Highlights

- Sectors to gain disproportionately- Capital goods, Infrastructure and financials

- Auto and pharma gain from policy tweaks (scrappage) and higher allocation

- Make in India boost: Higher Customs duty to benefit electronic goods manufacturers

- Key loser - Steel due to Customs duty change

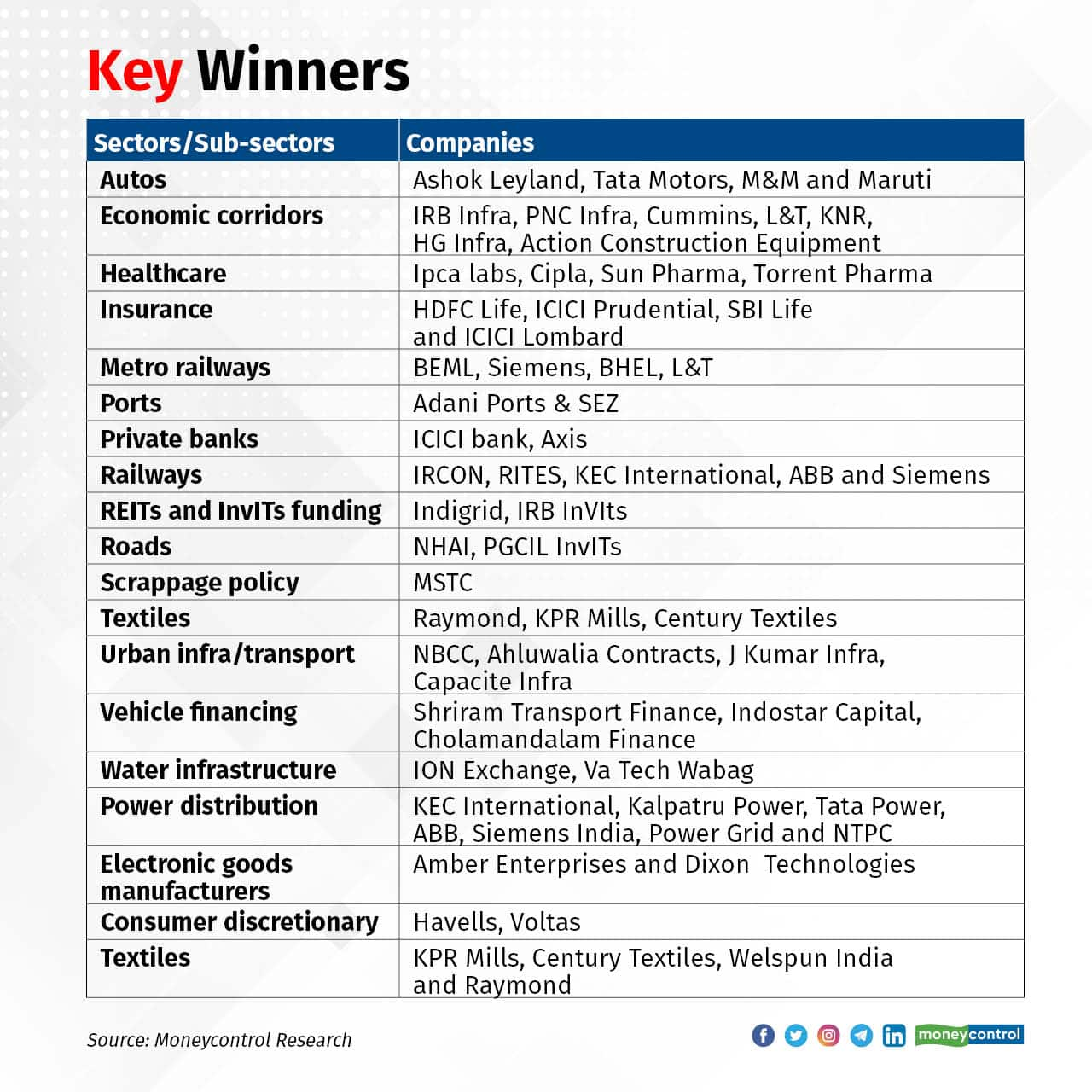

The risk-on budget keeping fiscal deficit at 6.8 percent for FY22 with a 35 percent jump in capital expenditure is probably what the weak economy needed after a once in a hundred year kind of pandemic that pushed the country into a technical recession. Key sectors which should benefit disproportionately are capital goods, infrastructure and financials, followed by automobile as well as pharmaceutical because of higher overall expenditure and gems and jewellery due to Customs duty reduction. The key loser is iron and steel due to lower protection on account of reduction in customs duty.

In financials, privatisation proposal of two public sector banks in addition to IDBI Bank and one general insurance company and hiking foreign holding limit in insurance sector from 49% to 74% are big positives. Also, the proposal to set up ARC/AMC - a new entity which will take bad loans off bank balance sheets and allow banks to focus again on their core business of lending and supporting economic growth was a longstanding ask. The stocks that will benefit are all insurance companies – HDFC Life, ICICI Prudential, SBI Life and ICICI Lombard. Also, the private sector banks and public sector banks (SBI, BOB, IDBI Bank) shall move up as the way to tackle the huge stock of non-performing assets is on the way. Overall investors should go long on PSU Bank Index.

Takeaways for infrastructure, capital goods are multipronged. In case of Railways, emphasis on electrification, security and push for capital expenditure, which is up 21 percent should help IRCON, RITES, KEC International, ABB and Siemens. Further, higher capex and focus on efficiency of power distribution sector reform is likely to bring focus on KEC International, Kalpatru Power, Power Grid and NTPC. Additionally, higher awarding, availability of long term funding in the road sector should benefit NHAI and PGCIL InvITs.

Coming to auto, the vehicle scrappage policy aiming to replace commercial vehicles (CV) and passenger cars (PV) older than 15 years and 20 years of age, respectively, is expected to benefit CV manufacturers such as Ashok Leyland and Tata Motors and M&M and Maruti in the PV space. Note that there are close to 450,000- 500,000 CVs which could get replaced. Other beneficiary of scrappage policy could be MSTC (for scarp trading) and vehicle financing companies (Shriram Transport Finance, Indostar Capital, Cholamandalam Finance).

Other major beneficiary is the domestic oriented companies in the Health care sector due to sharp jump in allocation by 137 percent. Beyond vaccines, focus on creating health infrastructure with 5-6 year time frame in mind is clearly a strong move. The target is to take total public health expenditure to 2.5 per cent of GDP from current 1-1.3 percent. Here, all the domestic oriented companies in the Health care sector are likely to benefit indirectly from this better healthcare coverage.

Additionally, Budget’21 also proposed changes in custom duties on a number of import goods duties to boost the domestic manufacturers. Increase in customs duty on Compressors for refrigerators and ACs, Printed Circuit Board Assembly appears a positive for companies both electronic goods manufacturers (Amber Enterprises and Dixon Technologies) and branded players (Havells, Voltas).

Among marginal beneficiaries are textiles (set up of textile parks) and Jewellery sector (reduction of custom duty).

Key disappointment is the lower customs duty on Iron and Steel sector which may impact likes of Tata Steel, Steel authority of India, JSW Steel and Jindal Steel and Power. Further, introduction of agri infra cess of 100 percent on alcoholic beverages comes as a negative surprise for United Spirits and Radico Khaitan.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!