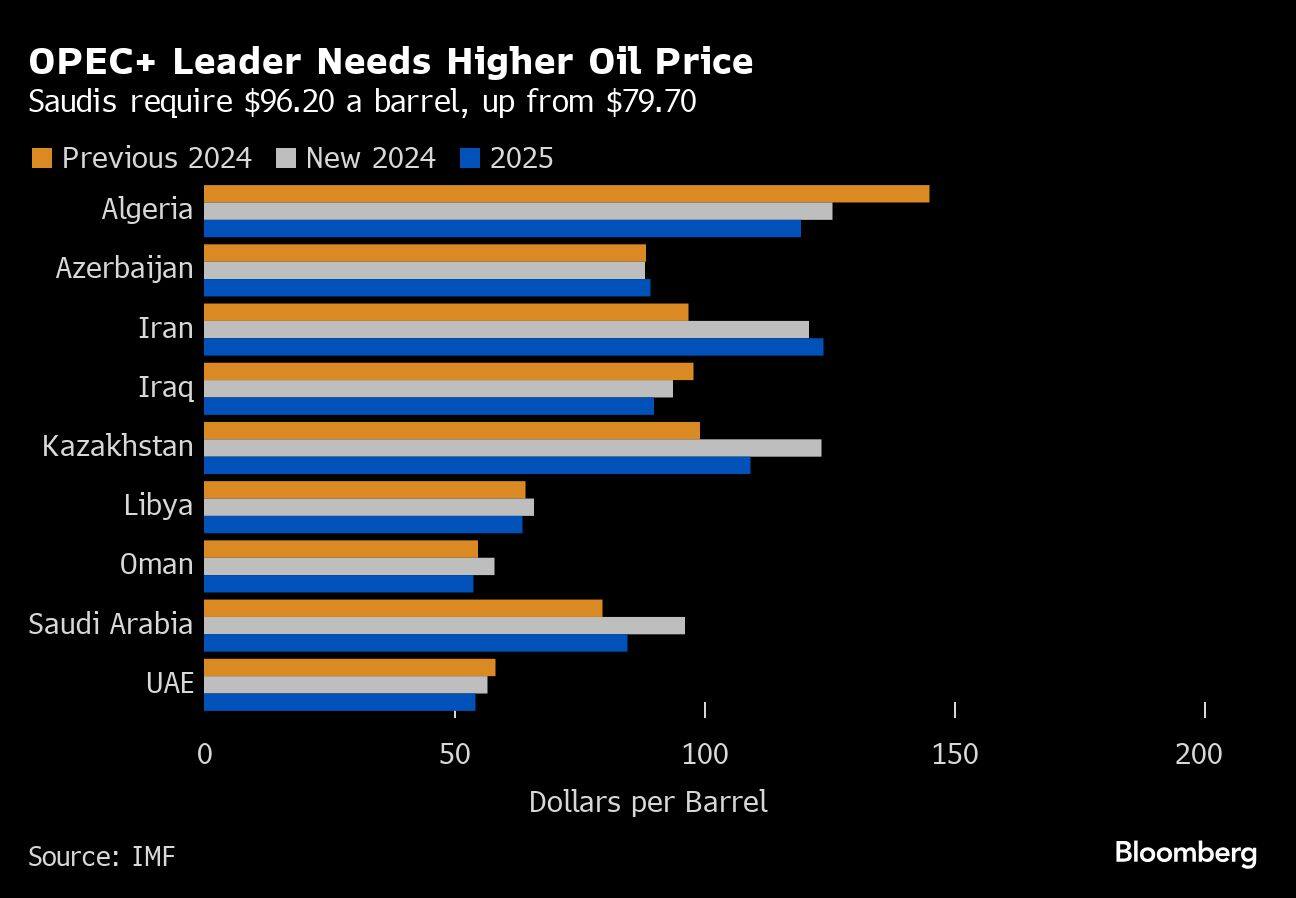

Saudi Arabia will need a higher oil price than previously thought this year as the OPEC+ leader spearheads the group’s production cuts, according to the International Monetary Fund.

Riyadh will require an average oil price of $96.20 a barrel to balance its budget, assuming it holds crude output steady near 9.3 million barrels a day this year, the Washington-based Fund said in its regional economic outlook on Thursday.

That’s up 21% from a previous forecast in October, when the IMF predicted that the kingdom would pump 10 million barrels a day in 2024. It’s also higher than the current price for international benchmark Brent futures, which are trading near $89 a barrel.

The Saudis have led the OPEC+ alliance in curbing output to stave off a global crude surplus and shore up prices, deepening cutbacks by 1 million barrels a day since last July. The measures have helped buoy the market, but as Riyadh sacrifices sales volumes it need a higher price to compensate.

The kingdom needs considerable revenue to fund the ambitious transformation plans of Crown Prince Mohammed bin Salman, which involve spending hundreds of billions of dollars on everything from futuristic cities like Neom to top-flight sports players.

The government has resorted to debt as a way of bridging some gaps, selling $12 billion of bonds in January, equivalent to more than half the fiscal deficit projected for this year.

Neom is also planning a debut riyal bond sale later this year as it looks for more sources of funding, Bloomberg reported this week.

The kingdom’s quest for foreign direct investment has so far under-delivered. The government wants to hit $100 billion of FDI annually by 2030, a haul roughly three times bigger than it has ever achieved and about 50% more than what India gets today.

Kazakhstan and Iran, fellow OPEC+ members, also saw their price needs climb, according to the IMF’s calculations. But the break-evens for several others in the group — which haven’t made such deep output sacrifices as the Saudis — remained broadly stable or even decreased.

Assuming the kingdom relaxes the supply cuts and revives production to 10.3 million barrels a day next year, its break-even price requirement should subside to $84.70 a barrel, according to the IMF.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!