Nifty at 20k: What do technical indicators tell us about market’s future course?

Even as some fundamental analysts have raised questions over valuation of the Nifty and its constituents, technical analysts don’t see any immediate pause for the index. Rohit Srivastava, Founder and Market Strategist at indiacharts.com, sees the Nifty rising to 20,600 level. He believes the index will continue with the trend of higher highs and higher lows.

1/8

Nifty 50: Stocks above 20 SMA between April 1 2023 - Sep 11 2023: An overwhelming 98 percent Nifty 50 stocks traded above 20 SMA (simple moving average) as on September 11, indicating not just the strength in momentum but also a broad-based rally.

2/8

Nifty 50: Stocks above 100 SMA between April 1 2023 and Sep 11 2023: Similarly, eight out of every 10 stocks in the Nifty 50 are also trading above 100 SMA. The ratio has actually come down in recent months, which indicates that some stocks are still playing catch-up.

3/8

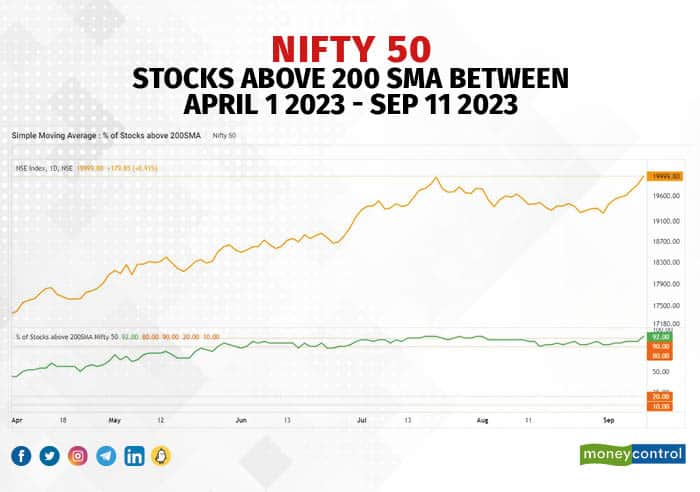

Nifty 50: Stocks above 200 SMA between April 1 2023 and Sept 11 2023: Every nine out of 10 stocks in the Nifty traded above their 200-DMA, which is a long-term momentum indicator. This signals the strength and duration of the bull run. 200-DMA will work as a strong support for them in case there is any sell-off going ahead.

4/8

Nifty 50: Stocks with MACD Buy between April 1, 2023 and Sept 11, 2023: A similar number of stocks in Nifty 50 (i.e., 9 out of 10) has signalling ‘BUY’ on MACD as they trade above their signal line. Moving average convergence/divergence (MACD) shows the relationship between two exponential moving averages (EMAs) of a stock’s price. The MACD line is calculated by subtracting the 26-period EMA from the 12-period EMA.

5/8

Nifty 50: Stocks with RSI >= 50 between April 1, 2023 and Sept 11, 2023: Not surprisingly, an overwhelming majority are showing overbought condition. The Relative Strength Index (RSI) indicates whether a stock is in an overbought or oversold zone. It is calculated using average price gains and losses over a given period of time.

6/8

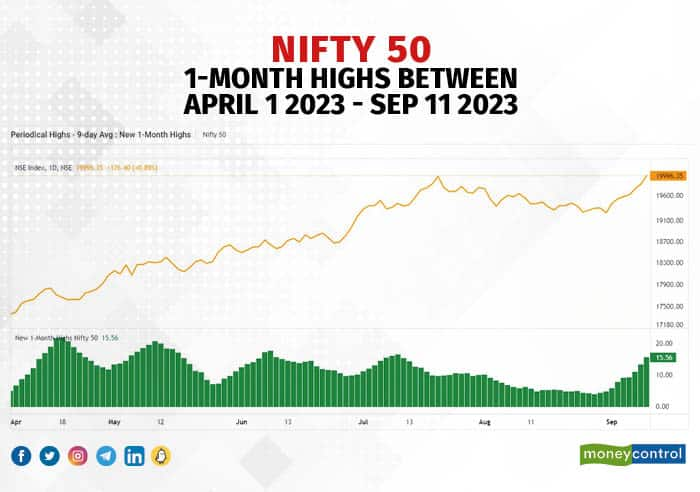

Nifty 50: 1-Month Highs between April 1, 2023 and Sept 11, 2023: The chart shows how many stocks are making new highs on a particular day. As the bottom chart shows, the number of stocks making new highs have grown progressively – a sign of a bull run.

7/8

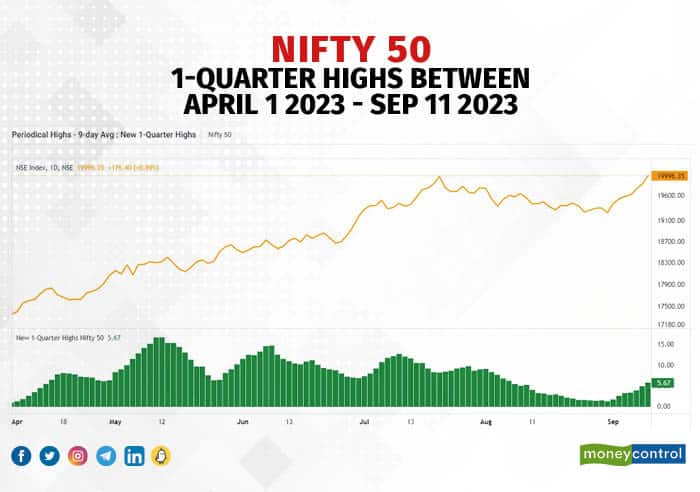

Nifty 50: 1-Quarter Highs between April 1, 2023 and Sept 11, 2023: A similar trend can be observed in this graph as well. However, the number of stocks making such highs is comparatively lower because of the longer time period.

8/8

Nifty 50: One-year highs between April 1, 2023 and Sept 11, 2023: Those making one-year highs are also progressively getting higher as the buying picks up. Analysts expect the trend to continue.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!