Big returns in small packets! Well, this is true for stocks especially in the small and midcap space which have seen re-rating by the market. Midcaps now trade at a 45 percent premium to the Nifty in terms of P/E.

The small and midcaps have been outperforming benchmark indices throughout this week. The S&P BSE Midcap index rose to a fresh record high of 17,093 while the S&P BSE Smallcap index rallied to a record of 18,273 on Tuesday.

The broader market saw buying interest on a day when both Nifty and Sensex closed in the red. The trend is unlikely to get challenged anytime soon as experts feel that there is a lot of money waiting on sidelines especially for stocks which can deliver growth.

Life Insurance Corporation of India (LIC), the country’s largest institutional investor, has significant exposure in the small and midcap space.

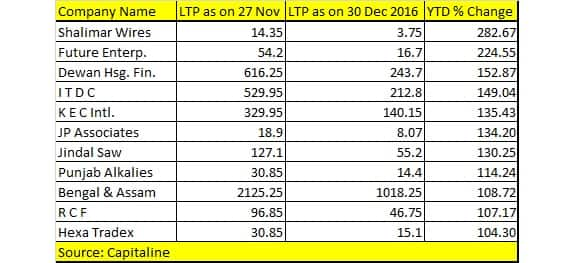

Out of 108 stocks in its portfolio, top 11 stocks based on return given belong to the mid and smallcap space. These stocks have more than doubled investors’ wealth so far in the year 2017.

Stocks which saw a gain of 100-280 percent rally in the current calendar year include names like Hexa Tradex, RCF, Bengal & Assam Company, Punjab Alkalies, Jindal Saw, JP Associates, KEC International, ITDC, Dewan Housing Finance, Future Enterprises, and Shalimar Wires.

According to a recent media report, Life Insurance Corp. of India (LIC), booked a trading profit of at least Rs13,500 crore from the sale of equity holdings in the first half of the current financial year, as stocks scaled record highs.

The figure marked a 23.8% increase over the Rs10,900 crore in trading profit that LIC earned in April-September 2016 through investment redemptions, the media report said which was released earlier this week.

As many as 33 stocks got added to LIC’s portfolio for the quarter ended September when compared with June quarter which include names like Adani Ports, Assam Company, Bank of Baroda, Bharati Defence, Canara Bank, Coal India, JBF Industries, Power Grid, Tata Elxsi, Wockhardt, India Cements etc. among others, according to Capitaline data.

The largest institutional investor pulled out money from as many as 21 companies which include names like Aban Offshore, BSE, Dredging Corp, Gokak Textiles, Oriental Bank of Commerce, Infosys, Oriental Bank of Commerce, Rathi Steel, Tata Motors etc. among others.

What should investors do?The small and midcaps stocks are known to deliver impressive growth when compared to largecap peers especially in a low growth rate environment.

“With high liquidity and investors looking for ‘value’ outside the large cap space, small & midcap stocks have seen significant appreciation. While the Nifty trade at 26x trailing PE, the small and midcap index is trading at historic highs of over 50x trailing PE,” Saurabh S Jain, MD, SSJ Finance & Securities told Moneycontrol.

“Obviously the valuations thereby leave significant room for disappointment on the earnings growth and ROE fronts in comparison to what valuations are implying. There is a need for a constant reality check in terms of earnings growth potential in stocks which have given astronomical returns in the short run,” he said.

Over the last 12 months, midcaps have delivered 23 percent returns, as against 20 percent by the Nifty. In the last five years, midcaps have outperformed the Nifty by 68 percent, Motilal Oswal said in a report.

“We do not recommend booking profits across the board. Strategy differs from stock to stock. Overall there has been a rerating of the small cap and mid cap space and now the valuation gap has disappeared,” Devarsh Vakil, Head – Advisory (Private Client Group), HDFC Securities told Moneycontrol.

“So, tactically one should reduce exposure to small and midcaps and keep 20% of the money earmarked for these stocks into cash,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!