Madhuchanda Dey

Moneycontrol Research

How sweet is the buyback candy for small shareholders of Infosys?

In the midst of the boardroom battle at Infosys, small shareholders in the company have something to cheer. The buyback price of Rs 1150 per share is at a significant premium to the market price. But more importantly the SEBI rule mandating 15 percent reservation for investors holding up to Rs 2 lakh worth of shares, makes it an attractive deal for small shareholders.

Talk now is that co-founder Nandan Nilekani may return to lead the company though it is not clear in what role. That could be an added bonus for retail investors' stand should Infosys shares rally on news of a possible truce between the board and the founders?

The buyback dynamics

Let us understand the buyback dynamics first. Infosys plans to buy back 11.3 core shares at Rs 1150 apiece. The allocation for small shareholders works out to 1.7 crore shares.

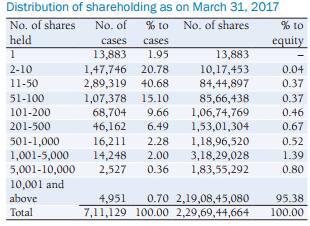

There are broadly two variables in this exercise. First and foremost, what quantity of holding will qualify as small shareholders and then how many such small shareholders will Infosys have on the record date.

As per our understanding, to qualify as a small shareholder, the value of holding shouldn’t exceed Rs 2 lakhs on record date. So this can vary from 200 shares to 222 shares depending on where the stock price is on the record date. If the events in the coming weeks turn out to be positive, the stock might have an upward bias.

The other key variable is the number of small shareholders of the company on record date. As per the annual report of Infosys, the number of shareholders owning up to 200 shares in the company is close to 2.87 crore. However, depending on the price, this number can go up (for instance, if the price is Rs 900 then a quantity of 222 might qualify). In addition, because of the possible gains from the offer, there might be additional buying that could add to the number of small shareholders.

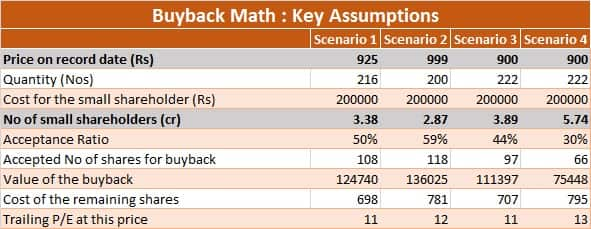

So what are the possible scenarios and how can the return vary? In Scenario I we have assumed the acquisition price to be Rs 925. Considering that the cut-off quantity is at 216, it makes some of the shareholders in the 201-500 category eligible. We have added 1/3rd of those shares. Hence, the acceptance ratio works out to 50 percent and break-even price of this trade at Rs 698.

In Scenario I we have assumed the acquisition price to be Rs 925. Considering that the cut-off quantity is at 216, it makes some of the shareholders in the 201-500 category eligible. We have added 1/3rd of those shares. Hence, the acceptance ratio works out to 50 percent and break-even price of this trade at Rs 698.

Scenario 2 is one where should the share rally, fewer investors will qualify as small shareholders. Consequently, the acceptance ratio goes up to 59 percent, but the break-even also rises to Rs 781.

In Scenario 3 and 4 we expect the price to hover around the current level. However, in scenario 3 we expect some incremental buying by new small shareholders, but in scenario 4 we expect major buying to pocket this gain. Accordingly, the number of small shareholders is significantly high in Scenario 4. Consequently, the acceptance ratio falls to 44 percent and 30 percent. The break-even prices under these two scenarios are, therefore, vastly different (Rs 707 and Rs 795, respectively).

The valuation support?

For small shareholders the break-even price assumes importance as post the buyback, under normal circumstances, the stock might drift down. But as the exhibit suggests, that the valuation of Infosys at these break-even levels is quite attractive and these prices are far lower than the 52-week low price.

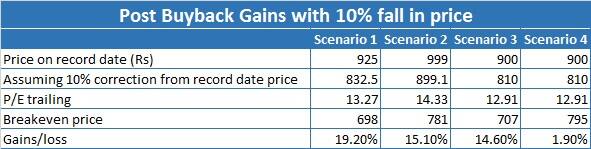

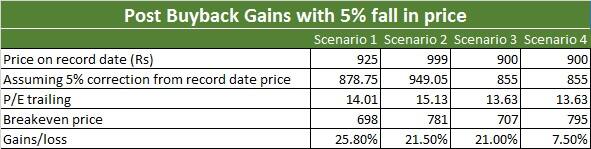

Do the gains evaporate should there be a decline in prices?

As our analysis suggests, should prices fall by 5 percent or even 10 percent the gains do not vanish and the likelihood of such a steep decline is limited thanks to the valuation support that the stock should get at those levels.

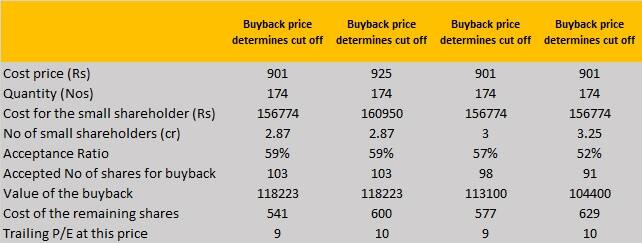

What if the definition of small shareholders is ownership of 174 shares (as determined by the buyback price)?

What if the definition of small shareholders is ownership of 174 shares (as determined by the buyback price)?

In this case, small shareholders have enough reasons to cheer. As the exhibit shows, with a lower acquisition cost and higher acceptance ratio, the breakeven level falls drastically. Even a 10 percent decline in prices, should still result in handsome gains for the small shareholders.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!