The Mutual Fund industry in India is on the cusp of a big change. With a growing number of options, it falls upon industry pioneers to set benchmarks for operations and new product offerings. As India’s first direct-to-investor mutual fund house, Quantum Mutual Fund has always been at the cutting edge of new investment trends, with innovative and intuitive products that serve the needs of thoughtful investors.

With integrity, ethics and transparency as the core of business, Quantum Mutual Fund has chosen to be a leader carving its own path rather than being a follower in a herd.

A MUTUAL FUND SOLUTION FOR ALL YOUR FINANCIAL GOALS

While having multiple mutual fund schemes is a common practice, Quantum Mutual Fund has followed the practice of launching only one scheme in each category. Since the launch of the flagship Quantum Long Term Equity Value Fund in 2006, the company has created a comprehensive platform for all types of mutual fund investments and the needs of retail investors across Equity, Debt and Gold categories.

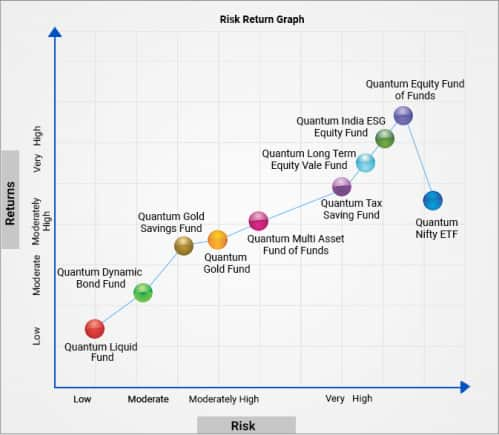

RISK RETURNS GRAPH OF QUANTUM MUTUAL FUND SCHEMES

| The above graph is for illustrative purpose to explain the concept of Risk and Returns in Quantum Mutual Fund schemes. Please review the actual returns and risk-o-meter of the respective schemes independently to make an informed investment decision. |

Since their inception, all Quantum Mutual Fund products have remained true-to-label and have not been reconstructed to comply with SEBI requirements for reclassification. These funds are components of Quantum’s '12-20-80' Asset Allocation Strategy, which caters to an investor's financial goals.

STEP ONE TO ACHIEVE FINANCIAL INDEPENDENCE

The pandemic driven financial crisis has disrupted economies across the globe. Like the previous black swan events, this pandemic, too, has underlined the importance of having a financial buffer to cover emergency/unexpected costs. Quantum Liquid Fund is a prudent choice to ensure safety or build a strong foundation for your investment portfolio. Launched in 2009, the fund has tightened its portfolio construction & has stopped investing in any private corporate credit corporations. It only invests in AAA/A1+ rated PSU and PFI securities and carries a low credit risk. It is an alternative to regular fixed income instruments like a savings account in a bank - and has a relatively lower Interest rate and credit risk (classified as A-1 as per the PRC matrix).

YOUR GOLDEN BUCKET

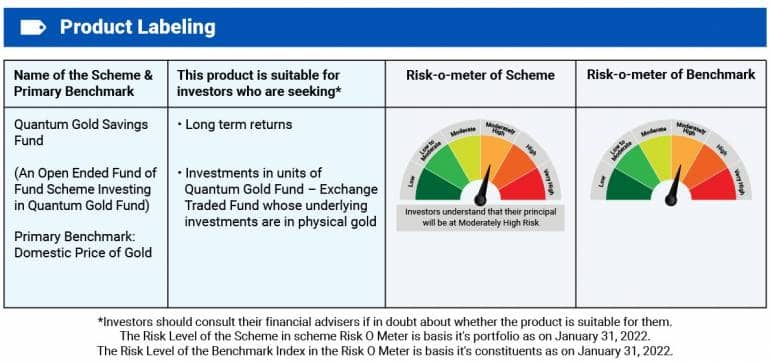

When it comes to investing in gold, investors have many concerns regarding the quality and purity of the yellow metal. Quantum Mutual Fund, therefore, launched the Quantum Gold Fund ETF – being the only fund house to offer independent testing for gold bars.

For investors who prefer SIP, the company also introduced the Quantum Gold Savings Fund to increase investment flexibility. In general, gold shows the opposite performance to equities - with gold outperforming equities when their performance is poor. Therefore, gold is an ideal portfolio diversifying investment and is a coveted block of risk diversification as well.

THE NEED FOR DIVERSIFICATION

During times of uncertainty, Quantum Long Term Equity Value Fund provided valuable downside protection. However, diversification of portfolio and simplification of a fund selection process among the 350+ mutual funds available is always necessary.

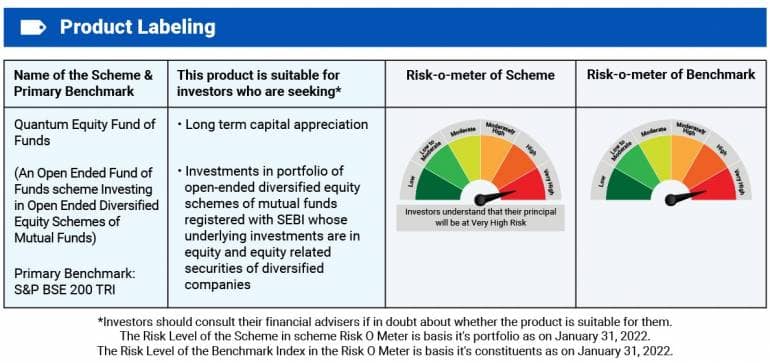

Quantum Equity Fund of Funds addresses this requirement. The portfolio consists of 5-10 diversified equity funds belonging to other fund houses - with a proven track record. Each third-party fund is thoroughly researched so that investors get a solid portfolio that performs with the lowest possible scheme expense ratio - both qualitatively and quantitatively.

In Quantum Mutual Fund’s 12-20-80 strategy, 80% comprises equity allocation. This is the Growth block and is further classified into three products — Quantum Equity Fund of Funds, Quantum Long Term Equity Value Fund and Quantum India ESG Equity fund.

Quantum recommends, at least 70% of this Growth Block is invested in Quantum Equity Fund of Funds, which offers a mix of diverse equity funds with varying investing approaches and market capitalization.

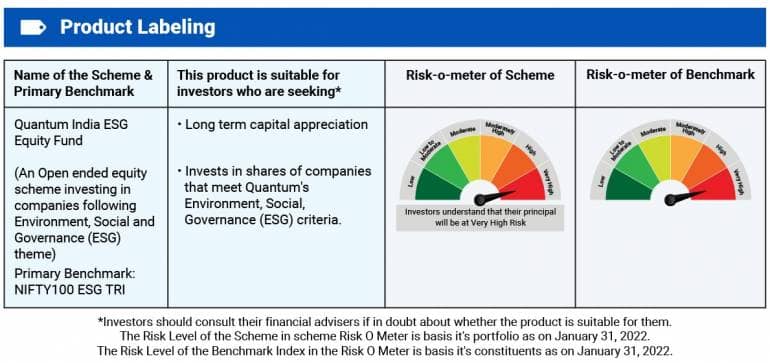

Quantum India ESG Equity Fund is one of the country's first true-to-label ESG equity funds. The ‘Integrity Screen’ launched at the Group Level in 1996, brought in a complete and rigorous proprietary ESG assessment mechanism. The fund sheds insight on how founders treat minority shareholders, money allocation, and environmental concerns. While social and environmental factors drive the fund, good governance and transparency are at the heart of the research.

Quantum Mutual Fund has continuously strived to improve the investment environment by ensuring that all procedures are beneficial to investors. In this regard, it is also an organization of many firsts - setting standards and best practices that have gone on to become industry norms.

DISTRIBUTION COST & PENCHANT FOR TRANSPARENCY

Although distributors are key contact points in an investment ecosystem, distributor fees were formerly not mentioned in the annual AMC report. Quantum Mutual Fund rejected such opaque practices in the interest of its investors and 2006, introduced direct investments without the involvement of distributor commissions, even before it was introduced as a SEBI norm.

FIRST TO ADOPT TOTAL RETURN INDEX (TRI) AS A SCHEME BENCHMARK

Continuing to do what is best for investors, Quantum Mutual Fund was the first fund house to have the Total Return Index as a scheme benchmark. The mutual fund regulator in 2018 mandated mutual fund schemes to use TRI to benchmark their performances.

FULLY INDEPENDENT BOARD

Since trustees are given the responsibility of safeguarding the interest of investors, it is only fair that they are not a part of the AMC in question. Therefore, Quantum has a 100% independent board of trustees - one of the very few companies to do so. This is yet to be accepted as a regulatory norm.

FOLLOWING MARK-TO-MARKET SINCE 2012

Quantum Liquid Fund was the only fund to go for complete Mark-To-Market valuation philosophy in liquid funds since 2012 - till SEBI tightened valuation norms debt instruments in 2019.

Quantum Mutual Fund’s continued relevance is a product of its reputation as a trailblazer in the realm of mutual fund investing. With a solid track record of progressive investment strategies and a commitment to the well-being of investors, they continue to remain a premier fund of choice for thoughtful investors.

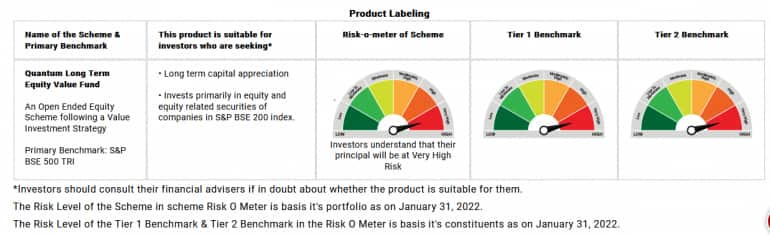

Product Label

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate, and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Disclaimer – Terms of Use

The data in this presentation are meant for general reading purpose only and are not meant to serve as a professional guide/investment advice for the readers. This presentation has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been suggested or offered based upon the information provided herein, due care has been taken to endeavor that the facts are accurate and reasonable as on date. Quantum AMC shall make modifications and alterations to the performance and related data from time to time as may be required as per SEBI Mutual Fund Regulations. Readers are advised to seek independent professional advice and arrive at an informed investment decision before making any investment. None of the Sponsors, the Investment Manager, the Trustee, their respective Directors, Employees, Affiliates or Representatives shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the data/information/opinions contained in this presentation. The Quantum AMC shall make modifications and alterations to the performance and related data from time to time as may be required.Please visit – www.QuantumMF.com to read scheme specific risk factors. Investors in the Scheme are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme. Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-). Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!