Uttaresh Venkateshwaran & Viswanath Pilla Moneycontrol News

Pharmaceutical stocks were under immense pressure during the session, continuing with its fall from Monday as investors reacted to the negative outlook for the sector.

A combination of bad news flow along with poor outlook for the sector laid out by a Credit Suisse report made investors wary of the overall sector, with headline stocks cracking. The BSE healthcare index was down over 2.5 percent, while the NSE’s pharma index was down 3 percent intraday on Tuesday.

A fall in sales of Taro, the US subsidiary of Sun Pharma, dragged the Indian owner on the indices by 8 percent. This spilled over to other pharma stocks such as Aurobindo Pharma, which cracked over 6 percent intraday. Investors reacted negatively to the stock despite the market regulator disposing a case of violation of insider trading norms against its promoter, reflecting the bearish sentiment in the sector.

Meanwhile, other major stocks such as Cipla, Lupin, Ajanta Pharma, and Alembic Pharma, were all in the negative zone throughout the day.

“Today's fall is due to Taro's disappointing results, 1600 basis points decline in margins. That indicates the pricing pressure in US market, which is likely to impact the results of other major companies numbers as well. The pain will remain for one or two quarters beyond US FDA clearance of facilities and new approvals will start kicking in,” Ranjit Kapadia of Centrum Broking told Moneycontrol. Kapadia is still bullish on pharma. “It's very good price to enter, for someone with two-three quarters investment horizon,” he added.

One of the other major reasons, apart from negative news developments, is a report by research firm Credit Suisse that red flagged the companies’ outlook in the US due to price erosion.

The global research firm expects a price erosion of 10-12 percent from 7-8 percent currently due to three primary reasons:

- Higher competition from increasing FDA approvals, which it expects to grow more than 50 percent in the next two years

- Increasing channel consolidation where Express Script joining Walgreen consortium, top three buyers now account for 90 percent of generic purchasing

- Increasing approvals of new entrants, which get 30 percent of system approvals now.

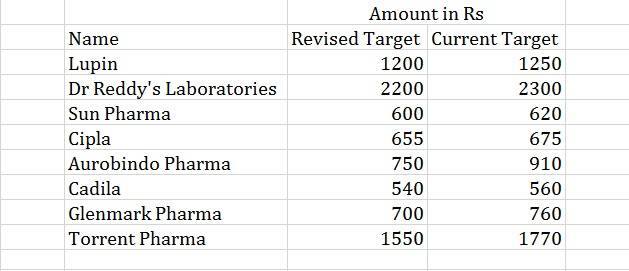

Analysts at the firm see more downside from this point as the bottoming out is yet to come. Pharma stocks have de-rated by 10% as price erosion moved from stable of 5% to 7-8% already. This is on the back of as FDA increasing ANDA approval rate as well as increasing pressure from channel consolidation, the report added.

“We cut target multiple of US generics from 16-18x to 14-16x to factor in higher price erosion. We cut earnings for FY19 for coverage universe by 7% average to factor higher channel consolidation (only the direct impact of discount equalisation and further volume discounts),” they wrote in the report.

So, what is next for an investor?

“There is speculation on rise of competition which has caused 10-12 percent price erosion of base business of companies… at some point whatever players come into the base business or oral solids business, they will not be able generate any significant revenues to invest on complex molecules because the margins would be lower. These players will not be able to grow,” said Amey Chalke of HDFC Securities. Having said that, he expects the situation to ease in 6-7 months. “Going ahead 10-12 percent kind of price erosion may not sustain, it is there right now because there is sudden spike in approvals for new companies especially into oral solid dosages,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!