Anubhav Sahu Moneycontrol research

Bodal Chemicals’ quarterly result reflects the business transition concerns, although progress in various capacity and operational projects keep it positioned to benefit from industry tailwinds. Dye manufacturers in India will benefit from the recent surge in dye intermediate prices due to supply constraints in China. While environmental compliance and the resultant plant shutdowns in China are not new developments, the situation appears to be more structural as news flow suggests Chinese manufacturers are looking for business collaboration in India to source dyestuff and dye intermediates. In our view, a vertically-integrated manufacturer like Bodal Chemicals is better placed to ride this positive demand and pricing outlook.

Also read: Bodal Chemicals: Core business on track, headwinds for diversification projects a concern

Q4 update – Improving gross margins

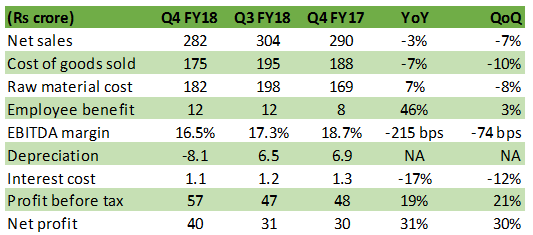

Bodal reported a decline in Q4FY18 topline due to challenges like the lag effect of external events (demonetisation and GST) and revamp of effluent discharge canals.

Gross margins improved on better pricing and product mix. Utilisation level for the dyestuff production was near optimum. It is noteworthy that higher margin dyestuff products constituted 36 percent of sales in Q4FY18 compared to 24 percent in Q4FY17. Export market fared better with 39 percent of share in sales.

At the earnings before interest, tax, depreciation, and amortisation (EBITDA) level, however, there was a margin contraction due to higher overheads.

Reported net profit was 31 percent higher on year on year (YoY) basis but this was due to change in depreciation method. On like for like basis, growth in net profit was flattish.

Source: Company

Core business to ramp up

Company’s dyes business appears well positioned to gain from higher volumes from capacity expansion, strong pricing trend and the demand-supply imbalance in China. The recent completion of 12,000 tonnes dyestuff capacity expansion is expected to be utilised by ~50 percent for next three quarters in FY19. In FY20, the company expects optimum capacity utilization (75-80 percent). In FY19, this is expected to add about Rs 75 crore to the top line after considering a higher percentage of the dye intermediate product capacity would be utilised internally.

The has also been a sharp increase in prices of dye intermediates (H-acid, Vinyl sulphone) due to strict environmental compliance in China and resulting in various plant shutdowns. Improved pricing is expected to reflect in the results of Q2 FY19.

While it is difficult to predict the sustenance of such pricing trend, frequent purchase order inquiries from China and the news flow that Chinese manufacturers are looking for Joint Venture in India indicate a structural change favoring Bodal Chemicals.

Vinyl sulphone: capacity plan enhanced

In case of key dye intermediate, Vinyl sulphone, capacity expansion of 6000 tonnes is expected to operationalize by Q2 FY19 through its subsidiary SPS Processors as extraneous factors like licensing permission and feedstock supply concerns are now put to rest.

Thionyl Chloride – on track

Thionyl Chloride project of 36,000 tonnes capacity is on track and expected to contribute from Q3 of FY19. It’s an interesting forward-backward integration project wherein Thionyl Chloride is used as a raw material for Vinyl Sulphone, at the same time Sulfur trioxide derived from Sulphuric Acid Plant will be used to make Thionyl Chloride.

Diversification projects under transition

The company continues to face headwinds on the diversification projects (Trion chemicals, LABSA, and liquid dyestuff) on account of competitive pressure and surge in raw material prices. Currently, LABSA (Linear Alkyl Benzene Sulphonic Acid) and liquid dyestuff businesses are operating at sub 20 percent utilization only. Having said that company expects improved performance for Trion chemicals (JV for water treatment chemical business) and liquid dyestuff businesses in FY19.

Core business prospects encouraging

Our positive stance on the company is driven by core business (dyes value chain) prospects. We are encouraged by the traction towards vertical integration, capacity expansion and efforts towards operational efficiency.

Further, company’s EBITDA margins are expected to sustain ahead of 18 percent as it executes various operational efficiency projects (co-generation power plant, Thionyl Chloride project) and improved pricing environment.

Given this context, we have tweaked our estimates and expect a 22 percent CAGR (FY18 -20e) growth in earnings. Post recent consolidation, the stock is currently trading at 11.3x 2019e and offers a decent opportunity to participate in the growth story of leading dyestuff manufacturer, in our view.

Source: Company, Moneycontrol research

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!