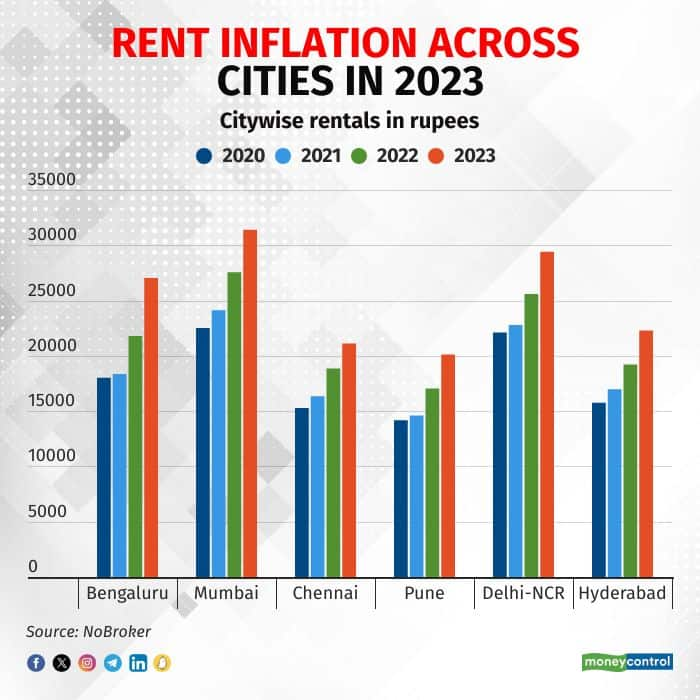

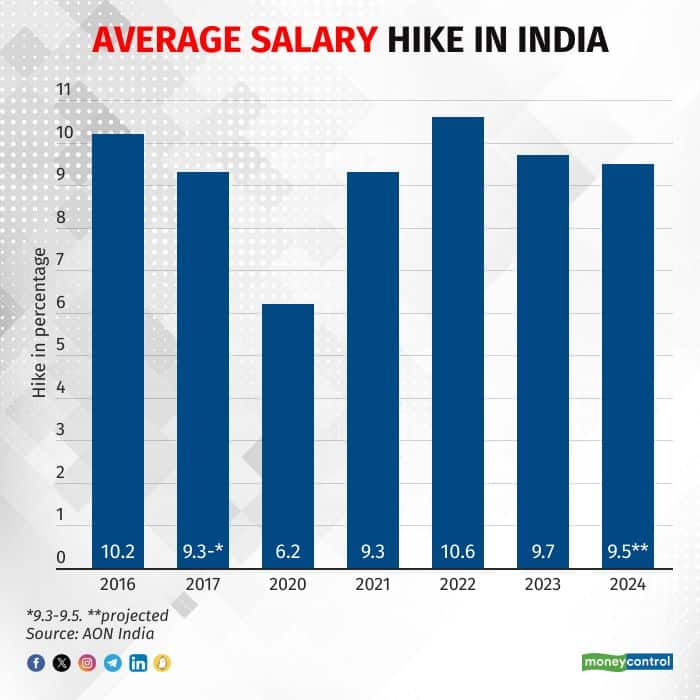

A widening gap in salary increments and rentals in residential real estate across major cities is triggering a cost of living crisis for a vast majority of Indians. According to data from Aon Group, a UK headquartered HR consulting firm, average salary hikes in India dipped to 9.7 percent in 2023 from 10.6 percent in 2022. In contrast, rentals in metro cities such as Bengaluru have outpaced salaries, rising on average by almost 30 percent from 2022 onwards.

"Although overall rent inflation in Bengaluru is 24 percent, in areas around tech parks and office complexes, it is upwards of 35 percent. The mismatch between demand and available supply is the core reason for this as companies resume working from the office, thus bringing an influx of migrants back into the city," Saurabh Garg, Co-founder & Chief Business Officer of NoBroker told Moneycontrol.

Experts said most of the housing inventory in Bengaluru launched after the pandemic has been absorbed, leading to a supply crunch. With many employees back to work in the office – even in the hybrid mode – there has been a spurt in rental demand over the past several months.

For example, Sayan Ghosh, a marketing professional in Bengaluru said his landlord recently increased the rent by 30 percent. "I tried searching for an apartment, however, was unable to find a decent apartment within budget. My landlord hiked the rent to meet the skyrocketing market rates. I wish our salaries also matched the market standards," he added.

Rentals on surge across cities

Rentals in certain pockets in Bengaluru today are almost at par with most of Mumbai's prime locations such as Worli, Bandra, Juhu and Versova with an average rent of Rs 90,000-2 lakh. Malabar Hill commands the highest rate of Rs 3.5 lakh, according to Ravi Kewalramani of RK Realtors in Mumbai.

Another tenant in Mumbai said, recently, the landlord increased her rent abruptly by Rs 18,000 to Rs 90,000 monthly for a 2BHK. Several tenants Moneycontrol spoke to said that today it is almost impossible to rent a proper 1 BHK for less than Rs 30,000 monthly in Mumbai.

Experts add that the riding on demand for rental properties, the situation remains the same in other metro cities such as Delhi-NCR. For example, areas such as BK Dutt Colony, Sewa Nagar, and Jor Bagh have fewer one-bedroom options but those that are available are expensive, with rents of furnished flats at Rs 25,000-30,000 per month, local brokers point out.

An October-December 2023 online property consultant Magicbricks said Indian metropolitan cities have registered a 17.4 per cent YoY surge in rents with Gurugram taking the lead among them with a 31.3 per cent growth. Bengaluru followed with a 23.1 percent YoY and Delhi saw a 10.5 percent surge in annual rental growth

Dent in affordable living

According to a 2023 poll by market research firm YouGov, high inflation over the past 12 months has reduced the disposable income of about 40 percent of urban Indians; however, the decline in the nation was among the lowest when compared with other worldwide markets. With a portion of disposable income being spent on necessities like food or rent, the poll said almost 41 percent of Indians are worried about the impact of inflation on spending in the next 12 months.

Another recent survey by NoBroker pointed out that in the first half of 2023, about 70 percent of millennials and Gen Z found rentals unaffordable in Bengaluru.

"The gap between monthly rentals and EMIs has been narrowing, making many tenants take the plunge and decide to purchase instead of continuing to stay on rent. City living has become more unaffordable as rentals are the biggest expenditure in a month in cities like Bengaluru and Mumbai," Garg added.

A March-April 2024 survey conducted by online real estate firm Magicbricks showed that Bengaluru ranked 141, the lowest across the top seven cities in the housing sentiment index. The study that surveyed over 4500 homebuyers ranked Kolkata at 160, Gurugram at 157 and Noida at 154. It added that homebuyers employed in the medical and pharma (163) and government sectors (158) exhibited a strong housing sentiment, possibly due to their jobs and correlated financial stability.

"Despite flat income rates in India, overall income still continues to grow thus leading housing sales across cities. However, we expect to see a major dip in home-buying sentiments if the real estate prices continue to grow in 2024 with flat income growth," Vivek Rathi, Head of Research at Knight Frank India said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!