Alphabet, Tesla and Amazon are among the most favourite stocks held by US-focused mutual funds. Here are top 10 stocks

Out of 48 international funds that Indian investors can invest, 12 invest in the US markets. Most of these invest in technology companies listed in the US markets.

1/13

Retail investors in India now have a chance to buy US stocks directly. Both the BSE and the NSE have announced to introduce a platform for trading in select US stocks for Indian investors. Currently, few brokers facilitate Indian investors for buying and selling US stocks through tie-ups with US brokers. However, mutual fund route has been the feasible way for taking exposure to US stocks for Indian investors. At present, there are 12 funds invest predominantly in US stocks either directly or using fund of funds route. It scores on many counts, including lower charges and professional management. US Equity markets have been one of the most developed markets in the world. These funds help Indian investors to buy stocks of companies that are otherwise not available in India. Allocation to foreign stocks also provide geographical diversification and hedge against US Dollar. Here is the list of top 10 stocks held by these US-focused funds. Portfolio data as on July 31, 2021.

2/13

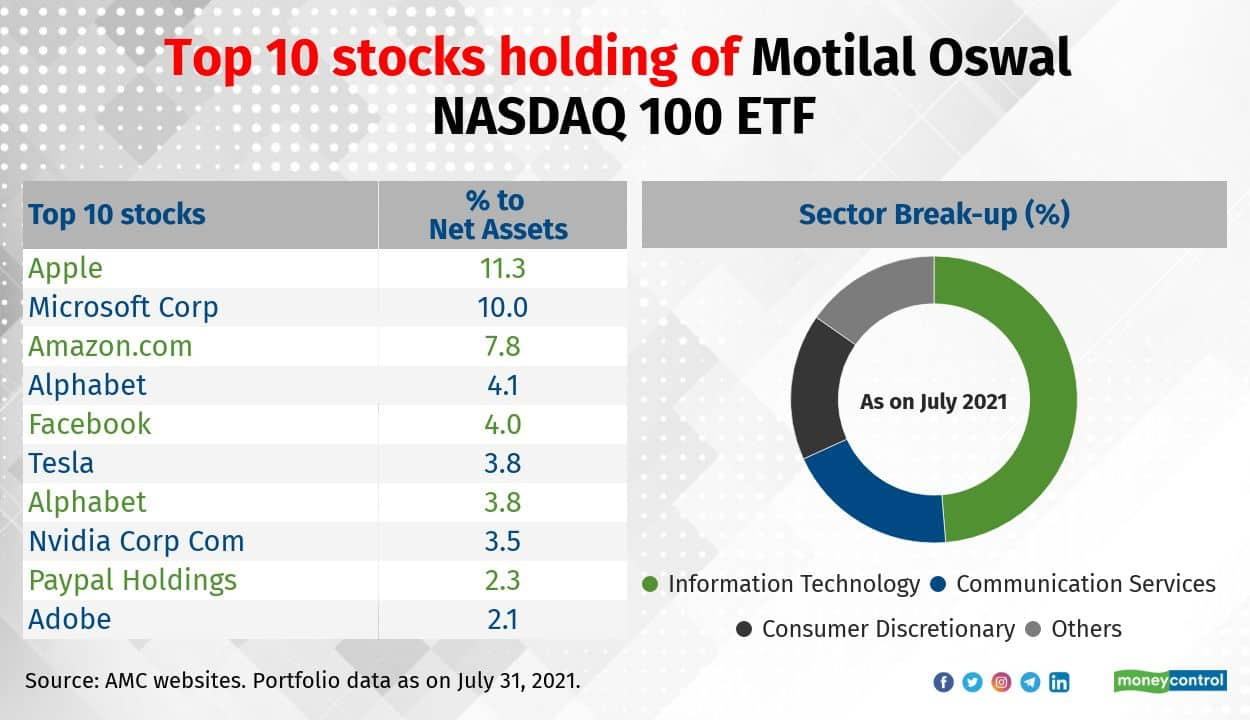

Motilal Oswal Nasdaq 100 ETF (MON100) is a passively managed exchange traded fund (ETF) investing in the constituents of NASDAQ-100 Index. It manages the largest asset size of Rs 4,746 crore (as on July 31, 2021) among the US-focused funds. The fund house also offers fund of funds (FoF) which mainly invest in the MON100. Nasdaq-100 index constitutes 100 of the largest non-financial companies listed on the Nasdaq Stock Market based on market capitalization. It reflects companies across computer hardware, and software, telecommunications, retail/wholesale trade and biotechnology. Over the last 10 years, MON100 delivered a compounded annualised return (CAGR) of 28%. The other fund ‘Kotak NASDAQ 100 FOF' invests in the overseas ETF of Ishares Nasdaq 100 ETF.

3/13

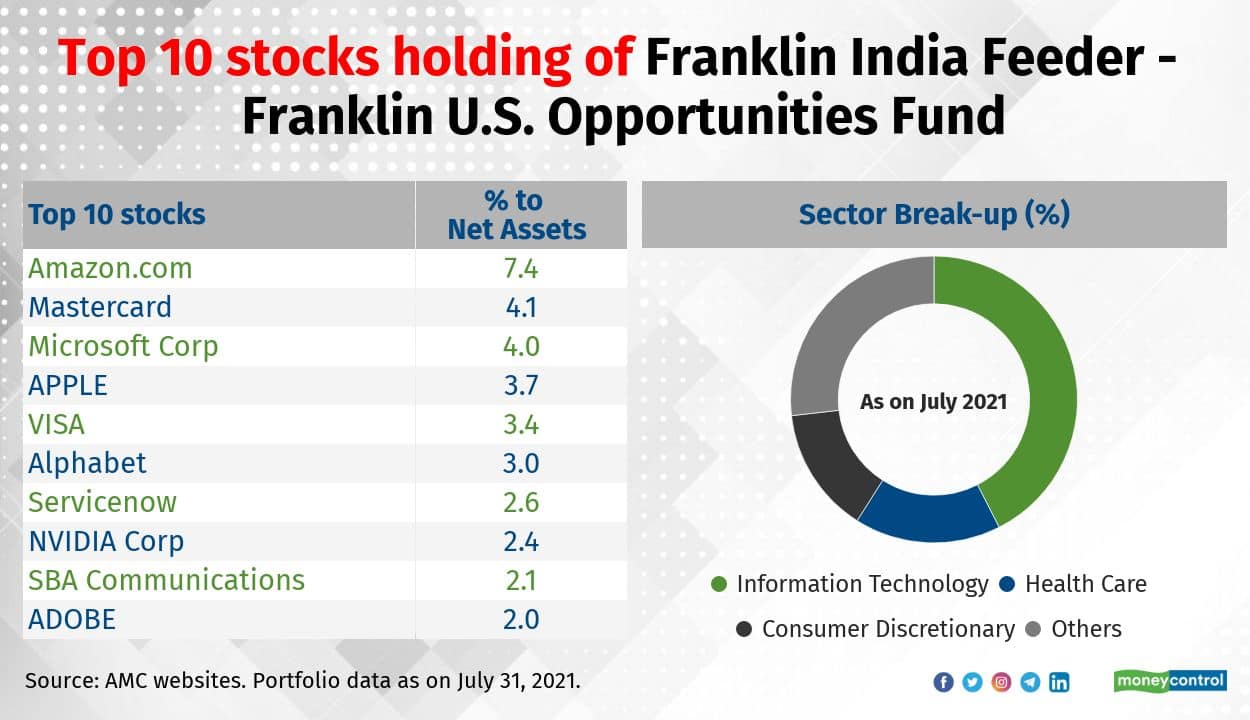

Franklin India Feeder - Franklin U.S. Opportunities Fund (FIF-FUSOF) is a FoF investing in the units of the overseas fund - Franklin U.S. Opportunities Fund (underlying fund). Launched in February 2012, FIF-FUSOF has delivered a CAGR of 20% since its launches. The underlying fund invests predominantly in US (95%), it also holds stocks listed in UK (1.7%), Canada (1.2%) and China (0.6%). However, it has higher weight in technology stocks (around 42%).

4/13

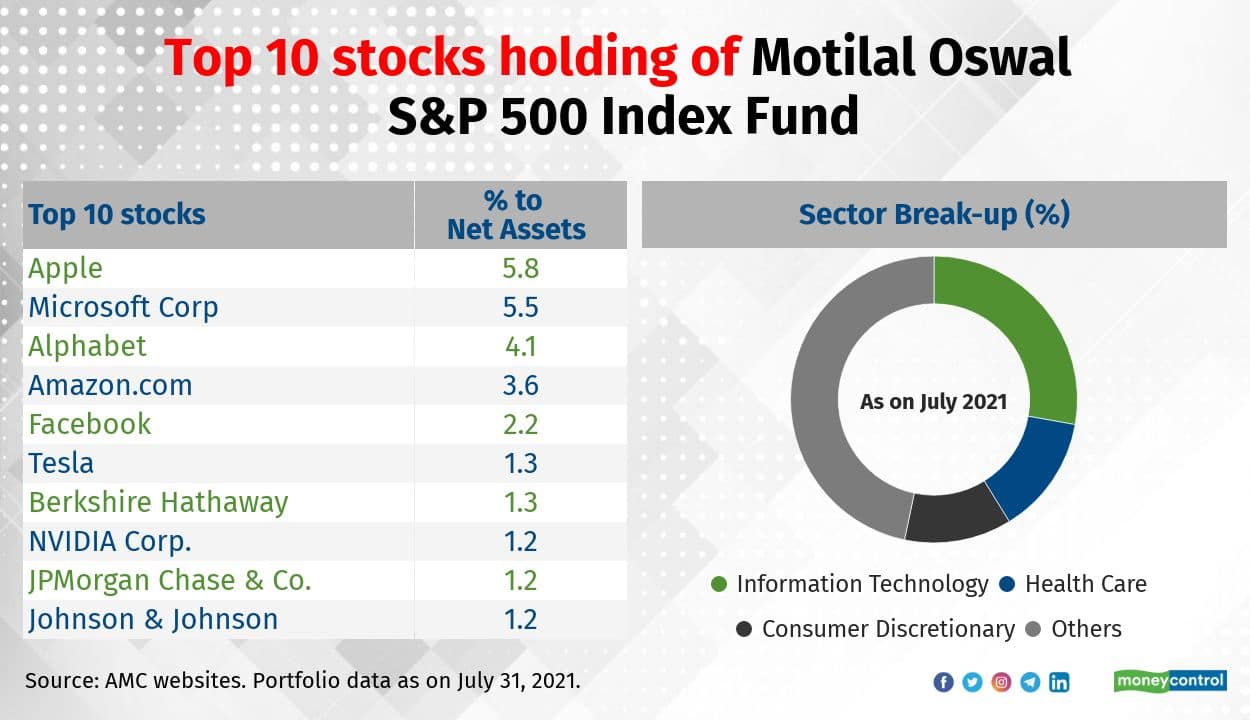

Motilal Oswal S&P 500 Index Fund is a passively managed index fund tracking the world’s largest index S&P 500 Index. The index invests in the leading 500 companies listed in US and covers approximately 80% of available market capitalization. Over the last 10 years, it has delivered a CAGR of 20% (in INR term).

5/13

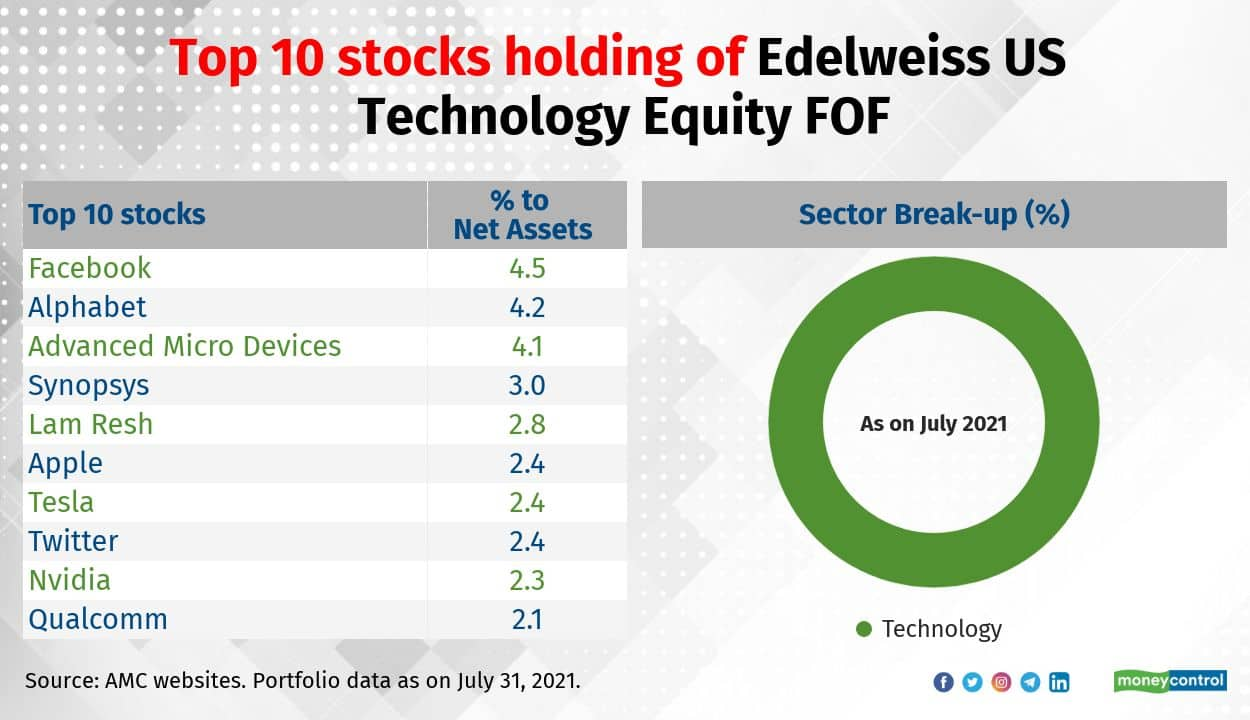

Edelweiss US Technology Equity FOF is a fund of funds investing in the underlying fund -JPMorgan US Technology Fund. It is a sector fund investing in the current technology megatrends like cloud computing, AI, OTT, electronic payments, autonomous cars, etc.

6/13

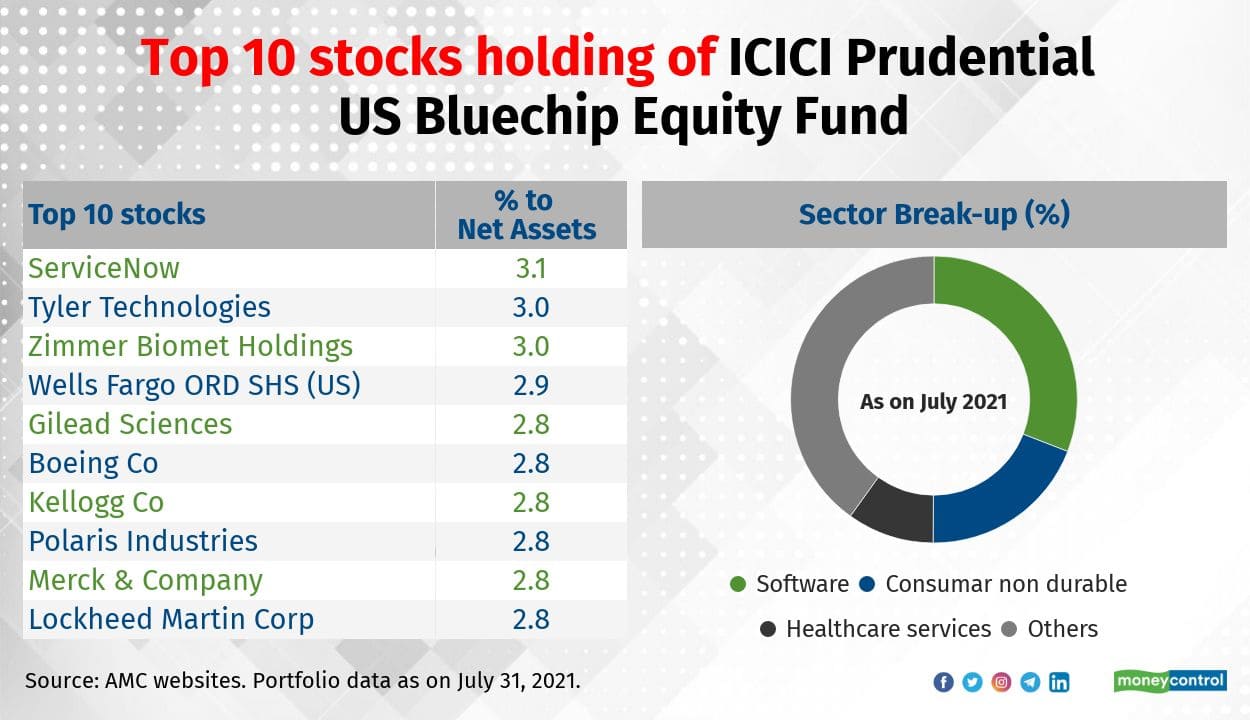

ICICI Prudential US Bluechip Equity Fund invests in the securities of blue-chip companies listed on the stock exchange of the US. It is benchmarked against S&P 500. It has a diversified portfolio of holding around 47 stocks across sectors. Launched in July 2012, it has delivered a CAGR of 18% since its launches.

7/13

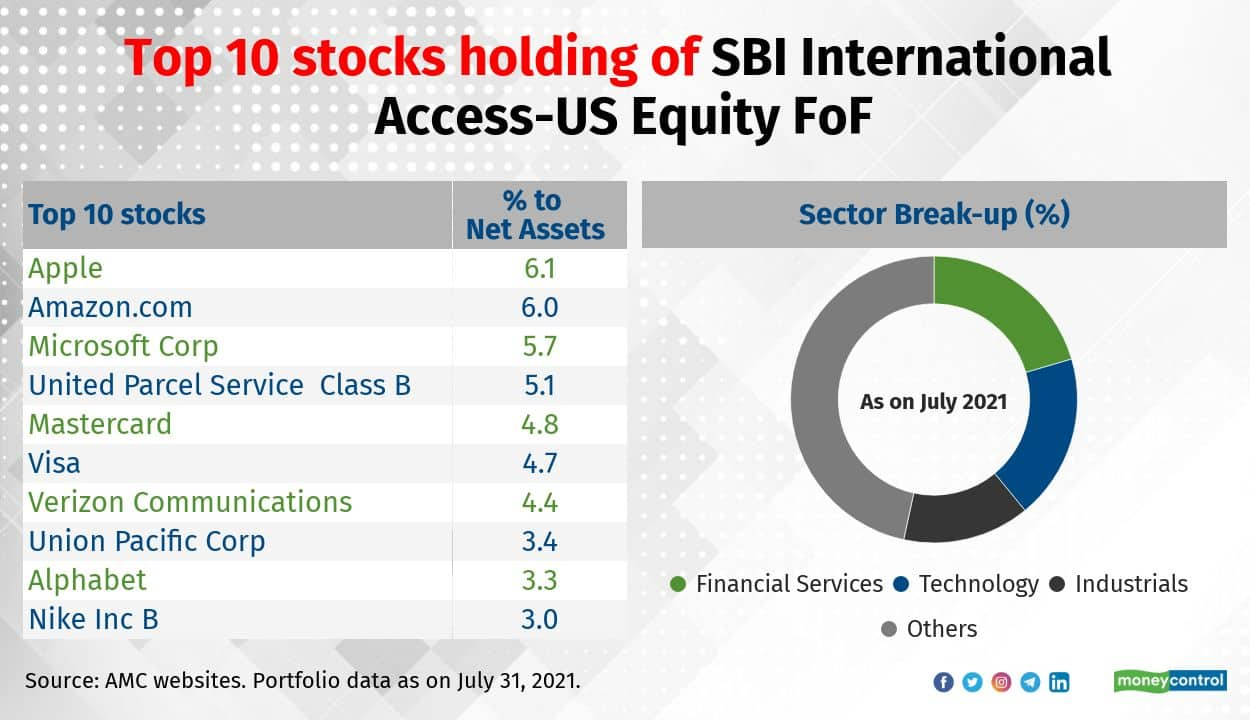

SBI International Access - US Equity FoF is a fund of funds investing in the units of AMUNDI Funds US Pioneer Fund -12 USD C that invests predominantly in securities in the US. It has a diversified portfolio.

8/13

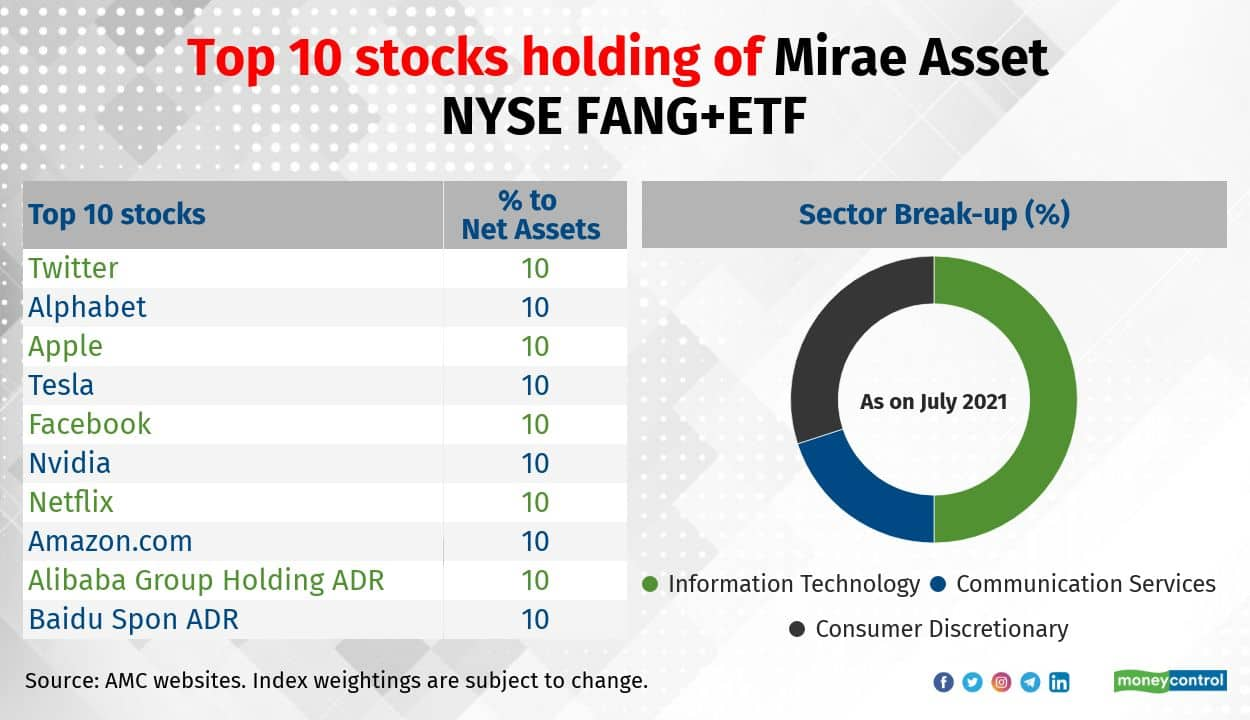

Mirae Asset NYSE FANG+ ETF (MAFANG) is a passively managed ETF tracking closely NYSE FANG+ Index. The NYSE FANG+ Index is an equal-dollar weighted Index designed to represent a segment of the technology and consumer discretionary sectors consisting of 10 US highly-traded growth stocks of technology and tech-enabled companies. It was launched on May 2021. The fund house also provides FoF which invests mainly in the MAFANG.

9/13

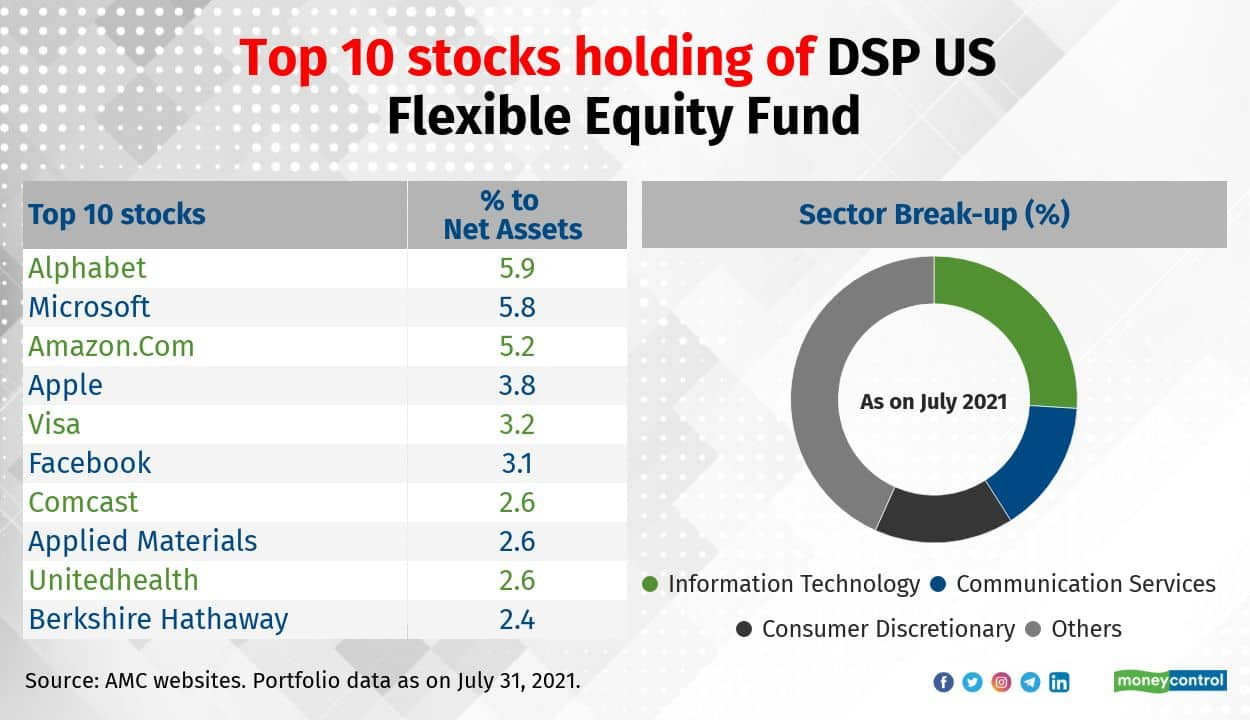

DSP US Flexible Equity Fund is a FoF investing in the units of BlackRock Global Funds - US Flexible Equity Fund (Underlying Fund). Launched in August 2012, it has delivered a CAGR of 17% since its launches. The underlying fund invests mainly in the largecap US stocks.

10/13

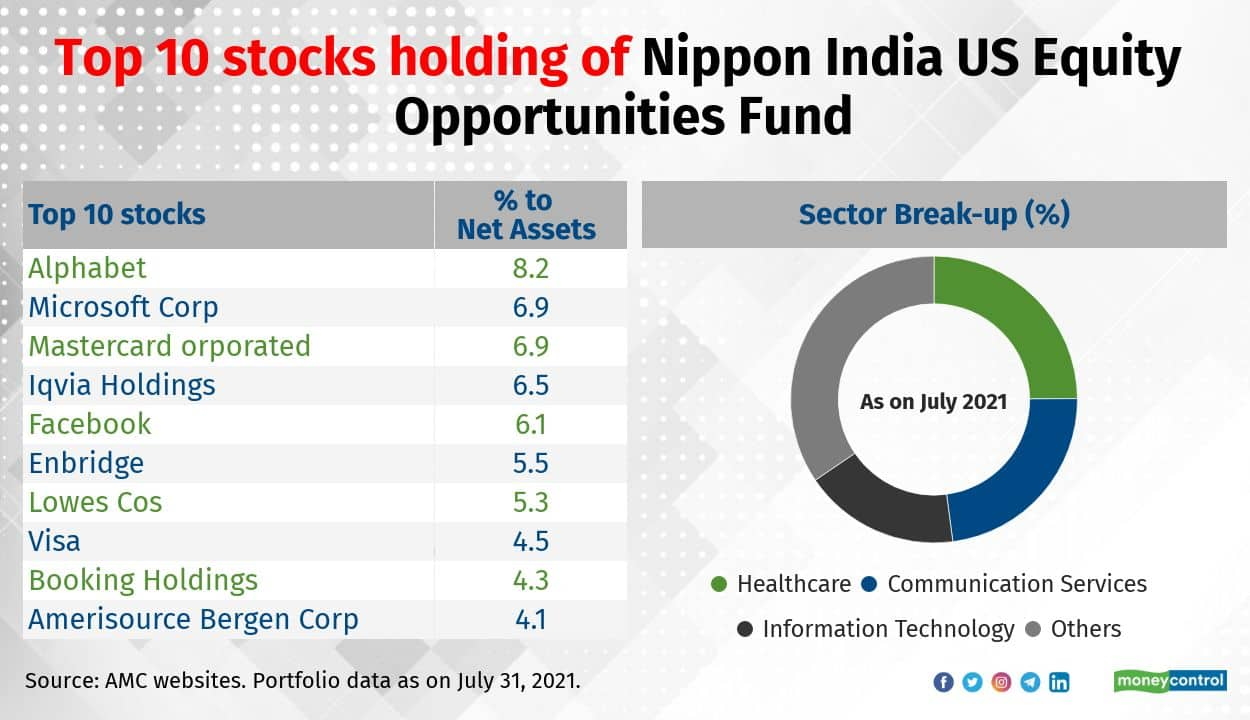

Nippon India US Equity Opp Fund invests in the high quality stocks listed in US. The investment strategy of the fund would be powered by the research support of Morningstar. Launched in July 2015, it has delivered a CAGR of 16% since its launches.

11/13

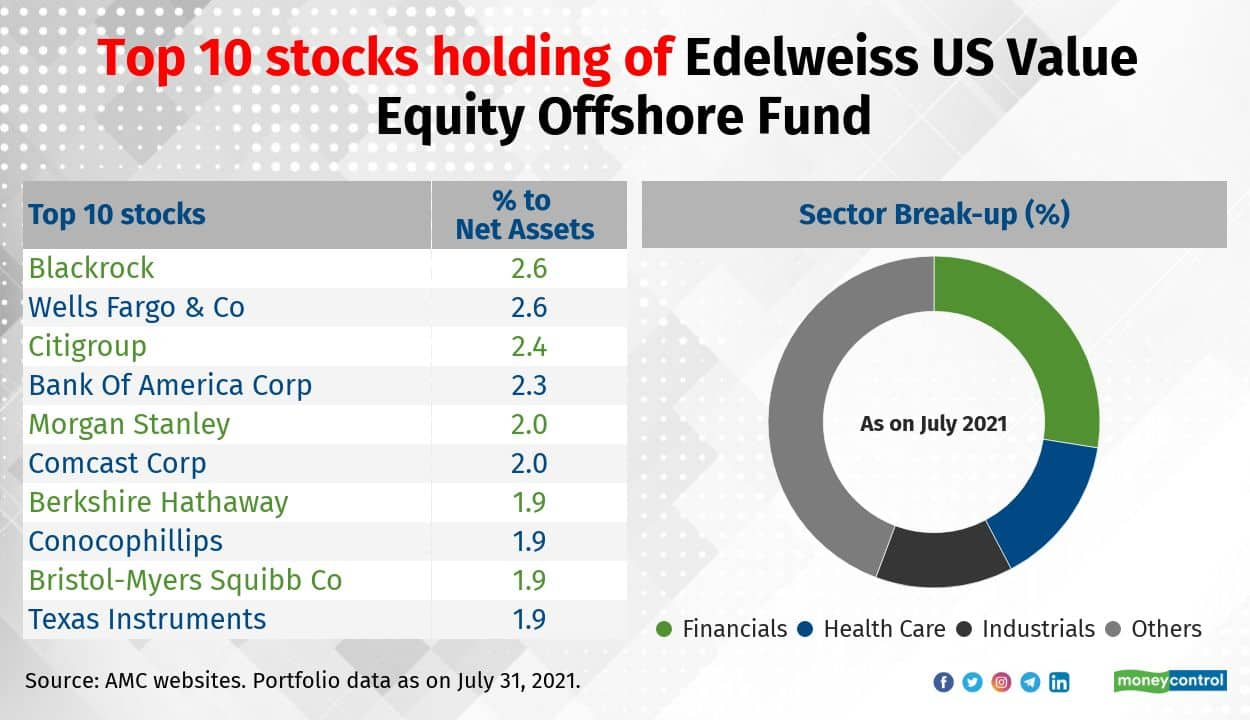

Edelweiss US Value Equity Offshore Fund (EUVEOF) is a FoF investing in JPMorgan Funds – US Value Fund (Underlying Fund). It is worth noting that while most of the other US focused funds follow growth oriented strategy and invest major portion in technology stocks, EUVEOF follows a value style and invests mostly in other than tech stocks.

12/13

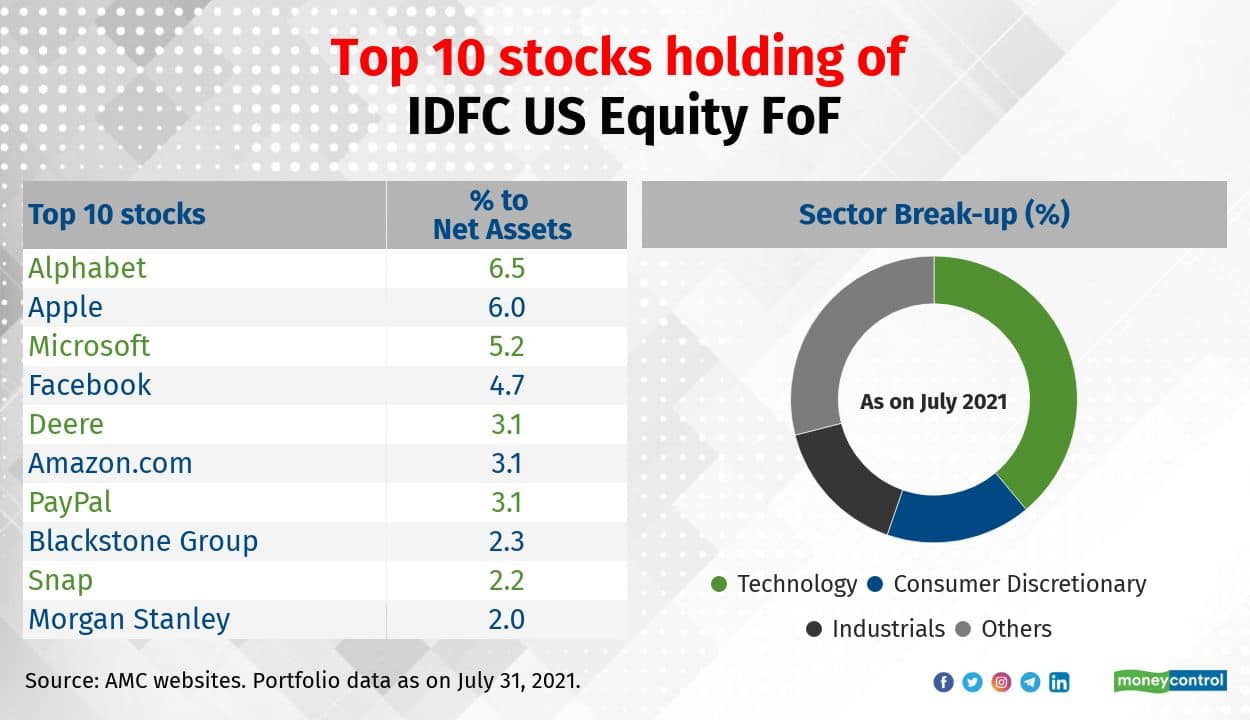

IDFC US Equity FoF (IUEF) is a recently launched fund which will invest in an underlying fund with a growth-style investing, i.e. JP Morgan US Growth Fund. The underlying fund invests majorly in large-cap stocks with some mid-cap exposure.

13/13

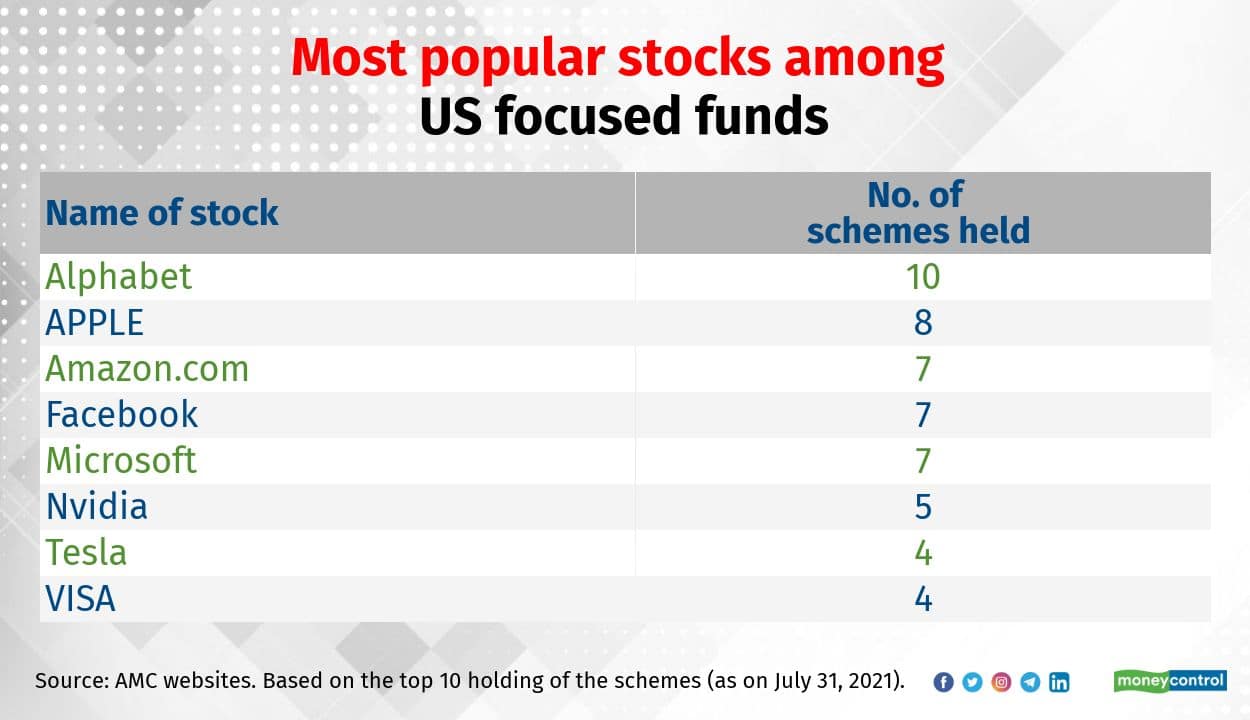

Alphabet Inc., a holding company of Google, has been the most preferred stock among the US focused mutual funds. The other preferred stocks are Apple, Amazon.com, Facebook, and Microsoft.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!