad challenges in the quarter gone by. The good news is the issues have blown over. In the case of crop protection business, the Mahad facility is already operational. The Taloja unit is back on track as MIDC (Maharashtra Industrial Development Corporation) has restored 100 percent supply of water post Supreme Court’s October ruling. Destocking at the client’s end is expected to stabilise in Q3 and orders are expected to pick up from Q4.

The Bengaluru pharma plant is back in operation after a planned shutdown. The destocking exercise at the client’s end is expected to normalise in a couple of quarters. Its new capacity in Bengaluru this quarter is seen as aiding top line growth this year.

Taken together, the company expects 5-10 percent sales growth in the current fiscal and guides for a double-digit growth in FY21. In the medium term, the capex plan offers a visibility of additional revenue of Rs 450 crore on full utilisation. This would imply a nearly 30 percent top line addition on a base FY19 sales.

Going forward, we expect operating margin to improve to 18-19 percent, benefiting from contribution from high-margin new products.

There has been a sharp correction in the stock price on account of weak results and lack of timely disclosure to the exchanges. Hikal appears to be on the mend. While the Street is quick to appreciate any improvement in operations, it generally discounts instances of corporate governance depending on the case.

Hence, we don’t see a case of multiple rerating. Though Hikal is trading at an interesting level (5.4x EV/EBITDA FY21, 11x FY21 earnings), we believe that the stock price would be a function of earnings improvement in the near term..

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.