The Pune-based industrial biotechnology company Praj Industries has excited Dalal Street by giving investors high returns. Analysts believe the stock rally may not hit a speed-breaker yet as they see a further 45 percent upside.

From today's high, an upside of over 43 percent can be expected, according to analysts.

In the past two years, the capital goods company’s stock has gained over 170 percent and, in the past five years, the scrip has given close to 300 percent returns.

Financial Performance

The company’s revenue from operations increased to Rs 909.97 crore in the December quarter of 2022 from Rs 876.58 crore in the previous quarter and Rs 585.64 crore a year ago. Net profit stood at Rs 62.30 crore in the reporting quarter, up 68.15 percent from Rs 37.05 crore last year. In the previous quarter, the company reported a net profit of Rs 48.13 crore.

In fact, the company's revenue, net profit and operating EBITDA (Earnings before interest tax depreciation and amortisation) in FY19 has more than doubled by FY22.

What does the company do?

Praj has three key business segments: (a) Bioenergy business that involves process design, engineering, fabrication, and commissioning of ethanol plants, (b) HiPurity Systems and (c) Engineering business that has three sub-divisions: water and waste water treatment that operates in the industrial waste water systems, critical process engineering that provides high-end equipment and systems finding applications in the oil and gas, petrochemical, fertiliser and chemicals industries, and brewery plants and equipment.

Why the market is bullish?

Praj Industries has been an undisputed market leader in the domestic ethanol plant installation and equipment business and the domestic breweries installation segment, said CRISIL.

During the first nine months of fiscal 2022, new order flow improved by over 65 percent YoY for ethanol business owing to favourable policies being announced by the government and increase in demand for pharmaceutical grade alcohol amid the rising need for sanitisation amid the ongoing pandemic. While continuously improving demand and support from recent government policies is likely to benefit Praj’s bioenergy segment, the ratings agency explained.

Centrum Broking that says ‘buy’ the stock with a target price of Rs 532, believes strong results and positive implications from the recent Union Budget augur well for the stock's outperformance.

The recent Union Budget entailed announcements regarding excise duty exemption on Compressed BioGas (CBG) blending, and relief for the financially stressed sugar sector.

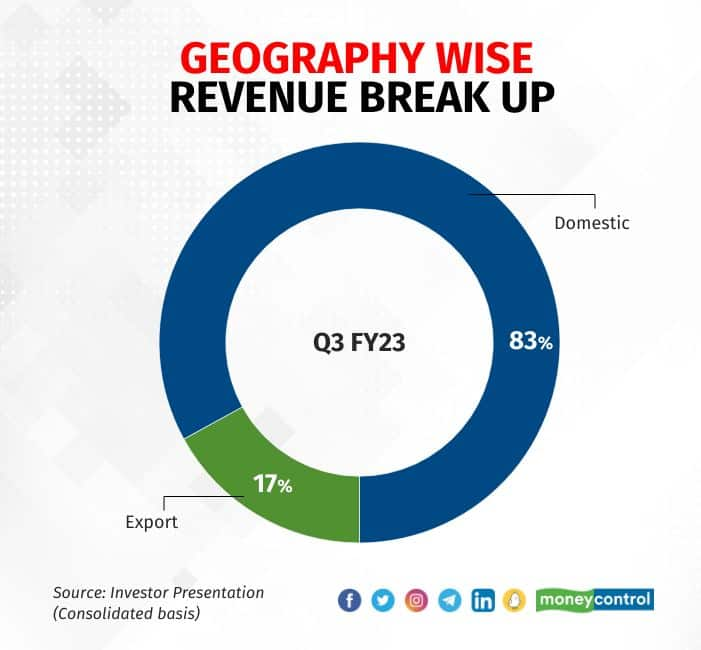

Considering Praj Industries is a prominent player in the green energy space as it provides solutions, technology and equipment to industries such as environment, energy, and agri-processing, Amit Anwani of Prabhudas Lilladher believes that the company is well-positioned. He said that the company has a market share of around 60 percent in the ethanol segment which is part of its bioenergy business that contributes a major chunk to revenues.

Considering Praj Industries is a prominent player in the green energy space as it provides solutions, technology and equipment to industries such as environment, energy, and agri-processing, Amit Anwani of Prabhudas Lilladher believes that the company is well-positioned. He said that the company has a market share of around 60 percent in the ethanol segment which is part of its bioenergy business that contributes a major chunk to revenues.

Prabhudas Lilladher, which has retained its ‘buy’ rating on the stock with a hike in target price to Rs 520 from Rs 495. The broking house believes the company is well-poised to benefit from upcoming opportunities given its strong leadership in domestic ethanol plants, global presence and focus on future-ready technologies like 2G plants, CBG.

It highlighted that Praj Industries has turned selective on taking profitable orders to protect its margins, especially in starchy-based 1G-plants orders from new customers. It is also in advance stage of discussion for 2G ethanol plant offerings in Europe.

Besides, the company’s order book stands healthy at Rs 33.8 billion which is one time its Trailing Twelve Month revenue, it added.

“Praj Industries is the pure equity play on India Ethanol Revolution and now marching its footprints globally. The company has also a very strong focus on Engineering business providing solutions across CPES, ZLD & ETP segments which caters to growing industry which makes us confident of company’s growth prospects,” Axis Securities said.

The brokerage firm has maintained its ‘buy’ recommendation on the stock with a target price of Rs 500.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!